August 20, 2025 a 09:31 am

Energy Stocks - Performance Analysis

Evaluating the energy sector's stock performance over various timelines reveals significant insights into market dynamics. This review examines short to medium-term trends, focusing on the top gainers and those lagging behind. As volatility persists, understanding performance metrics is crucial for strategic investment decisions.

📊 Energy Stocks Performance One Week

During the past week, the energy sector witnessed mixed performances with some stocks rebounding while others retreated. While Marathon Petroleum Corporation (MPC) led with a modest gain, others like Occidental Petroleum Corporation (CVX) and Williams Companies (WMB) dragged behind, indicating sectoral challenges.

| Stock | Performance (%) | Performance |

|---|---|---|

| MPC | 1.62 | |

| PSX | -0.33 | |

| XOM | -0.15 | |

| SLB | -0.61 | |

| KMI | -1.74 | |

| EOG | -1.81 | |

| WMB | -2.24 | |

| COP | -2.23 | |

| OKE | -2.43 | |

| CVX | -2.49 |

📊 Energy Stocks Performance One Month

The past month has provided valuable insights into energy sector volatility. ConocoPhillips (COP) outperformed with a notable increase, while Oneok, Inc. (OKE) faced significant declines, highlighting the divergence in firm-specific factors affecting stock performance.

| Stock | Performance (%) | Performance |

|---|---|---|

| COP | 3.15 | |

| CVX | 1.66 | |

| EOG | 0.86 | |

| SLB | -0.31 | |

| WMB | -1.84 | |

| KMI | -2.43 | |

| XOM | -0.49 | |

| PSX | -2.87 | |

| MPC | -5.92 | |

| OKE | -8.62 |

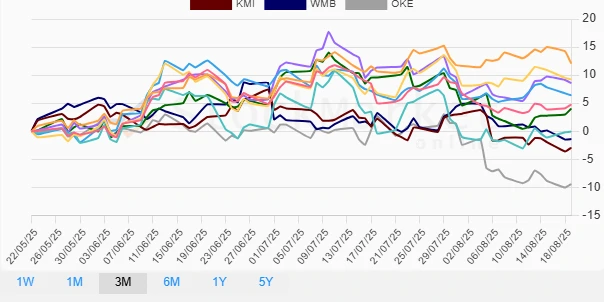

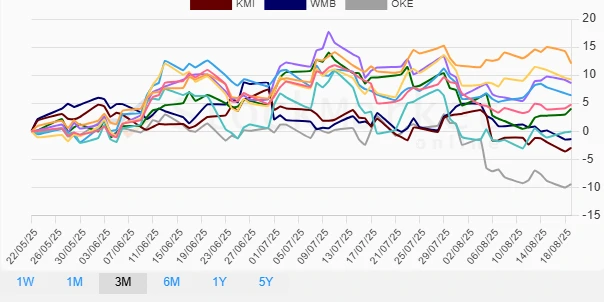

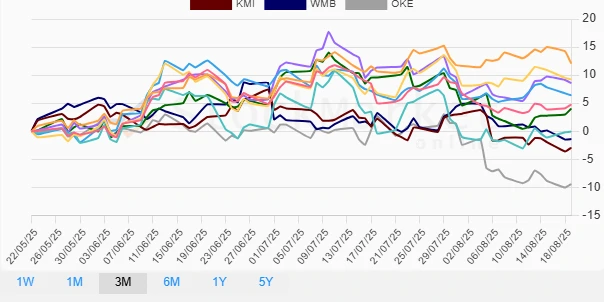

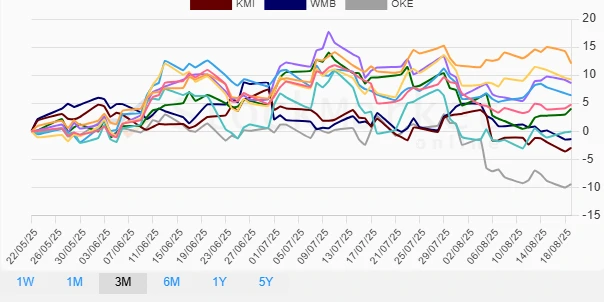

📊 Energy Stocks Performance Three Months

Over a three-month period, Chevron Corporation (CVX) emerged as the top gainer, indicating strong sectoral engagement, while Oneok, Inc. (OKE) suffered a substantial downturn. This may reflect different vulnerabilities and operational strengths within the sector.

| Stock | Performance (%) | Performance |

|---|---|---|

| CVX | 12.09 | |

| COP | 9.24 | |

| PSX | 8.59 | |

| EOG | 6.40 | |

| XOM | 4.75 | |

| MPC | 4.02 | |

| SLB | -0.06 | |

| WMB | -1.40 | |

| KMI | -2.95 | |

| OKE | -9.41 |

Summary 📈

The energy sector's stocks have experienced varied performance over short and medium terms. Chevron, ConocoPhillips, and EOG Resources have consistently shown resilience and growth, indicating robust business models and market confidence. Conversely, Oneok, Inc. struggles stand out, suggesting potential underlying issues. Investors should align their strategies with these trends, focusing on stocks with resilient growth trajectories while adopting cautious positions towards underperforming entities.