October 16, 2025 a 05:08 am

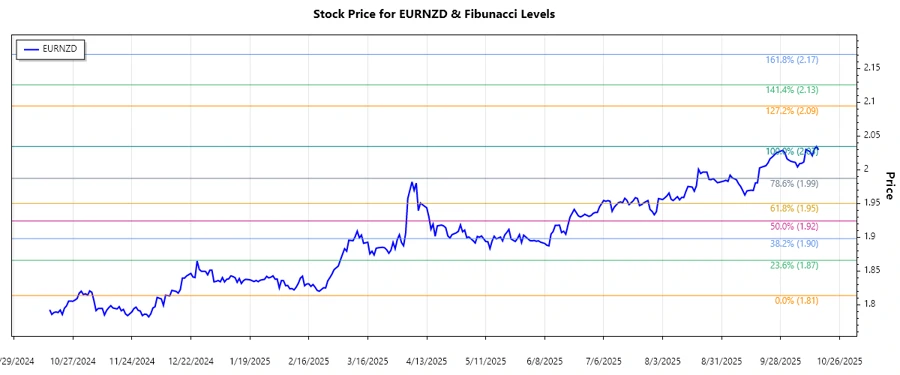

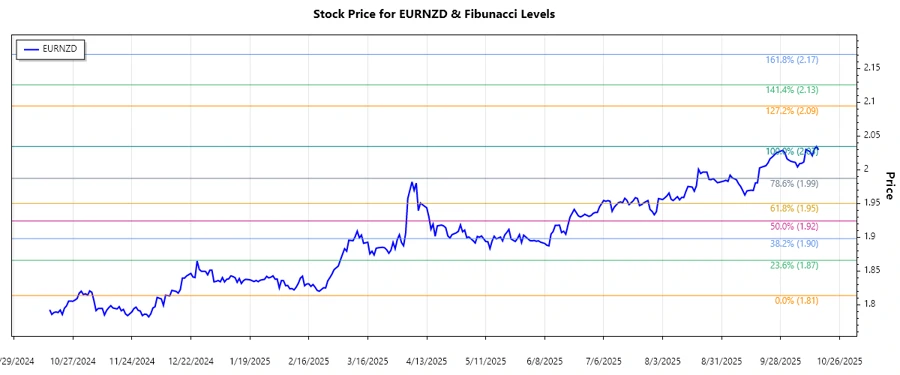

EURNZD: Fibonacci Analysis

The EURNZD currency pair has shown significant movements over the recent period, reflecting geopolitical and market influences. It's crucial for traders to understand the underlying drivers affecting this pair as they navigate through uncertain economic climates. Monitoring the trends and understanding areas of support and resistance can aid in making informed trading decisions.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Start Date | 2024-12-11 |

| End Date | 2025-10-16 |

| High Price Date | 2025-10-15 |

| High Price | 2.03425 |

| Low Price Date | 2024-12-11 |

| Low Price | 1.81374 |

| 0.236 Fib Level | 1.88163 |

| 0.382 Fib Level | 1.92995 |

| 0.5 Fib Level | 1.9240 |

| 0.618 Fib Level | 1.87217 |

| 0.786 Fib Level | 1.94812 |

| Current Price (as of 2025-10-16) | 2.02931 |

| Retracement Zone | Above 0.786 |

| Interpretation | The current price is above the 0.786 level, indicating potential resistance. |

Conclusion

The EURNZD appears to be in a strong uptrend, with the current price positioned above the key Fibonacci retracement levels. This suggests the trend may continue, but traders should be cautious of potential resistance as the price approaches higher levels. The pair's movements are influenced by market sentiment and external economic factors. While opportunities for profit exist, the risks associated with holding positions should not be underestimated. Analysts need to remain vigilant, keeping an eye on technical indicators and geopolitical events that may impact currency movement.