April 15, 2025 a 02:46 am

FOXA: Dividend Analysis - Fox Corporation

Fox Corporation has shown a stable dividend payout history over the last 7 years, with a current yield of approximately 0.96%. Despite a moderate yield, the company’s dividends suggest reliability as there have been no recent cuts or suspensions. Investors might find an entry point into this media giant’s stable revenue streams attractive due to its consistent dividend growth.

📊 Overview

Fox Corporation is a leader in the media sector, characterized by its consistent dividend practices. Despite a relatively low dividend yield of 0.96%, the company offers a current dividend per share of $0.59. Such metrics highlight Fox's firm commitment to rewarding its shareholders, evident over a continuous 7-year dividend history with no interruptions.

| Criteria | Value |

|---|---|

| Sector | Media |

| Dividend Yield | 0.96% |

| Current Dividend per Share | $0.59 USD |

| Dividend History | 7 years |

| Last Cut or Suspension | None |

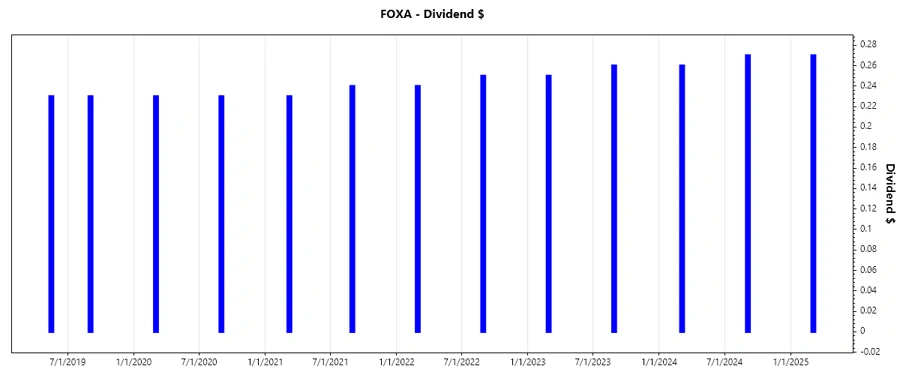

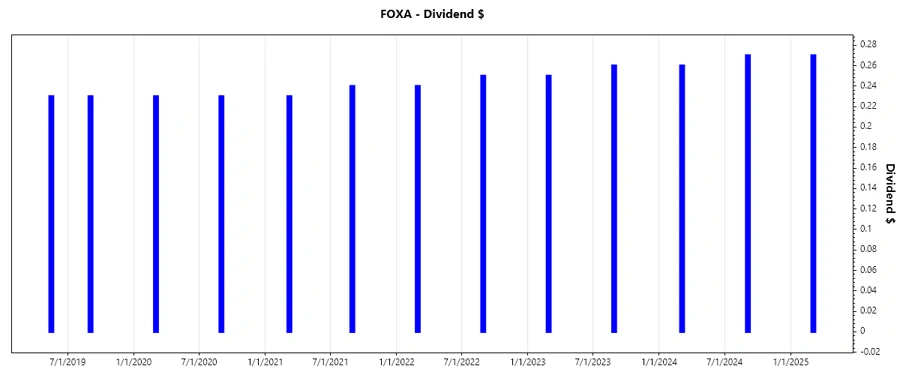

🗣️ Dividend History

The historical consistency of Fox Corporation’s dividends is crucial in assessing its reliability as an income-generating vehicle. A consistent dividend for 7 years signals a robust financial foundation and a shareholder-focused strategy.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | $0.27 |

| 2024 | $0.53 |

| 2023 | $0.51 |

| 2022 | $0.49 |

| 2021 | $0.47 |

📈 Dividend Growth

A stable growth in dividends over the years indicates a balanced financial approach. While the past 3 years show a growth of 4.09%, the 5-year period confirms a slower yet steady increase of 2.87%.

| Time | Growth |

|---|---|

| 3 years | 4.09% |

| 5 years | 2.87% |

The average dividend growth is 2.87% over 5 years. This shows moderate but steady dividend growth, reassuring for investors looking for capital appreciation.

✅ Payout Ratio

The payout ratios are informative of how much profit or cash flow is shared with shareholders as dividends. Fox Corporation maintains an EPS-based payout ratio of 12.30% and a free cash flow payout of 13.03%. These numbers suggest a conservative policy focused on sustaining and gradually growing dividends without over-stretching resources.

| Key figure ratio | |

|---|---|

| EPS-based | 12.30% |

| Free cash flow-based | 13.03% |

These ratios reflect a sound balance of rewarding shareholders while ensuring company growth and financial flexibility for future investments.

📉 Cashflow & Capital Efficiency

Fox Corporation’s cash flow metrics are indicative of its operational strength and capital discipline. Understanding these figures is vital in assessing whether the company generates sufficient cash to support its dividends and growth prospects.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 9.17% | 8.02% | 8.66% |

| Earnings Yield | 9.20% | 6.89% | 6.62% |

| CAPEX to Operating Cash Flow | 18.75% | 19.83% | 16.30% |

| Stock-based Compensation to Revenue | 0.64% | 0.50% | 0.73% |

| Free Cash Flow / Operating Cash Flow Ratio | 81.25% | 80.17% | 83.70% |

Fox's well-balanced cash flow and efficient use of capital illustrate its operational proficiency and strategic capacity to reinvest profits for long-term shareholder returns.

🗣️ Balance Sheet & Leverage Analysis

An analysis of Fox Corporation’s financial structure offers insights into its liquidity and leverage. With a modest level of debt-to-equity and debt-to-capital ratios, the company shows an ability to manage its liabilities effectively.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 76.09% | 69.47% | 64.49% |

| Debt-to-Assets | 37.10% | 32.97% | 32.96% |

| Debt-to-Capital | 43.21% | 40.99% | 39.21% |

| Net Debt to EBITDA | 1.32x | 1.18x | 0.87x |

| Current Ratio | 2.50x | 1.93x | 3.61x |

| Quick Ratio | 2.33x | 1.78x | 3.26x |

| Financial Leverage | 2.05x | 2.11x | 1.96x |

The analysis indicates solid financial stability with satisfactory leverage levels, suggesting robust financial health that supports ongoing operations and potential adversity management.

📊 Fundamental Strength & Profitability

Assessing profitability and capital management, Fox Corporation demonstrates a strong hold on efficient operations, yielding robust returns on equity.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 14.01% | 11.94% | 10.63% |

| Return on Assets | 6.83% | 5.67% | 5.43% |

| Net Margin | 10.74% | 8.31% | 8.62% |

| EBIT Margin | 17.95% | 13.98% | 14.82% |

| EBITDA Margin | 20.73% | 16.74% | 17.42% |

| Gross Margin | 34.99% | 32.27% | 32.16% |

| Research & Development to Revenue | 0% | 0% | 0% |

Fox’s effective management strategies are reflected in its rising profit margins and returns, underpinning a fundamental prowess and reinforcing its profitability agenda.

📈 Price Development

🗳️ Dividend Scoring System

| Criteria | Score | Score Bar |

|---|---|---|

| Dividend Yield | 2 | |

| Dividend Stability | 5 | |

| Dividend Growth | 3 | |

| Payout Ratio | 5 | |

| Financial Stability | 4 | |

| Dividend Continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 4 |

Total Score: 32/40

🏆 Rating

In conclusion, Fox Corporation stands out as a reliable dividend-paying entity with a stable history. Its balanced approach to dividend payout, reflected by conservative payout ratios and solid financial strength, makes it a viable choice for conservative investors seeking steady income streams in a competitive media industry.