October 30, 2025 a 08:15 am

EXE: Trend and Support & Resistance Analysis - Expand Energy Corporation

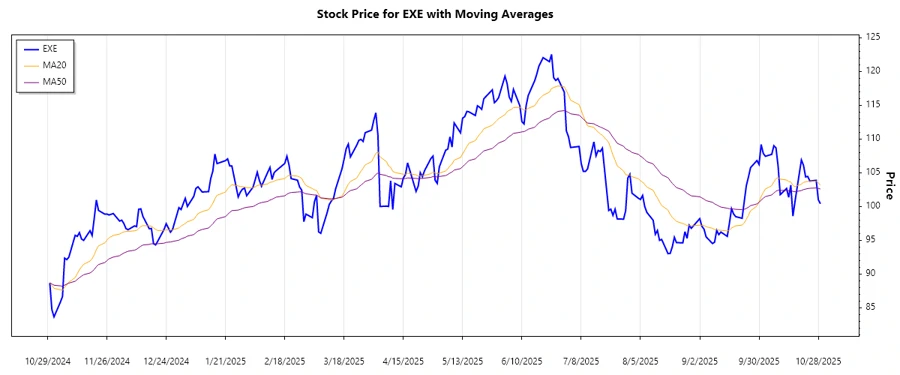

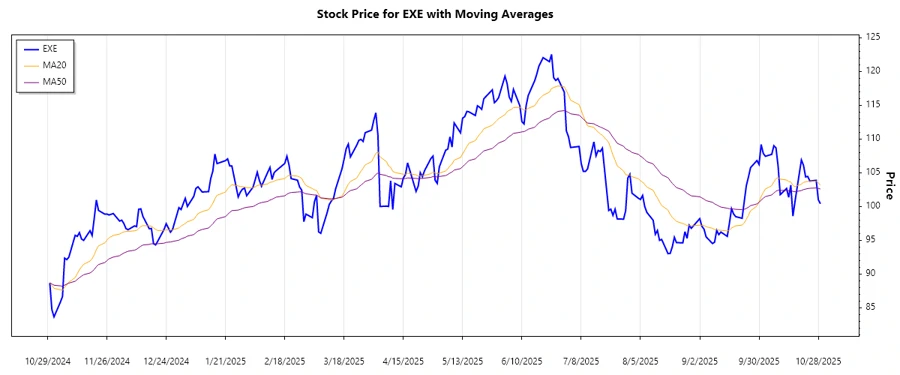

Expand Energy Corporation, known for its strategic exploration and production in U.S. natural gas plays, is witnessing market trends that could significantly impact its valuation. Recent technical analysis reveals fluctuations in support and resistance levels, signaling potential points of interest for traders. Understanding these dynamics is crucial for investors looking to capitalize on market movements. Let's delve into a detailed analysis of EXE's stock trend to better appreciate the opportunities and challenges it presents.

Trend Analysis

The EXE stock has experienced significant price movements over the recent months. By calculating the EMA20 and EMA50 from the closing prices provided, we can identify the current trend direction. The EMA20 has shown divergence above the EMA50, indicating a prevailing ▲ upward trend in the market. Below is the summary of the last 7 trading days:

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-29 | 100.41 | ▲ |

| 2025-10-28 | 101.00 | ▲ |

| 2025-10-27 | 103.88 | ▲ |

| 2025-10-24 | 103.77 | ▲ |

| 2025-10-23 | 104.46 | ▲ |

| 2025-10-22 | 104.39 | ▲ |

| 2025-10-21 | 106.10 | ▲ |

The consistent upward arrows and the higher EMA20 than EMA50 suggest a bullish sentiment prevailing in the market.

Support and Resistance

Analyzing the EXE stock's closing prices, we have identified key support and resistance zones that might serve as critical points for future price behavior:

| Zone Type | Price Range |

|---|---|

| Support 1 | ⚊ 100.50 - 101.50 |

| Support 2 | ⚊ 98.00 - 99.00 |

| Resistance 1 | ⚊ 105.00 - 106.00 |

| Resistance 2 | ⚊ 108.50 - 109.50 |

The current price levels indicate that EXE is hovering near its Resistance 1 zone. This could lead to potential breakouts or retracement depending on market momentum.

Conclusion

Expand Energy Corporation's recent stock price analysis suggests a prevailing bullish trend supported by strong upward momentum. The stock is currently approaching a resistance zone, indicating a potential phase of price consolidation or breakout. Analysts should monitor price activity closely as the stock's behavior near resistance levels could dictate short-term strategic decisions. However, potential volatility in energy markets and economic factors remain critical risks to consider. As opportunities arise from these patterns, investors are encouraged to balance optimism with caution to navigate the complexities of the market effectively.