February 03, 2026 a 12:38 pm

FRT: Analysts Ratings - Federal Realty Investment Trust

Federal Realty Investment Trust (FRT) is an established leader in high-quality retail-based property investment, focusing on sustainable long-term growth in prime urban areas. The stock has shown consistent stability, evidenced by its uninterrupted dividend growth over 54 years—unmatched in the REIT sector. Currently, the sentiment among analysts shows a strong inclination towards holding the stock, suggesting a cautious optimism in light of ongoing market conditions.

Historical Stock Grades

The latest data for February 2026 reflects a steady sentiment with the majority of analysts recommending 'Hold' or better, and none suggesting 'Sell' or 'Strong Sell'. This indicates a stable perception of FRT as a valuable asset for the coming months, with a notable presence of 'Strong Buy' recommendations suggesting potential growth opportunities.

| Recommendation | Number | Score |

|---|---|---|

| Strong Buy | 5 | |

| Buy | 6 | |

| Hold | 8 | |

| Sell | 0 | |

| Strong Sell | 0 |

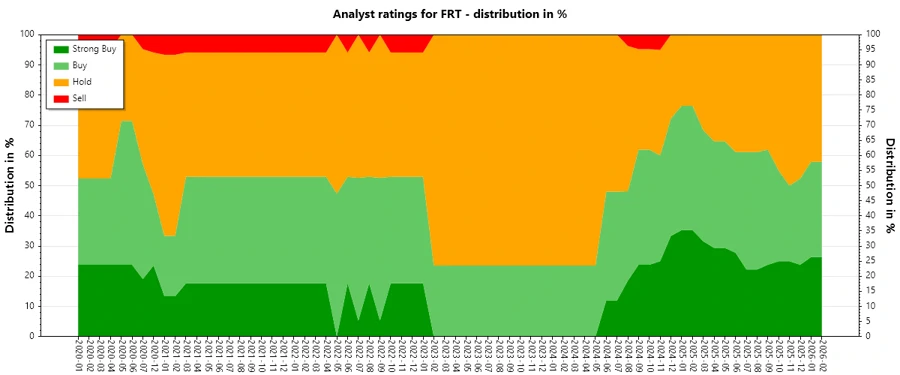

Sentiment Development

The analyst sentiment over the past months reflects a cautious yet optimistic stance. The sustained levels of 'Hold' and 'Buy' ratings underscore a sense of stability, with a slight shift from 'Strong Buy' to 'Hold' as a signal of short-term caution. This trend indicates a measured approach by analysts to balance potential market volatility with long-term investment confidence.

- Overall, analyst recommendations have increased marginally in volume with a consistent hold carry-over.

- The last 12 months have seen a gradual and cautious tilt towards 'Hold' from 'Buy'.

- 'Sell' and 'Strong Sell' categories remain notably empty, signifying a healthy confidence among analysts.

Percentage Trends

Over the last year, there has been a noticeable shift from predominantly 'Buy' and 'Strong Buy' ratings to a more balanced mix including 'Hold'. This can be interpreted as a sign of growing caution amongst investors amid broader economic factors impacting retail REITs. The detour from aggressive buying recommendations towards stability reflects the need for risk mitigation strategies.

- In February 2025, 'Strong Buy' ratings accounted for about 25% of the total, which has declined slightly over the year.

- 'Hold' ratings have been steady, showing a slight upward trend, indicating cautious optimism.

- The proportions indicate a gradual shift towards balanced, less aggressive recommendations.

Latest Analyst Recommendations

Recent changes in analyst recommendations suggest a nuanced approach to the stock. The movement from 'Neutral' to 'Overweight' by JP Morgan highlights potential undervaluation, whereas maintaining 'Sector Outperform' signals steady expected performance.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-01-14 | Sector Outperform | Sector Outperform | Scotiabank |

| 2025-12-18 | Overweight | Neutral | JP Morgan |

| 2025-12-16 | Buy | Hold | Jefferies |

| 2025-12-02 | Hold | Hold | Truist Securities |

| 2025-11-18 | Equal Weight | Overweight | Barclays |

Analyst Recommendations with Change of Opinion

Recent downgrades, including JP Morgan's shift from 'Overweight' to 'Neutral', point to growing caution. Simultaneously, there have been upward adjustments like the move from 'Hold' to 'Buy', suggesting selective confidence in FRT's potential amid fluctuating market dynamics.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-12-18 | Overweight | Neutral | JP Morgan |

| 2025-12-16 | Buy | Hold | Jefferies |

| 2025-11-18 | Equal Weight | Overweight | Barclays |

| 2025-09-15 | In Line | Outperform | Evercore ISI Group |

| 2025-06-23 | Neutral | Overweight | JP Morgan |

Interpretation

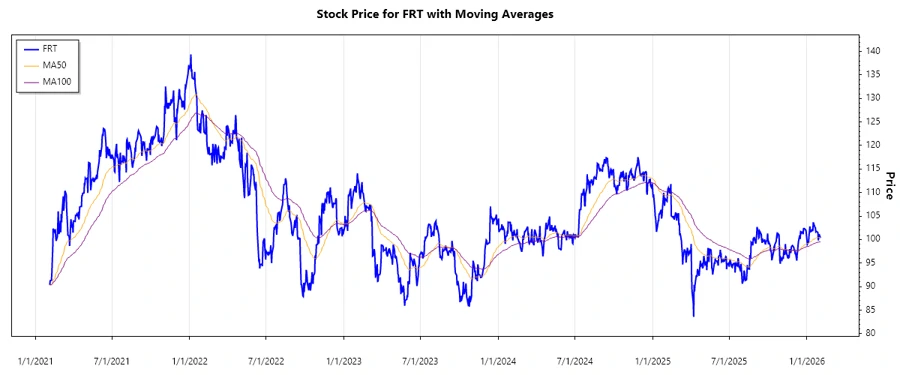

The FRT stock exhibits a generally stable perception among analysts, indicative of the trust in its long-term growth strategy underpinned by strategic property investments. The lack of 'Sell' ratings and a consistent 'Hold' suggests confidence amidst a challenging retail environment. However, the mild shifts signal some uncertainty, reflecting broader market conditions. The stock shows resilient stability, but investors should cautiously monitor emerging trends affecting retail-based properties.

Conclusion

Federal Realty Investment Trust maintains a stable position backed by steady analyst recommendations amidst fluctuations in sentiment. Its sustained growth trajectory is promising, particularly given the strategic focus on high-demand locations. However, potential risks may arise from broader economic pressures affecting retail environments. In conclusion, FRT presents a balanced blend of risk and opportunity, favored by its long-standing dividend performance and cautious analyst optimism, albeit tempered by contemporary market challenges.