June 26, 2025 a 03:15 am

EMN: Trend and Support & Resistance Analysis - Eastman Chemical Company

The Eastman Chemical Company (EMN) has shown variability in its stock prices over recent months, influenced by broader market trends. Their involvement in diverse sectors from transportation to agriculture offers a resilient business model, offering growth opportunities amidst economic fluctuations. However, recent trends suggest a predominately downward trajectory impacted by decreased demand in certain segments. Investors should consider both the technical signals and the company's market strategy moving forward.

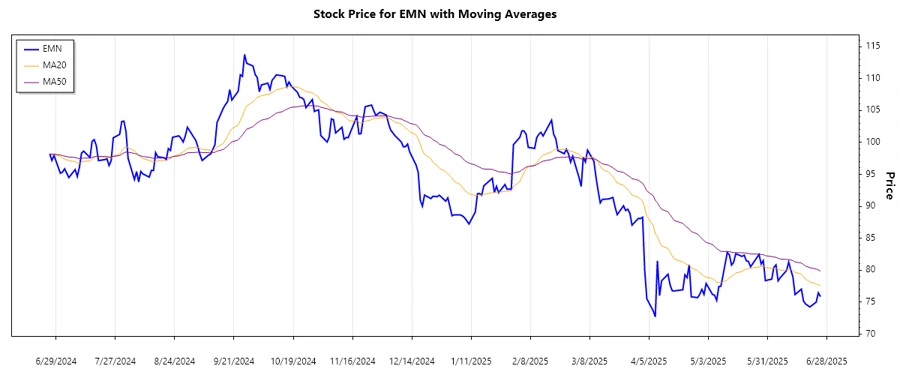

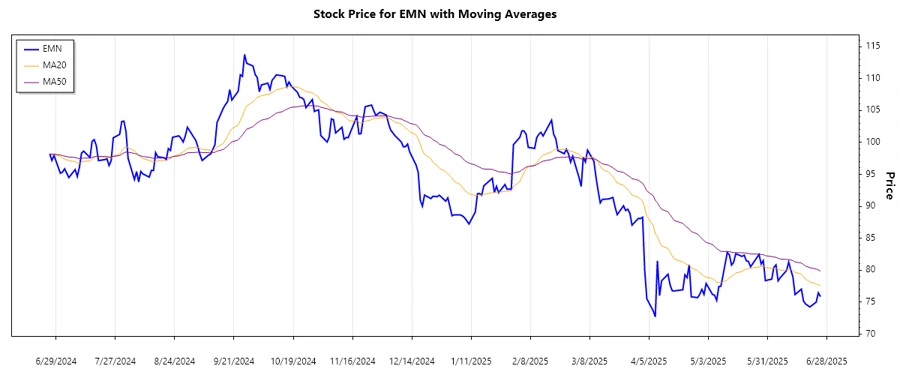

Trend Analysis

The trend analysis for Eastman Chemical Company indicates fluctuating momentum but primarily a bearish outlook in recent weeks. By evaluating the data for the last 50 days, the EMA (Exponential Moving Average) calculations reveal a consistent decrease in prices, suggesting a weakening in the market valuation of the stock.

| Date | Close Price | Trend |

|---|---|---|

| 2025-06-25 | $75.87 | ▼ |

| 2025-06-24 | $76.46 | ▼ |

| 2025-06-23 | $75.01 | ▼ |

| 2025-06-20 | $74.25 | ▼ |

| 2025-06-18 | $74.71 | ▼ |

| 2025-06-17 | $75.17 | ▼ |

| 2025-06-16 | $77.04 | ▲ |

The data reveals a prevailing downward trend with short-term fluctuation, suggesting careful assessment of entry points for longs.

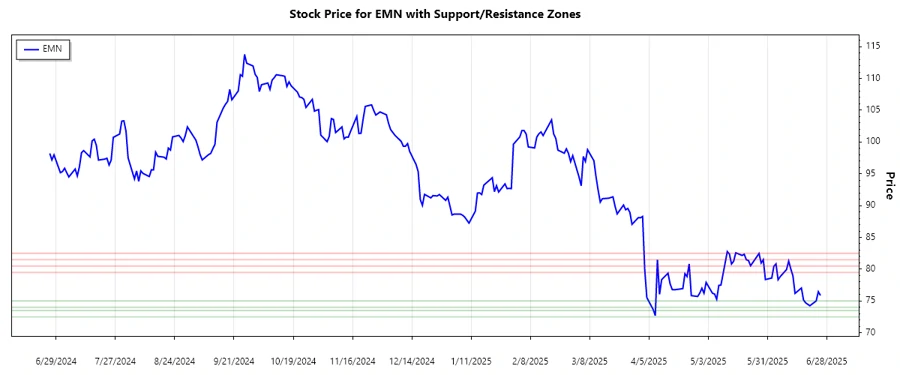

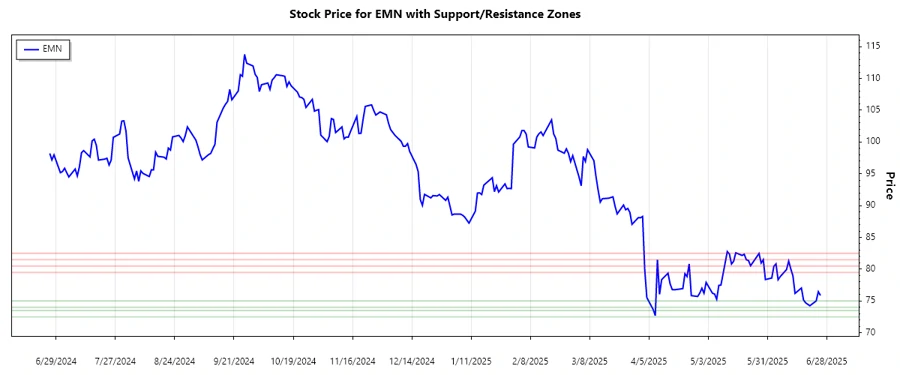

Support and Resistance

Detailed technical analysis of EMN's recent trading range identifies crucial support and resistance zones which suggest potential price barriers. These could act as key decision-making levels for traders and investors.

| Zone Type | From | To | Indicator |

|---|---|---|---|

| Support 1 | $74.00 | $75.00 | 🟢 |

| Support 2 | $72.50 | $73.50 | 🟢 |

| Resistance 1 | $79.50 | $80.50 | 🔴 |

| Resistance 2 | $81.50 | $82.50 | 🔴 |

The stock is currently approaching support levels, indicating potential stabilization. Therefore, monitoring for a possible upturn is advisable.

Conclusion

Eastman Chemical Company stands at a pivotal point, where support levels suggest a potential rebound opportunity amidst a predominantly bearish phase. While the EMA analysis indicates a selling sentiment, the proximity to support could offer a strategic entry or exit. Investors should weigh the potential for gradual recovery against external market pressures. Fundamentally robust, Eastman's diversified operations can mitigate some risks, but tactical trading aligned with technical signals may yield optimal outcomes.