November 17, 2025 a 03:15 am

EPAM: Trend and Support & Resistance Analysis - EPAM Systems, Inc.

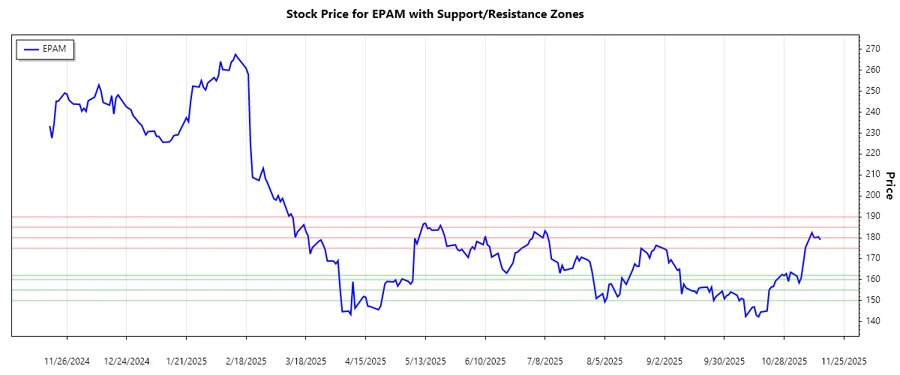

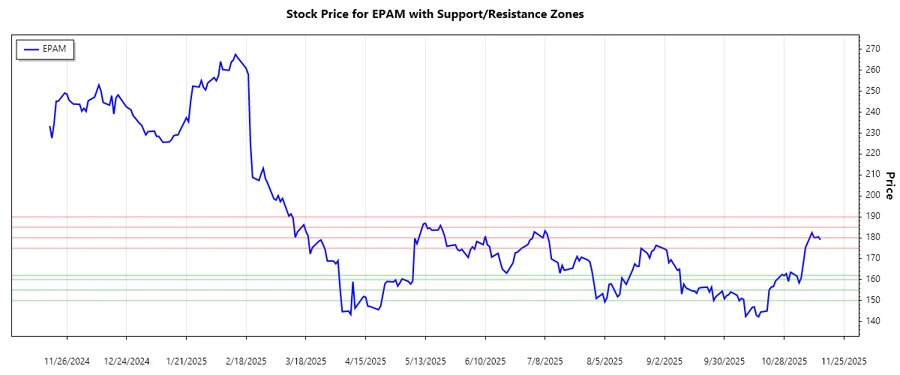

The stock of EPAM Systems, Inc. has exhibited some fluctuating trends over the past months. As a digital platform engineering and software development leader, EPAM operates in a dynamic industry, impacting its stock's price patterns. Recent trends indicate a notable movement. Using key technical indicators like EMA20 and EMA50, we can analyze the directionality to anticipate future behavior. Specific support and resistance zones will provide further insights into potential price movements.

Trend Analysis

Analyzing the data through the exponential moving averages (EMA), we get a clearer picture of the stock's momentum. The EMA20 and EMA50 comparison gives us vital hints about the underlying trend. Over the recent period, the stock has shown fluctuating patterns between bullish and bearish trends, indicative of market volatility.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-14 | $179.02 | ⚖️ |

| 2025-11-13 | $180.47 | ⚖️ |

| 2025-11-12 | $180.12 | ⚖️ |

| 2025-11-11 | $180.16 | ⚖️ |

| 2025-11-10 | $182.40 | ▲ |

| 2025-11-07 | $175.30 | ▼ |

| 2025-11-06 | $168.00 | ▼ |

Overall, the trend analysis suggests caution with a recent sideways trend predominating. The EMA indicators show a predominance toward no clear long-term trend, signaling potential price stability in the short-term.

Support- and Resistance

Identifying support and resistance zones provide crucial levels where the price might react if approached either as a barrier or a foundation for price movement. Evaluating this has been key for investors to decide on entry and exit points.

| Zone Type | From | To |

|---|---|---|

| Support | $160.00 | $162.00 |

| Support | $150.00 | $155.00 |

| Resistance | $185.00 | $190.00 |

| Resistance | $175.00 | $180.00 |

The current trading range is not in contention with any immediate support or resistance zone, highlighting a possible calm before a stretch in either direction.

Conclusion

EPAM Systems, Inc. shows a stock in a flux, with the potential for both growth and caution. The technical indicators suggest an equilibrium over recent sessions. Factoring in market conditions and external influences, this stock could see varied interest. The identified support and resistance points offer strategic levels for engagement. Investors should remain cautious and focus on the emerging market dynamics before committing. The stock appears fundamentally stable but requires further directional clarity.