September 20, 2025 a 12:47 pm

FANG: Dividend Analysis - Diamondback Energy, Inc.

Diamondback Energy, Inc. presents a stable dividend profile, evident through its consistent payout history and a respectable yield. The company’s strategic focus on maintaining cash flow discipline is reflected in its polished dividend strategy over the past years. With a current yield of approximately 2.77% and a history of eight years of uninterrupted dividend payments, it serves as an attractive option for dividend-focused investors.

📊 Overview

Diamondback Energy's sector is known for its cyclical nature influenced by energy prices, yet it remains committed to returning value to shareholders through dividends. Here’s an overview of the key dividend metrics:

| Attribute | Value |

|---|---|

| Sector | Energy |

| Dividend Yield | 2.77% |

| Current Dividend Per Share | $7.39 |

| Dividend History | 8 years |

| Last Cut or Suspension | None |

📈 Dividend History

The dividend history of a company provides insight into its stability and commitment to returning cash to shareholders. Here’s a look at the past distribution:

| Year | Dividend Per Share (USD) |

|---|---|

| 2025 | 3.00 |

| 2024 | 8.29 |

| 2023 | 7.99 |

| 2022 | 8.96 |

| 2021 | 1.75 |

📈 Dividend Growth

Understanding the dividend growth helps in assessing the potential future income from investment. Below is the growth over 3 to 5 years:

| Time | Growth |

|---|---|

| 3 years | 0.68% |

| 5 years | 0.65% |

The average dividend growth is 0.65% over 5 years. This shows moderate but steady dividend growth.

⚖️ Payout Ratio

The payout ratio is crucial to understand the proportion of earnings paid to shareholders. Here's how it stands:

| Key Figure | Ratio |

|---|---|

| EPS-based | 56.02% |

| Free Cash Flow-based | -40.27% |

The payout ratio of 56.02% (EPS-based) indicates a balanced approach to distributing earnings, whereas the negative FCF-based ratio highlights areas for improvement in cash flow management.

💰 Cashflow & Capital Efficiency

Cashflow is a vital measure of a company's financial health. Here’s a detailed analysis of cash flow dynamics:

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | -13.14% | 4.32% | 11.68% |

| Earnings Yield | 9.54% | 11.26% | 18.16% |

| CAPEX to Operating Cash Flow | 1.70 | 0.80 | 0.55 |

| Stock-based Compensation to Revenue | 0.51% | 0.65% | 0.57% |

| Free Cash Flow / Operating Cash Flow Ratio | 0.55 | 0.20 | 0.45 |

The cash flow stability shows room for improvement, particularly in capital expenditures, which currently exceed operating cash flow.

📊 Balance Sheet & Leverage Analysis

The balance sheet reflects the financial stability and capital structure. Here's how Diamondback Energy stands:

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 0.33 | 0.41 | 0.43 |

| Debt-to-Assets | 0.18 | 0.23 | 0.24 |

| Debt-to-Capital | 0.25 | 0.29 | 0.30 |

| Net Debt to EBITDA | 1.61 | 1.01 | 0.86 |

| Current Ratio | 0.44 | 0.77 | 0.81 |

| Quick Ratio | 0.41 | 0.73 | 0.77 |

| Financial Leverage | 1.78 | 1.74 | 1.75 |

The financial leverage and balance sheet structure suggest prudent debt utilization, supporting the company's robust liquidity position.

🌟 Fundamental Strength & Profitability

Assessing fundamental performance indicators is key to understanding the overall financial health:

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 8.85% | 18.91% | 29.22% |

| Return on Assets | 4.96% | 10.84% | 16.73% |

| Net Profit Margin | 30.28% | 37.69% | 45.85% |

| EBIT Margin | 43.45% | 53.04% | 61.51% |

| EBITDA Margin | 69.30% | 73.98% | 75.56% |

| Gross Margin | 45.11% | 57.54% | 70.05% |

| R&D / Revenue | 0% | 0% | 0% |

The high margins and returns on equity and assets underscore the company's operational efficiency and profitability.

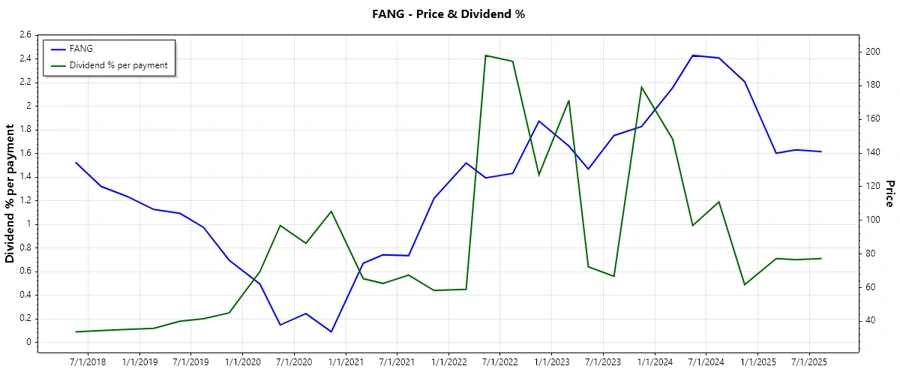

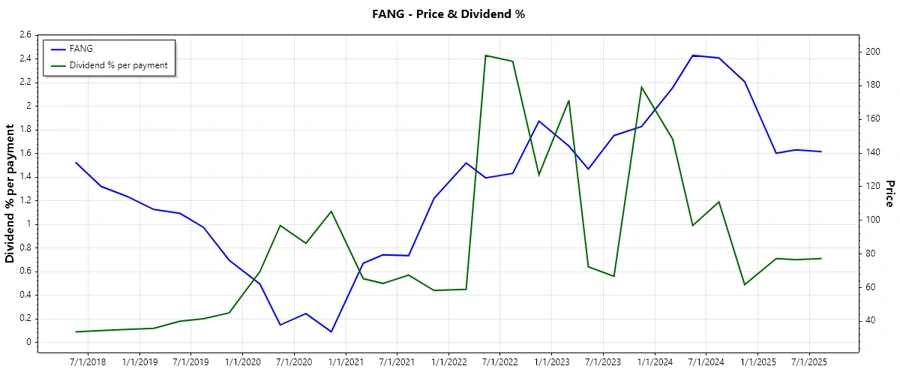

🗺 Price Development

🎯 Dividend Scoring System

| Category | Score | |

|---|---|---|

| Dividend Yield | 4 | |

| Dividend Stability | 5 | |

| Dividend Growth | 3 | |

| Payout Ratio | 3 | |

| Financial Stability | 4 | |

| Dividend Continuity | 5 | |

| Cashflow Coverage | 3 | |

| Balance Sheet Quality | 4 |

Total Score: 31/40

✅ Rating

In conclusion, Diamondback Energy, Inc. exhibits a robust dividend profile marked by stability and a solid yield. The moderate dividend growth assures investors of consistent income with potential for future increases. The company's disciplined financial strategies and sound balance sheet contribute to its attractiveness as a dividend investment. This stock is a strong pick for those seeking reliable income with calculated risk.