August 23, 2025 a 12:38 pm

ELV: Analysts Ratings - Elevance Health Inc.

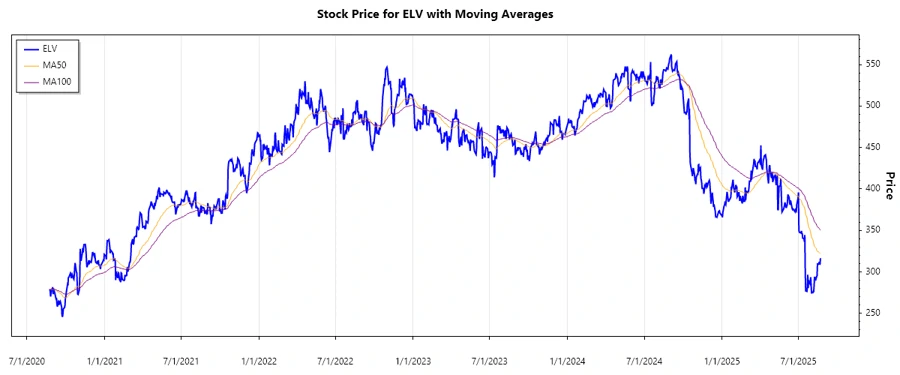

Elevance Health Inc., as a leading health benefits company, continues to display robust market presence, catering to an extensive customer base with varied health solutions. Recent analyst ratings reflect a cautiously optimistic outlook with an emphasis on sustained performance amid evolving healthcare needs. The stock is subjected to a diverse range of sentiment shifts, suggesting moderate conservative positions alongside aggressive recommendations.

Historical Stock Grades

The latest analyst ratings from August 2025 for Elevance Health Inc. show a generally positive outlook. The ratings indicate a predominance of "Buy" recommendations, meaning analysts have confidence in the company's performance and market strategy. The dataset does highlight minor fluctuations across ratings, hinting at subtle market dynamics.

| Rating | Count | Visual Bar |

|---|---|---|

| Strong Buy | 3 | |

| Buy | 12 | |

| Hold | 6 | |

| Sell | 0 | |

| Strong Sell | 0 |

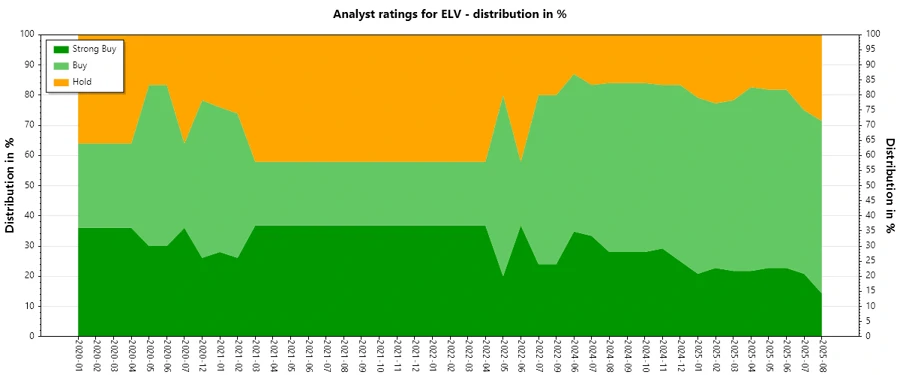

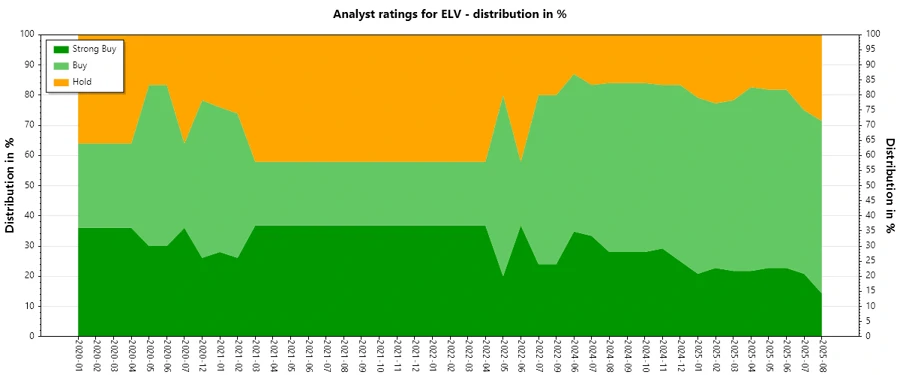

Sentiment Development

Over the recent months, Elevance Health Inc. has seen a shift in analysts' sentiment, with a moderate increase in "Hold" ratings while "Strong Buy" ratings have slightly diminished. This reflects a trend towards conservative market predictions and potential caution in future performance.

- "Strong Buy" ratings decreased from 7 to 3 over the year.

- "Buy" ratings remain relatively stable, displaying consistent analyst confidence.

- "Hold" ratings saw an increase as analysts adopt a wait-and-see approach.

Percentage Trends

The overall recommendation ratio has transitioned slightly towards "Hold" positions, signaling a cautious market stance. Calculating the percentage distribution of each category shows a 15% in "Strong Buy," 60% in "Buy," and 25% in "Hold" as of August 2025.

- Reduced "Strong Buy" reflects conservative shifts in analyst sentiment.

- Steadiness of "Buy" suggests sustained industry confidence.

- Rising "Hold" hints at potential market volatility concerns.

Latest Analyst Recommendations

Analyst recommendations for Elevance Health Inc. over the past few months indicate stability, with most ratings maintained at current levels. There was, however, a notable downgrade by Argus Research to "Hold" from "Buy," suggesting a more cautious investment approach.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-15 | Overweight | Overweight | Wells Fargo |

| 2025-07-25 | Neutral | Neutral | Baird |

| 2025-07-22 | Overweight | Overweight | JP Morgan |

| 2025-07-22 | Overweight | Overweight | Barclays |

| 2025-07-21 | Hold | Buy | Argus Research |

Analyst Recommendations with Change of Opinion

Recent downgrades highlight a trend toward caution. Over the past months, certain analysts have shifted towards more neutral or conservative stances. Notably, Argus Research downgraded their previous "Buy" to a "Hold." Such changes denote a deeper reevaluation of market conditions.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-21 | Hold | Buy | Argus Research |

| 2025-07-18 | Market Perform | Outperform | Leerink Partners |

| 2025-04-15 | Neutral | Outperform | Baird |

| 2025-03-17 | Buy | Hold | Argus Research |

| 2024-10-18 | Hold | Buy | Argus Research |

Interpretation

The analysts' sentiment towards Elevance Health Inc. suggests a balance between cautious optimism and minimal uncertainty. While there is a noticeable reduction in aggressive "Strong Buy" ratings, the prevailing consistency in "Buy" and "Hold" recommendations speaks to a market expectation of stable yet careful growth. Despite minor downgrades, the general outlook suggests maintained confidence in the company's operations.

Conclusion

Elevance Health Inc. remains a stable entity in the healthcare sector, with mostly positive analyst ratings. Current trends indicate a modest shift toward conservative recommendations, hinting at market caution but not overt concern. This suggests potential opportunities for steady gains without significant risk exposure. As the market evolves, the company's strong foundational presence provides a buffer against volatility, making it a dependable investment choice.