November 02, 2025 a 08:38 pm

FITB: Analysts Ratings - Fifth Third Bancorp

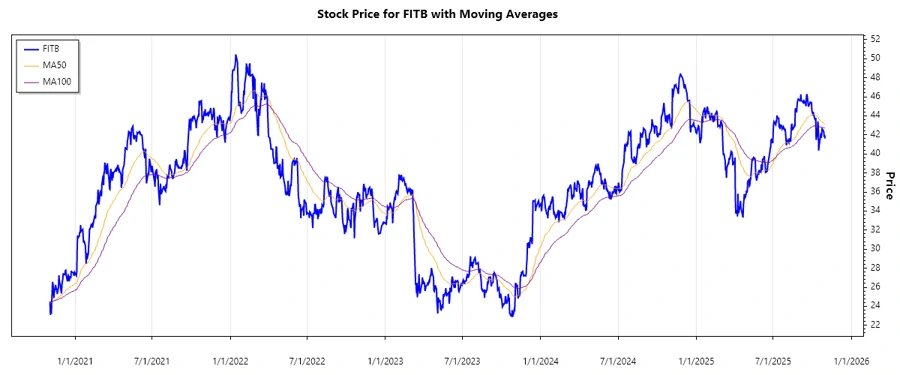

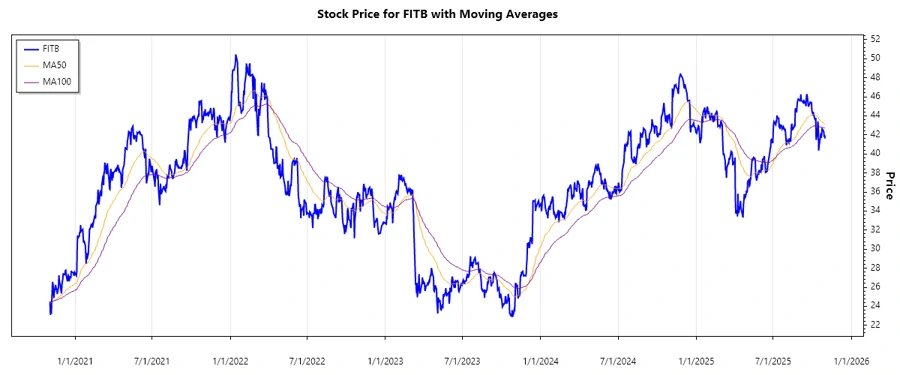

Fifth Third Bancorp's stock has displayed resilience amidst a dynamic financial landscape. Recent analyst activities reflect an overall positive sentiment, characterized by a substantial number of Buy and Strong Buy recommendations. The absence of Sell recommendations suggests a stable outlook, underpinned by the bank's diversified financial services and extensive market presence. As market conditions evolve, monitoring the subtle shifts in analyst perspectives will be crucial for potential investors.

