November 01, 2025 a 04:28 am

EURCHF: Trend and Support & Resistance Analysis

The EURCHF currency pair has shown a recent stabilization following a period of volatility. Technical indicators suggest a potential shift in trend direction, while key support and resistance levels may influence short-term movements. Monitoring these levels can provide critical insights for traders and investors looking to capitalize on market conditions.

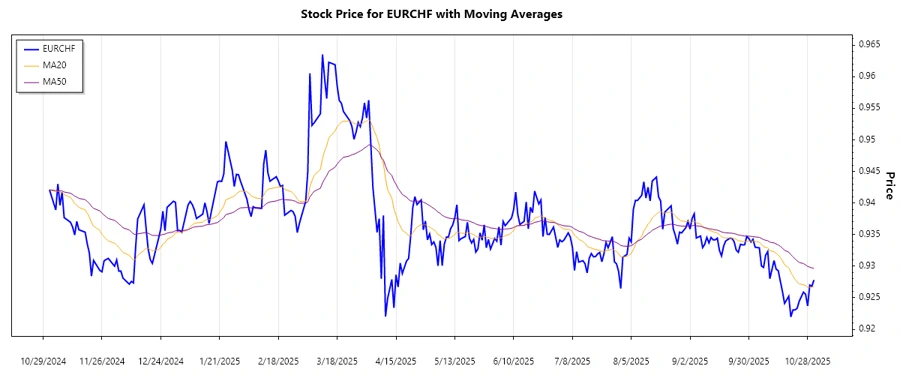

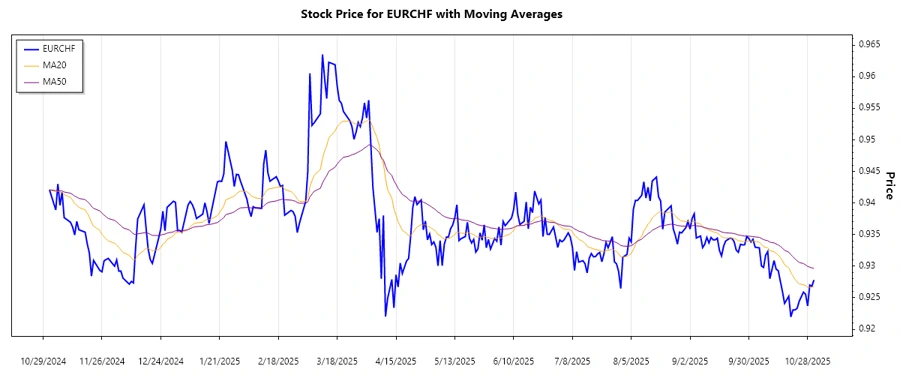

Trend Analysis

The analysis of the EURCHF pair indicates notable movements over the observed period. When examining the exponential moving averages, particularly the EMA20 and EMA50, a downward trajectory becomes apparent as the EMA20 has fallen below the EMA50. The trend suggests a bearish sentiment in recent market activity.

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-31 | 0.92781 | ▼ Downtrend |

| 2025-10-30 | 0.92682 | ▼ Downtrend |

| 2025-10-29 | 0.92701 | ▼ Downtrend |

| 2025-10-28 | 0.92370 | ▼ Downtrend |

| 2025-10-27 | 0.92556 | ▼ Downtrend |

| 2025-10-26 | 0.92588 | ▼ Downtrend |

| 2025-10-24 | 0.92447 | ▼ Downtrend |

The consistent downtrend across the recent days underscores potential bearish sentiment among traders. This continued movement below key averages signifies a cautious outlook for EURCHF.

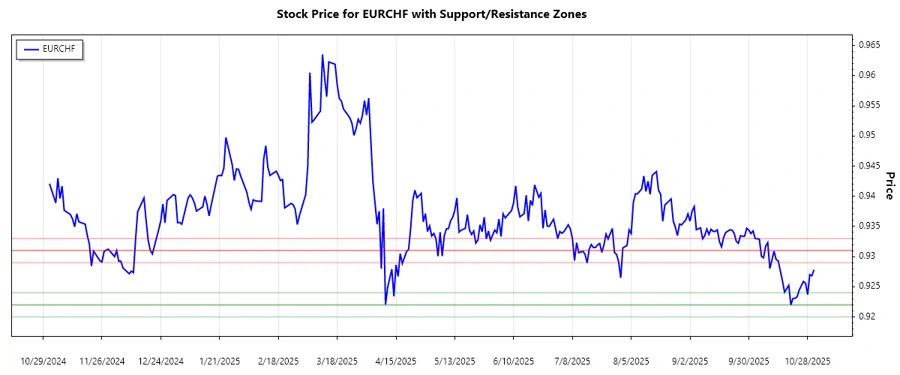

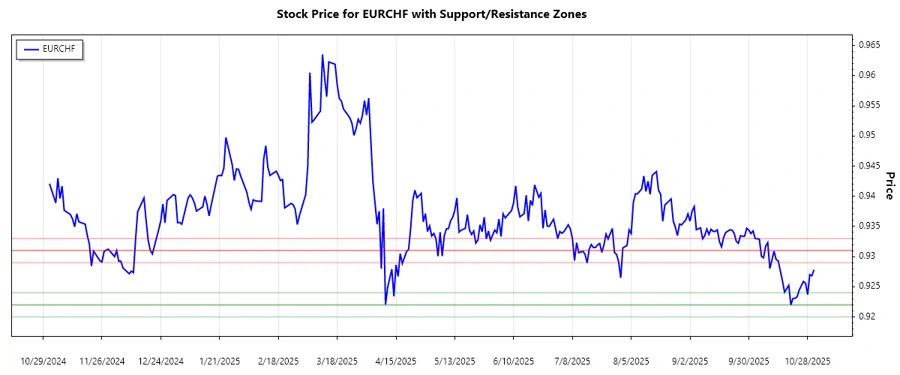

Support and Resistance

Technical analysis pinpoints key support and resistance zones that are crucial for the EURCHF pair's price action. Key support zones lie within the range of 0.9220 to 0.9240, while resistance zones are identified around 0.9290 to 0.9310.

| Zone Type | Zone Range |

|---|---|

| Support Zone 1 | 0.9220 - 0.9240 ▼ |

| Support Zone 2 | 0.9200 - 0.9220 ▼ |

| Resistance Zone 1 | 0.9290 - 0.9310 ▲ |

| Resistance Zone 2 | 0.9310 - 0.9330 ▲ |

The current price level lies above the identified support zones, indicating a potential rebound. However, breaking below these zones could signify further declines, while surpassing resistance zones could suggest an upward retracement.

Conclusion

In conclusion, the EURCHF currency pair's recent downtrend reflects bearish market sentiment, with movements influenced by broader economic factors and technical thresholds. While the formation of strong support zones offers a potential safety net, breaking these supports could pave the way for further declines. Conversely, surpassing resistance levels may provide a fresh impetus for upward momentum. Investors should remain vigilant and adjust their strategies in line with these indicators to navigate potential risks and capitalize on emerging opportunities.