August 12, 2025 a 04:28 am

EURGBP: Trend and Support & Resistance Analysis

The EURGBP currency pair has shown shifting trends over the analyzed period with notable volatility. Recent patterns suggest potential movements that could affect near-term trading opportunities. It's crucial for traders to stay informed about these changes to capitalize on potential market shifts.

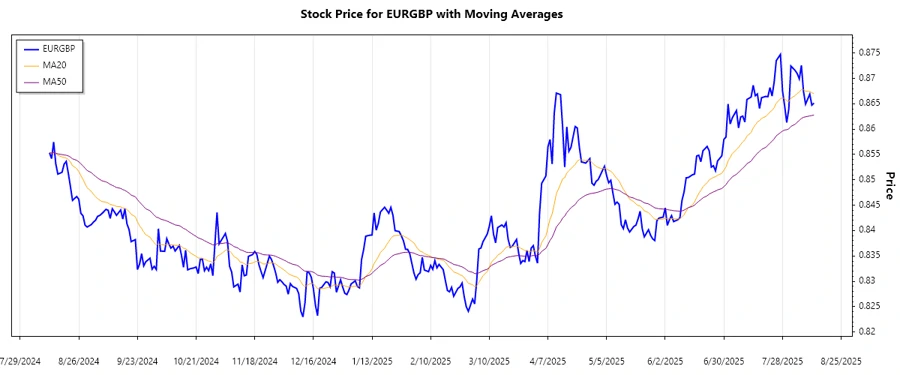

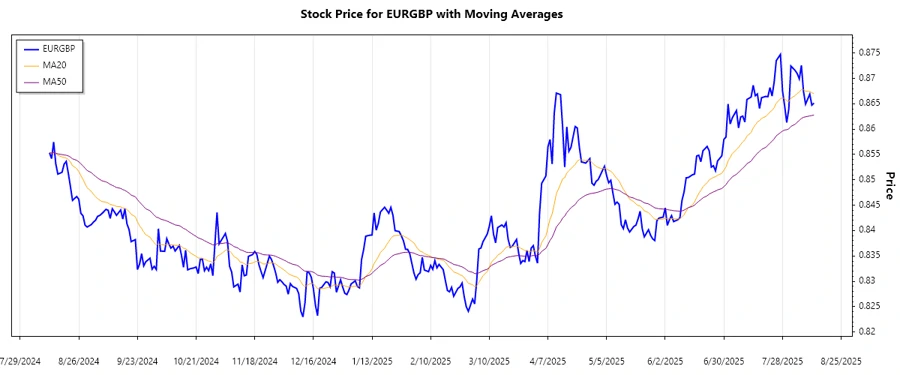

Trend Analysis

Evaluating the recent data for EURGBP, the EMA20 has consistently stayed above the EMA50, indicating an ongoing ▲ Uptrend. The market sentiment appears favorable as the pair remains buoyant above key support levels.

| Date | Close Price | Trend |

|---|---|---|

| 2025-08-12 | 0.86514 | ▲ Uptrend |

| 2025-08-11 | 0.86472 | ▲ Uptrend |

| 2025-08-10 | 0.86689 | ▲ Uptrend |

| 2025-08-08 | 0.86493 | ▲ Uptrend |

| 2025-08-07 | 0.86746 | ▲ Uptrend |

| 2025-08-06 | 0.87256 | ▲ Uptrend |

| 2025-08-05 | 0.8699 | ▲ Uptrend |

The continuation of the uptrend suggests a favorable market condition for euroidel investments, yet investors should remain cautious of potential reversals.

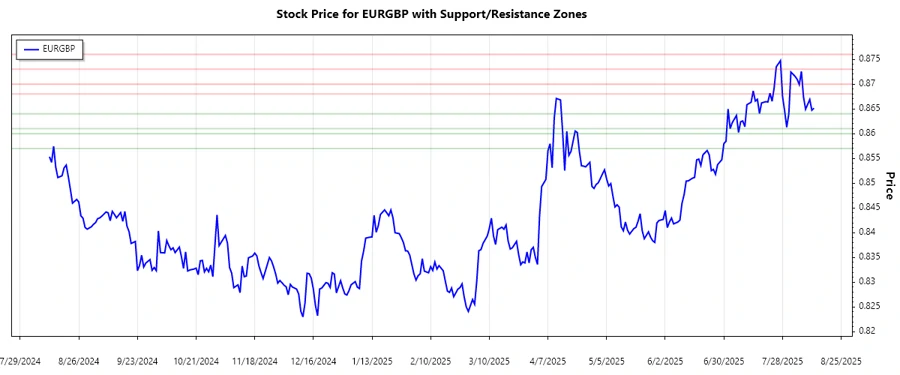

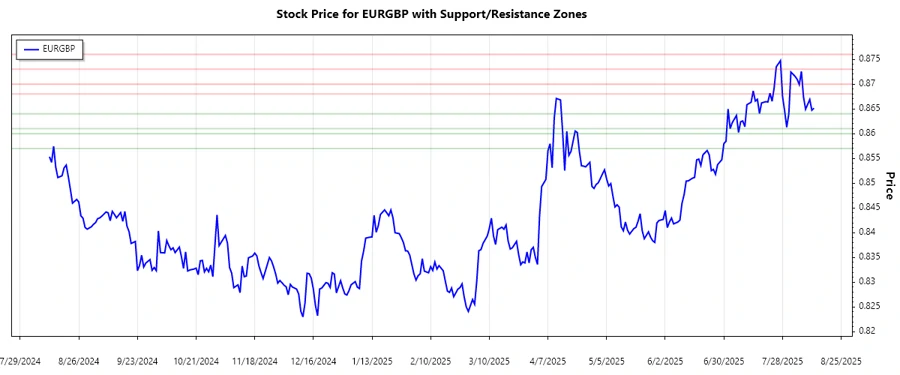

Support- and Resistance

Analyzing the EURGBP currency pair, we identified critical support and resistance zones. These zones present strategic entry and exit points for traders.

| Zone Type | Range | Direction |

|---|---|---|

| Support Zone 1 | 0.8610 - 0.8640 | ↗️ Support |

| Support Zone 2 | 0.8570 - 0.8600 | ↗️ Support |

| Resistance Zone 1 | 0.8680 - 0.8700 | ↘️ Resistance |

| Resistance Zone 2 | 0.8730 - 0.8760 | ↘️ Resistance |

Currently, the EURGBP is trading near the resistance zone 1, suggesting a possible reversal if there is no breakthrough.

Conclusion

The EURGBP has exhibited an upward trend, supported by consistent breaks above moving average levels. However, this upward trajectory might encounter resistance within identified zones. Investors should weigh the risks of resistance reversals against potential profit opportunities. Upcoming market events could offer directional clues, presenting actionable signals to traders. Staying informed and vigilant is paramount to capitalizing on these dynamics while safeguarding against potential downturns. As the market unfolds, the current trends and support levels offer strategic insights into the currency's possible futures.