November 19, 2025 a 05:08 am

EURJPY: Fibonacci Analysis

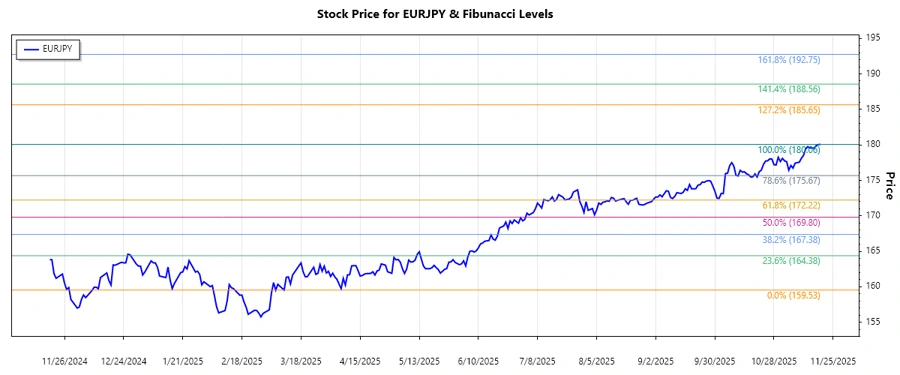

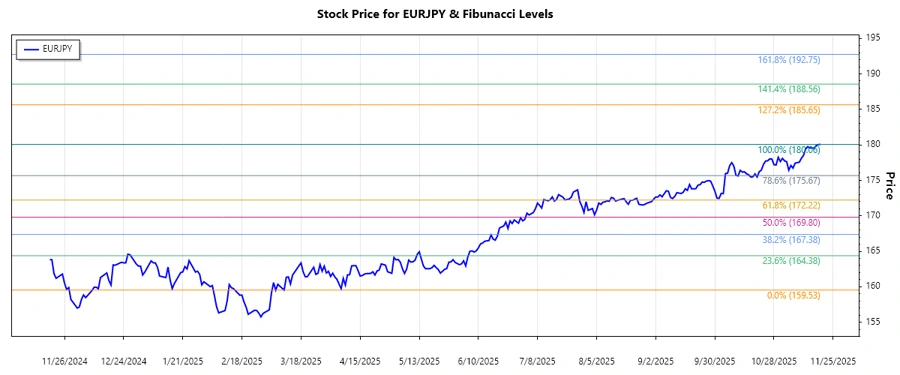

The EURJPY currency pair has shown a robust upward movement in the past months, indicating a strong bullish trend. Starting from mid-2025, we see consecutive higher highs and higher lows, denoting a well-defined uptrend. Recent market conditions suggest temporary pullbacks may form, offering strategic entry points for traders looking to capitalize on the dominant trend.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Trend Start Date | 2024-11-19 |

| Trend End Date | 2025-11-19 |

| Highest Price Point | 180.062 on 2025-11-19 |

| Lowest Price Point | 159.533 on 2025-03-10 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | 165.788 |

| 0.382 | 169.620 |

| 0.5 | 174.797 |

| 0.618 | 177.188 |

| 0.786 | 179.420 |

The current price of 180.049 is above all the retracement levels, indicating that the currency pair is currently experiencing strong bullish momentum with possible support forming at the 0.786 level.

Technical interpretation suggests that if the pair pulls back, it might find support around the 0.786 Fibonacci level, offering an opportunity for buyers to enter the market. If momentum continues, further highs may be tested.

Conclusion

The Fibonacci retracement levels provide a comprehensive view of potential support and resistance areas. The current bullish trend in EURJPY indicates strong demand, with the possibility of temporary retracements serving as entry points for strategic investors. Should the pair sustain above the 0.786 level, it would affirm the uptrend's strength, while any dip below might invite cautious buying interest. However, traders should remain vigilant for market changes that could affect EURJPY's trajectory, necessitating adjustments to their strategies.