February 12, 2026 a 10:15 am

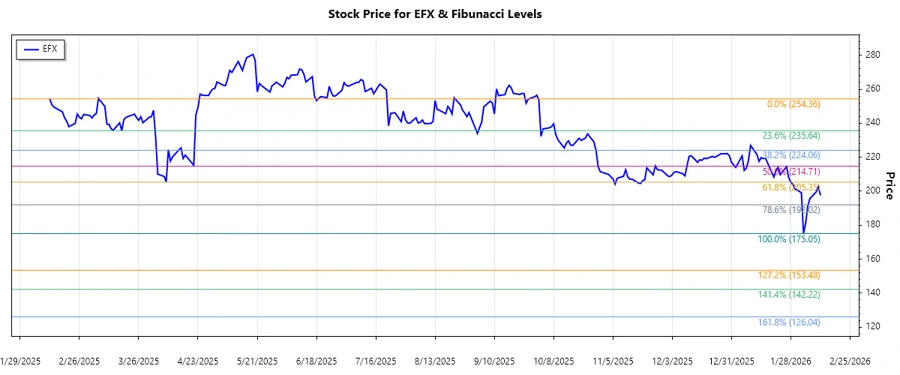

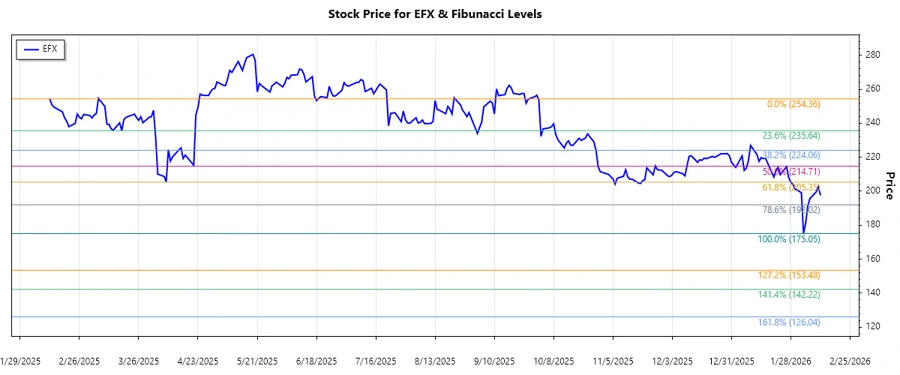

EFX: Fibonacci Analysis - Equifax Inc.

Equifax Inc.'s stock has recently shown a predominant downtrend over the analyzed period, reflecting market adjustments and investor sentiment. With its diverse business segments, the company continues to hold a significant position in the information solutions industry. Upcoming market responses and regulatory impacts may provide further movement in its stock price.

Fibonacci Analysis

| Parameter | Details |

|---|---|

| Start Date | 2025-02-12 |

| End Date | 2026-02-11 |

| High (date/price) | 2025-02-12 / 254.36 |

| Low (date/price) | 2026-02-04 / 175.05 |

| Fibonacci Level | Price |

|---|---|

| 0.236 | 198.66 |

| 0.382 | 210.99 |

| 0.5 | 214.70 |

| 0.618 | 226.74 |

| 0.786 | 239.66 |

The current stock price is situated within the 0.236 retracement level, around 197.6, indicating weak support. This proximity to the lowest Fibonacci level suggests potential resistance, and investors might expect further decline unless a reversal occurs.

Conclusion

Equifax Inc.'s recent stock trajectory suggests a cautious investor stance amidst market volatilities and economic factors. While the retracement analysis shows potential support levels, the risk of further downward movement remains. Analysts should watch for changes in market sentiment and regulatory developments impacting the industry. Equifax's strong position in the information services sector mitigates some risks, but the technical analysis suggests a prudent approach before making any significant investment decisions.