July 28, 2025 a 09:00 pm

ETN: Analysts Ratings - Eaton Corporation plc

Eaton Corporation plc, a diversified power management company, shows a resilient market standing with consistent analyst ratings. Despite minor fluctuations, the buy ratings indicate ongoing confidence in its growth potential, reflecting the robustness in its core offerings across electrical, aerospace, vehicle, and mobility segments. The stability of the ratings over the past months suggests continued faith from analysts in Eaton's market strategy and execution.

Historical Stock Grades

| Rating | Number | Score |

|---|---|---|

| Strong Buy | 7 | |

| Buy | 12 | |

| Hold | 10 | |

| Sell | 0 | |

| Strong Sell | 1 |

Sentiment Development

The sentiment around Eaton Corporation has remained stable, with a persistent confidence reflected in the high number of Buy and Strong Buy recommendations. The overall count of ratings has remained consistent over recent months, indicating steady interest and confidence from analysts. Noticeably, the Hold recommendations have fluctuated slightly, suggesting minor hesitance in a segment of analysts.

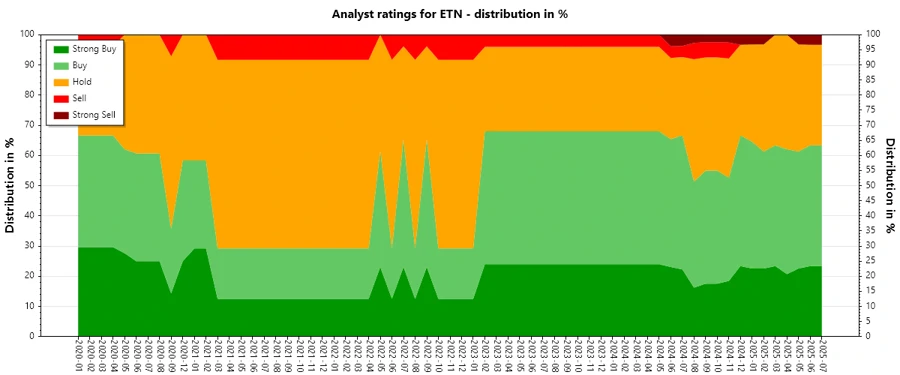

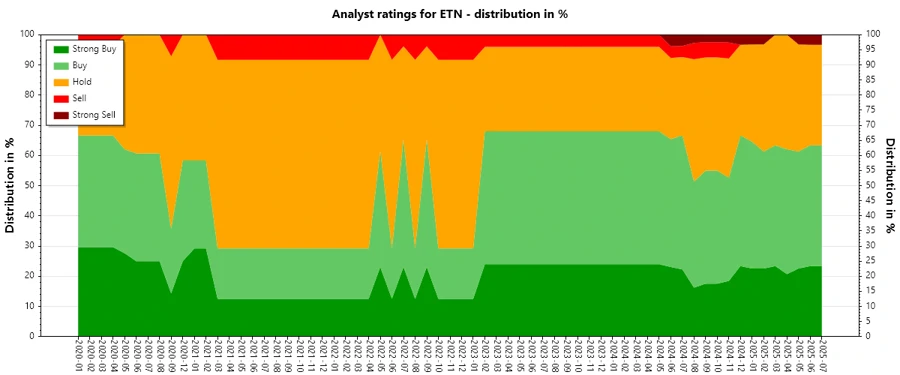

Percentage Trends

The percentage distribution of ratings reflects a slight shift towards caution, observed through a small increase in Hold ratings over the months. The persistence of Strong Buy and Buy ratings suggests a continued positive outlook from the majority, yet the marginal increase in Hold ratings over time could suggest emerging caution amongst analysts.

- Jan 2025: Strong Buy 21%, Buy 37%, Hold 31%, Sell 0%, Strong Sell 3% - Apr 2025: Strong Buy 19%, Buy 38%, Hold 35%, Sell 0%, Strong Sell 0% - Jul 2025: Strong Buy 22%, Buy 38%, Hold 31%, Sell 0%, Strong Sell 3%Latest Analyst Recommendations

The recent analyst activities reveal a consistent stance with no changes in ratings, indicating ongoing faith in the company's prospects without any drastic reevaluation.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-15 | Overweight | Overweight | Keybanc |

| 2025-07-14 | Buy | Buy | Citigroup |

| 2025-07-09 | Equal Weight | Equal Weight | Barclays |

| 2025-07-08 | Buy | Buy | Goldman Sachs |

| 2025-07-01 | Equal Weight | Equal Weight | Wells Fargo |

Analyst Recommendations with Change of Opinion

Some analysts have shifted their stance over the past months, with a few downgrades reflecting cautious perspectives amidst a generally stable positive sentiment.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-03-12 | Overweight | Sector Weight | Keybanc |

| 2025-01-28 | Hold | Buy | Melius Research |

| 2024-11-13 | In Line | Outperform | Evercore ISI Group |

| 2024-09-06 | Peer Perform | Underperform | Wolfe Research |

| 2024-04-08 | Underperform | Peer Perform | Wolfe Research |

Interpretation

The consistency in recommendations with minimal downgrades indicates continued confidence in Eaton Corporation's business strategy and execution. Analysts' stable ratings reflect a robust market perception, though some recent cautious adjustments hint at a watchful approach amidst broader market dynamics. Overall, there remains stability within analyst sentiment, suggesting sustained faith in Eaton's performance capacity.

Conclusion

In summary, Eaton Corporation plc continues to uphold a strong position in the power management industry, evidenced by consistent buy ratings from analysts. The steadiness in these ratings suggests a resilient outlook, underpinned by confidence in Eaton's diversified product offerings and strategic initiatives across its segments. While a slight increase in Hold stances may point to emerging caution, the prevailing sentiment tilts positively, emphasizing ongoing trust in Eaton’s growth potential and market strategies.