July 15, 2025 a 06:00 pm

EW: Fundamental Ratio Analysis - Edwards Lifesciences Corporation

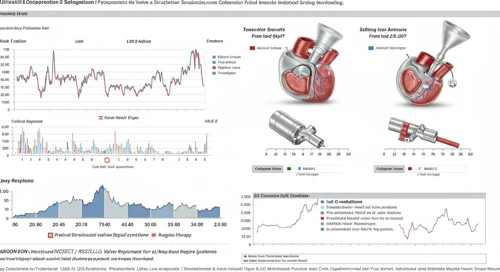

Edwards Lifesciences Corporation is a key player in the healthcare sector, specializing in innovative heart valve therapies and critical care monitoring. The stock shows moderate fundamental metrics with room for improvement in various financial parameters. Investors may find interest in the company's growth potential within the medical devices industry, particularly given its established market presence.

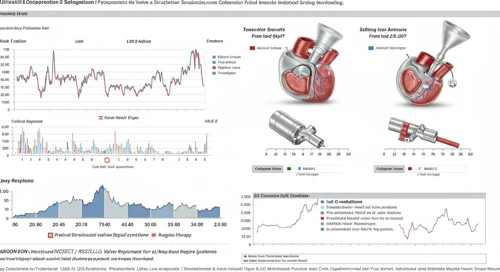

Fundamental Rating

The current fundamental rating indicates a stable outlook with moderate performance across key financial metrics.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 3 | |

| Return on Equity | 1 | |

| Return on Assets | 1 | |

| Debt to Equity | 1 | |

| Price to Earnings | 3 | |

| Price to Book | 1 |

Historical Rating

The historical scores show a consistent performance with minor fluctuations in the overall score.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-07-15 | 2 | 3 | 1 | 1 | 1 | 3 | 1 |

| Previous | 0 | 3 | 1 | 1 | 1 | 3 | 1 |

Analyst Price Targets

Analyst estimates project varied targets, with a consensus leaning towards continued growth potential.

| High | Low | Median | Consensus |

|---|---|---|---|

| 90 | 75 | 82.5 | 82.5 |

Analyst Sentiment

The prevailing analyst sentiment suggests a strong Buy recommendation with limited downside risk.

| Rating | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 28 | |

| Hold | 19 | |

| Sell | 1 | |

| Strong Sell | 0 |

Conclusion

Edwards Lifesciences Corporation remains a steady player in the medical devices industry, showcasing a solid performance across several fundamental parameters. While there are areas for growth, particularly in return metrics, analyst sentiment remains favorable, suggesting confidence in future prospects. The stock offers moderate risk with potential upside, bolstered by analyst price targets indicating a favorable outlook. Investors are encouraged to consider their risk tolerance against the company's innovation-led approach and established market presence in healthcare solutions.