October 20, 2025 a 05:08 am

EURUSD: Fibonacci Analysis

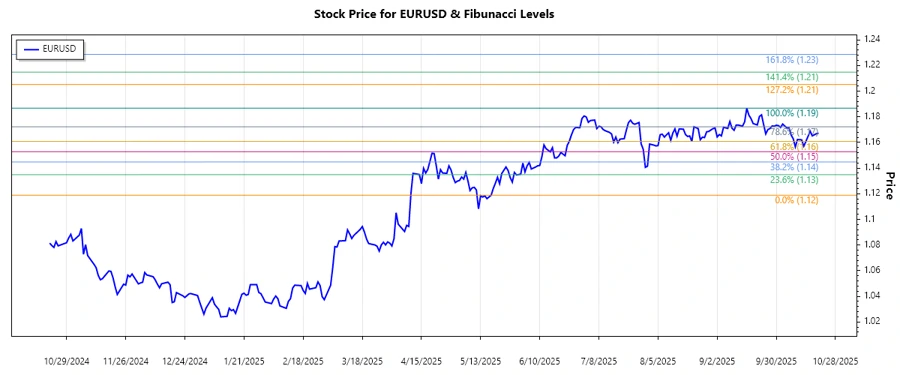

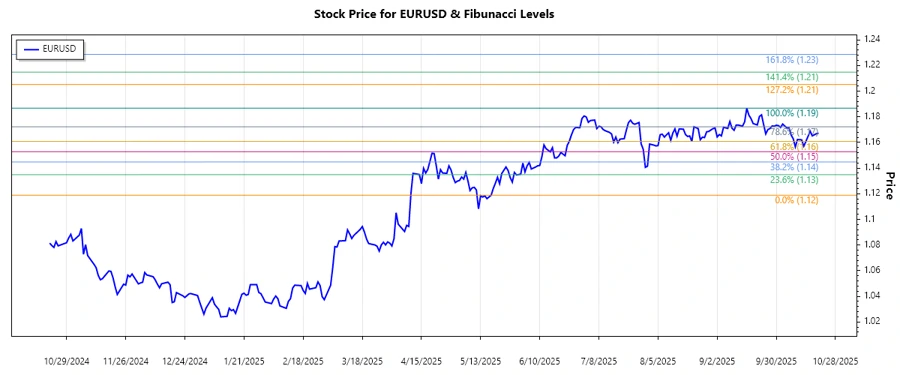

The EURUSD currency pair has shown a volatile pattern over the past few months. Observing its recent movements, the pair has demonstrated signs of an upward trend. Market participants should pay careful attention to central bank meeting hints and geopolitical factors impacting the euro zone and U.S. The technical analysis indicates the potential for further strengthening unless significant economic changes occur.

Fibonacci Analysis

A detailed examination of the EURUSD currency pair reveals a distinct upward trend in recent months. By analyzing highs and lows, we utilize the Fibonacci retracement tool to forecast potential future price levels.

| Parameter | Value |

|---|---|

| Trend Start Date | 2025-06-01 |

| Trend End Date | 2025-10-20 |

| High Price | 1.18668 (2025-09-16) |

| Low Price | 1.11883 (2025-05-18) |

| Fibonacci Level | Price |

|---|---|

| 0.236 | 1.13652 |

| 0.382 | 1.15179 |

| 0.5 | 1.15276 |

| 0.618 | 1.16973 |

| 0.786 | 1.17839 |

The current price is within the 0.618 retracement level. This indicates resistance at this level; a breakthrough could signify continued bullish momentum.

Conclusion

The upward trend in the EURUSD pair offers potential trading opportunities. However, traders should remain vigilant of key resistance and support levels emerging from Fibonacci retracements. The 0.618 retracement level is a crucial pivot point, potentially dictating future price actions. Understanding global economic conditions and trading volumes will be essential in predicting long-term positions. The euro-dollar dynamics remain sensitive to economic reports from both the Eurozone and the USA, which could influence trend reversals or continuations. Continuous monitoring is advised for optimal trading strategies.