February 12, 2026 a 09:00 am

EOG: Analysts Ratings - EOG Resources, Inc.

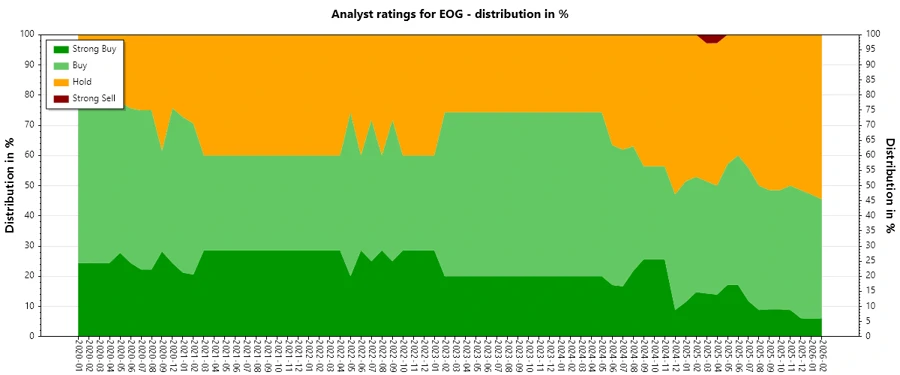

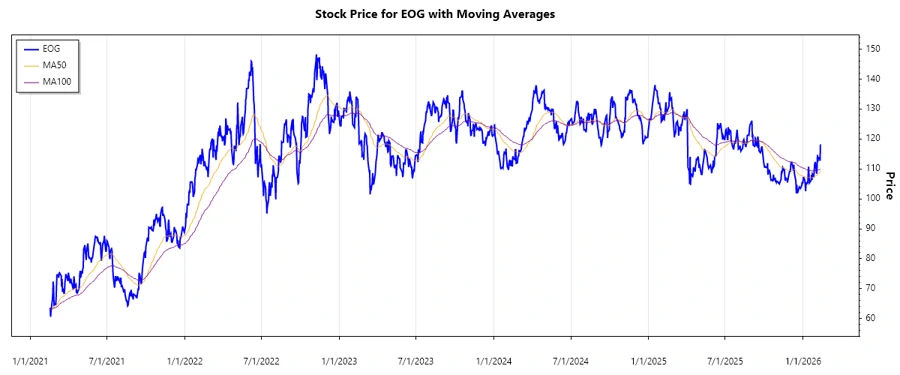

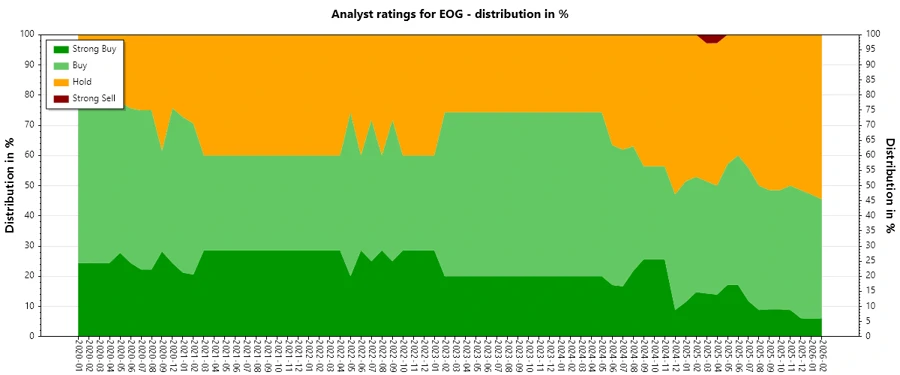

EOG Resources, Inc. represents a prominent entity within the oil and gas sector, with exploration and production operations focused heavily in New Mexico and Texas. Despite recent fluctuations in analyst ratings, the stock maintains strong support, particularly in the 'Hold' and 'Buy' categories, reflecting a certain level of confidence in its potential. The consistent level of 'Hold' ratings indicates some market caution, likely influenced by the volatility in the energy sector.

Historical Stock Grades

Examination of recent data indicates stability in the sentiment metrics surrounding EOG Resources, Inc. for the first quarter of 2026. While 'Strong Buy' ratings have slightly decreased since last year, a robust amount of 'Buy' and 'Hold' sentiments persist, demonstrating a balanced yet cautious outlook from financial analysts.

| Recommendation | Count | Score Visualization |

|---|---|---|

| Strong Buy | 2 | |

| Buy | 13 | |

| Hold | 18 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

Throughout the latter part of 2025 into early 2026, notable sentiment shifts are apparent, especially a gradual increase in the 'Hold' category and a consistent decrease in 'Buy' and 'Strong Buy' recommendations. This trend suggests a market growing more conservative or uncertain about EOG's short-term performance.

- Overall ratings show a steady increase in caution among analysts, with 'Hold' ratings becoming more prevalent.

- 'Strong Buy' recommendations have seen a reduction since late 2024, indicating conservative market expectations.

- Conversely, 'Sell' and 'Strong Sell' categories remain zero, reflecting relative market confidence that EOG will not perform poorly.

Percentage Trends

Analyzing the rating percentages over time reveals interesting shifts. There has been a noticeable drop in 'Strong Buy' ratings while 'Hold' percentages have risen. This redistribution of ratings can be interpreted as a move towards caution amidst volatile market conditions.

- 'Strong Buy' saw a decline from 25% in early 2025 to around 8% in early 2026.

- 'Hold' ratings increased significantly from 36% up to 72% during the same period, illustrating growing market restraint.

- 'Buy' leveled off around 52% after a brief period of increased confidence in early 2024.

Latest Analyst Recommendations

Recent analyst activities reflect consistency in sentiment, as most recommendations have been maintained. This stability signals a consensus on EOG's current market position and future outlook.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-01-28 | Neutral | Neutral | Piper Sandler |

| 2026-01-27 | Overweight | Overweight | Wells Fargo |

| 2026-01-26 | Positive | Positive | Susquehanna |

| 2026-01-23 | Equal Weight | Equal Weight | Morgan Stanley |

| 2026-01-21 | Equal Weight | Equal Weight | Barclays |

Analyst Recommendations with Change of Opinion

There have been several downgrades since mid-2025, reflecting a shift from more optimistic ratings to neutral or sector-weighted outlooks. Such movements imply a reevaluation of EOG's expected market performance relative to industry peers.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-01-16 | Sector Weight | Overweight | Keybanc |

| 2025-09-26 | Sector Perform | Sector Outperform | Scotiabank |

| 2025-08-25 | Hold | Buy | Argus Research |

| 2025-07-09 | Neutral | Buy | Roth Capital |

| 2025-04-11 | Sector Outperform | Sector Perform | Scotiabank |

Interpretation

The series of downgrades and maintained ratings suggest a balanced but cautious view of EOG Resources, Inc. There appears to be hesitation to commit to strong optimistic stances due to current market volatilities. Nonetheless, the absence of strong sell signals indicates a fundamental belief in the company’s underlying stability and competitive positioning. Generally, the sentiment reflects a watchful yet steady confidence in EOG's market presence, hinting at resilience amidst external pressures.

Conclusion

EOG Resources, Inc. continues to experience a generally supportive yet cautioned market view. As seen in recent downgrades and maintained ratings, there is a consensus on maintaining stable expectations and valuations amidst an uncertain energy landscape. Such a sentiment underlines the importance of monitoring EOG's operational efficiencies and market responses to strategize future developments. Ultimately, while risks exist given sector volatilities, the foundational prospects of EOG Resources, underpinned by their strong market position, offer room for cautiously optimistic engagement.