September 13, 2025 a 03:15 pm**Header and Introduction:**

**Fibonacci Analysis:**

**Fibonacci Analysis:**

**Conclusion:**

**Conclusion:**

FICO: Fibonacci Analysis - Fair Isaac Corporation

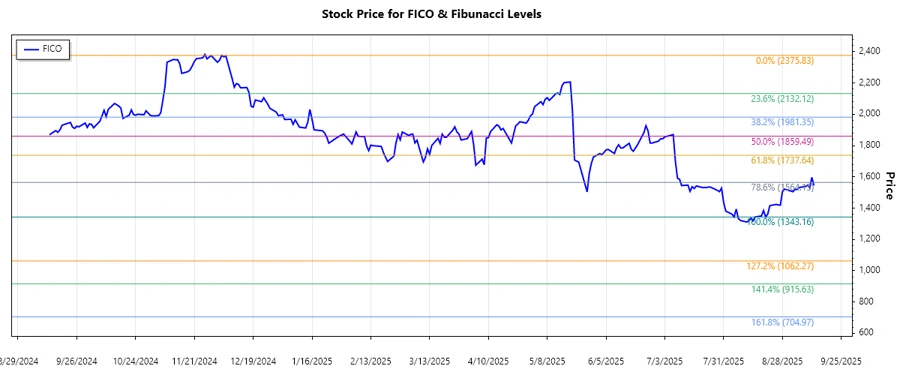

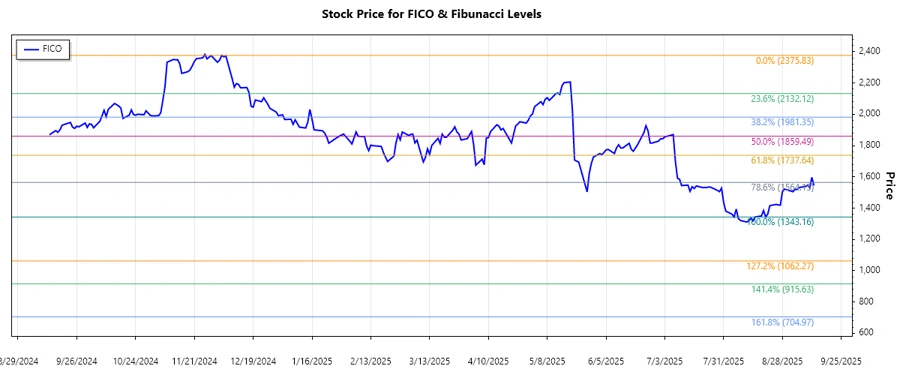

Fair Isaac Corporation (FICO) has seen a significant downtrend over recent months. The company, renowned for its analytic software, has faced challenges that have impacted its stock performance. Analyzing the recent market data, it's essential to understand the potential support and resistance levels through Fibonacci retracement for strategic investment decisions.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Start Date | 2024-12-06 |

| End Date | 2025-09-12 |

| High Point | 2375.83 (2024-12-04) |

| Low Point | 1343.16 (2025-08-15) |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | 1619.38 |

| 0.382 | 1763.97 |

| 0.5 | 1859.495 |

| 0.618 | 1955.02 |

| 0.786 | 2100.11 |

Currently, the price is within the 0.382 Fibonacci retracement level. This suggests a potential resistance level as the price attempts to recover from its recent dip.

The retracement level at 0.382 is forming a critical resistance area. If the stock breaks above this level, it may head towards the 0.5 or even the 0.618 level, indicating a potential bullish reversal.

**Conclusion:**

**Conclusion:**

Conclusion

Fair Isaac Corporation is currently experiencing a bearish trend with prices residing within a key Fibonacci retracement zone. Although challenges persist, the company's diverse analytic software offerings may provide long-term growth potential. Analysts should monitor the stock's ability to break through established resistance levels, such as the 0.382 Fibonacci level, which could signal a bullish reversal. However, failure to break through might extend the bearish trend, representing a continued risk to investors.

**JSON Output:**