September 08, 2025 a 07:43 am

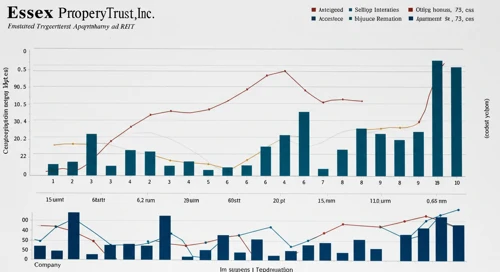

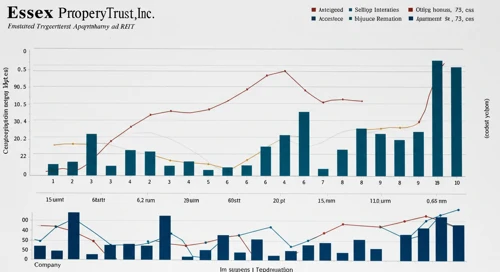

ESS: Fundamental Ratio Analysis - Essex Property Trust, Inc.

Essex Property Trust, Inc. is a reputable REIT with a focus on multifamily residential properties along the West Coast. The company's integration strategy in acquisition, development, and management is reflected in its stable growth and asset base. The stock's recent performance indicates a balanced blend of opportunities and challenges in the current real estate market.

Fundamental Rating

The fundamental ratings for Essex Property Trust show a solid B+ indicating strong management and performance metrics in key financial areas.

| Category | Score | Score Bar |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return On Equity | 5 | |

| Return On Assets | 5 | |

| Debt To Equity | 2 | |

| Price To Earnings | 2 | |

| Price To Book | 1 |

Historical Rating

A comparison of past and present scores reveals consistent strengths and reveals areas needing attention.

| Date | Overall Score | DCF | ROE | ROA | Debt to Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-09-05 | 3 | 4 | 5 | 5 | 2 | 2 | 1 |

| N/A | 0 | 4 | 5 | 5 | 2 | 2 | 1 |

Analyst Price Targets

The consensus price target suggests modest growth potential, with a target median at $309.

| High | Low | Median | Consensus |

|---|---|---|---|

| $309 | $283 | $309 | $300.33 |

Analyst Sentiment

Current market sentiment on Essex Property Trust is leaning towards holding, with significant support at 'buy' and 'hold' positions.

| Recommendation | Count | Distribution |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 18 | |

| Hold | 24 | |

| Sell | 4 | |

| Strong Sell | 0 |

Conclusion

Essex Property Trust, Inc. demonstrates a robust framework in maintaining upward momentum with strategic market engagements. However, potential investors should be mindful of the moderate risk displayed in debt-equity dynamics and price valuations. The analyst sentiment indicates relative steadiness, supported by general optimism for long-term holding. Given the competitive sector and volatile market conditions, Essex continues to position itself as a potentially profitable investment with balanced growth prospects.