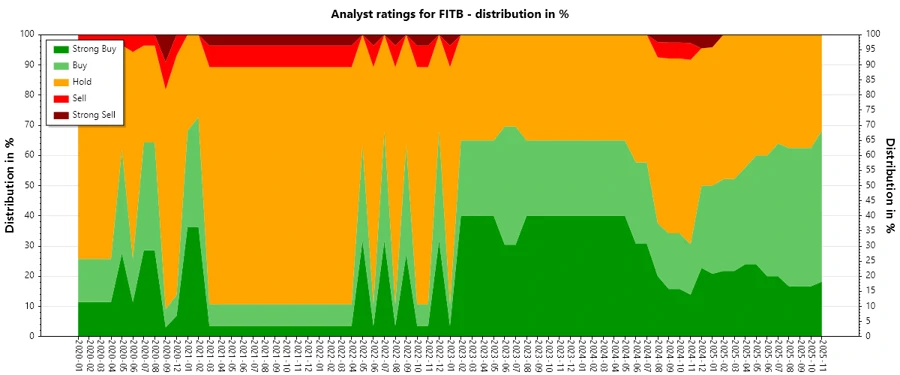

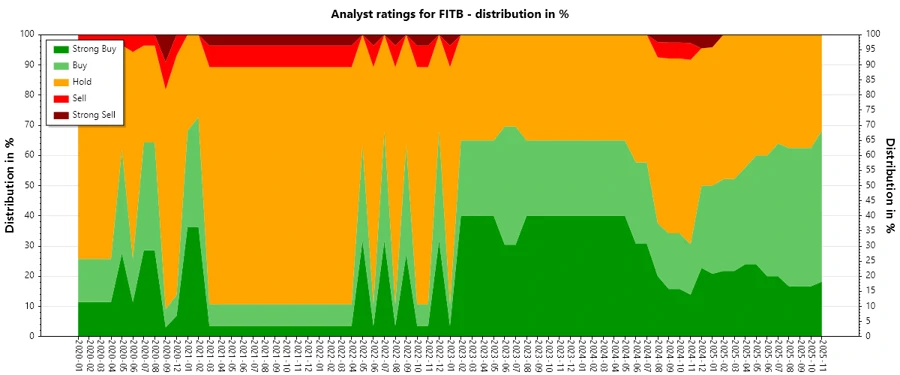

Historical Stock Grades

The analyst ratings for Fifth Third Bancorp have shown a consistent inclination towards positive sentiment. As of November 2025, there is a strong inclination towards recommending the stock as a Buy or Strong Buy, while no recommendations suggest selling.

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 11 | |

| Hold | 7 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

The sentiment toward Fifth Third Bancorp over the past months has shown a retention of confidence with consistent Buy and Strong Buy ratings. While the number of Hold ratings witnessed minor fluctuations, the overall sentiment remains bullish.

- The number of overall recommendations remained stable with a slight fluctuation in Hold positions.

- The trend indicates a solid baseline of support, with no shift towards negative sentiments such as Sell or Strong Sell.

Percentage Trends

Analyzing percentage trends reveals minimal shifts between categories. The share of Strong Buy recommendations displayed slight variability, while Buy recommendations maintain substantial weighting.

- Strong Buy ratings experienced a minor decrease over recent months, stabilizing around 20% of total recommendations.

- Buy ratings account for approximately 55% of the total, indicating majority consensus.

- The overall sentiment showcases a steady investment confidence, with negligible negative sentiment.

Latest Analyst Recommendations

Recent analyst activities suggest a blend of maintained ratings and upgraded evaluations. Notably, some analysts have upgraded their previous assessments, signaling strengthened confidence in Fifth Third Bancorp.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-20 | Buy | Buy | TD Cowen |

| 2025-10-14 | Overweight | Equal Weight | Stephens & Co. |

| 2025-10-08 | Buy | Buy | DA Davidson |

| 2025-10-07 | Overweight | Equal Weight | Morgan Stanley |

| 2025-10-07 | Neutral | Neutral | UBS |

Analyst Recommendations with Change of Opinion

Several analysts have revised their stances on Fifth Third Bancorp, primarily in the direction of upgrades. This trend emphasizes an increase in positive outlook and strengthened trust in the company's direction.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-14 | Overweight | Equal Weight | Stephens & Co. |

| 2025-10-07 | Overweight | Equal Weight | Morgan Stanley |

| 2025-06-09 | Buy | Neutral | DA Davidson |

| 2025-04-07 | Outperform | Neutral | Baird |

| 2024-05-31 | Outperform | Peer Perform | Wolfe Research |

Interpretation

The analyst ratings for Fifth Third Bancorp suggest a prevailing confidence in the company’s potential. The consistent Buy and Strong Buy ratings indicate a stable performance in market evaluations, with occasional upgrades highlighting particular confidence in its future outlook. The lack of any recent Sell or Strong Sell ratings further instills a sense of stability and trust in Fifth Third Bancorp's financial health and strategic positioning.

Conclusion

In conclusion, Fifth Third Bancorp presents a promising case for investors as reflected in consistent analyst ratings. The observed market confidence underscores the company’s solid financial standing and strategic execution. Nevertheless, prospective investors should continue monitoring market dynamics and sentiment shifts, especially in the face of broader economic changes. The ongoing momentum in upgrades may signify gradual increments in underlying market confidence, offering more nuanced investment perspectives in the medium to long term.