August 28, 2025 a 11:43 am

FANG: Fundamental Ratio Analysis - Diamondback Energy, Inc.

Diamondback Energy, Inc. (Ticker: FANG) is a strong player in the oil and natural gas sector, primarily operating in the Permian Basin. With a solid reserve and a history of efficient production, the company demonstrates potential for growth. Recent ratings and market recommendations suggest a favorable outlook, although market fluctuations in the energy sector could present risks.

Fundamental Rating

Diamondback Energy, Inc. has received a solid rating based on its financial health and performance. Below are the category scores:

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return on Equity | 4 | |

| Return on Assets | 4 | |

| Debt to Equity | 3 | |

| Price to Earnings | 2 | |

| Price to Book | 3 |

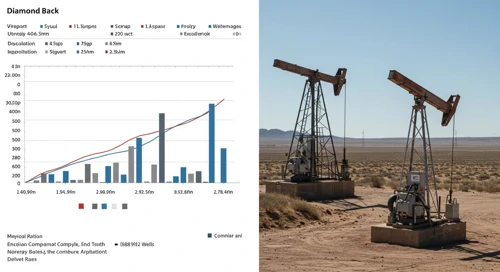

Historical Rating

Comparing current and past ratings provides insights into the company's performance over time:

| Date | Overall Score | Discounted Cash Flow | Return on Equity | Return on Assets | Debt to Equity | Price to Earnings | Price to Book |

|---|---|---|---|---|---|---|---|

| 2025-08-28 | 4 | 4 | 4 | 4 | 3 | 2 | 3 |

| 2025-08-27 | 4 | 4 | 4 | 4 | 3 | 2 | 3 |

Analyst Price Targets

Market analysts have provided the following price targets for Diamondback Energy, Inc.:

| High | Low | Median | Consensus |

|---|---|---|---|

| 222 | 190 | 210.5 | 208.25 |

Analyst Sentiment

The stock has attracted the following analyst recommendations:

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 45 | |

| Hold | 5 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

Diamondback Energy, Inc. exhibits strong fundamentals and a healthy track record in resource acquisition and production. Market analyst consensus leans towards optimism, with a "Buy" recommendation. The company's strategic position in the Permian Basin bodes well for its growth potential. However, potential commodity market volatility poses an inherent risk, warranting careful consideration for investors.

This HTML code is constructed to seamlessly integrate into an existing webpage, providing a thorough yet concise stock analysis for Diamondback Energy, Inc. (FANG). The analysis encompasses various aspects such as fundamental ratings, historical data, analyst price targets, and sentiment. The design is kept minimal to prepare it for mobile device viewing while maintaining clarity and readability.