August 03, 2025 a 05:15 am

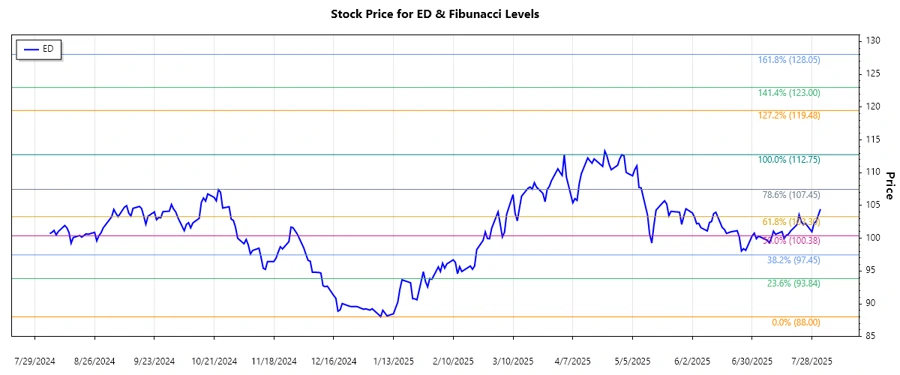

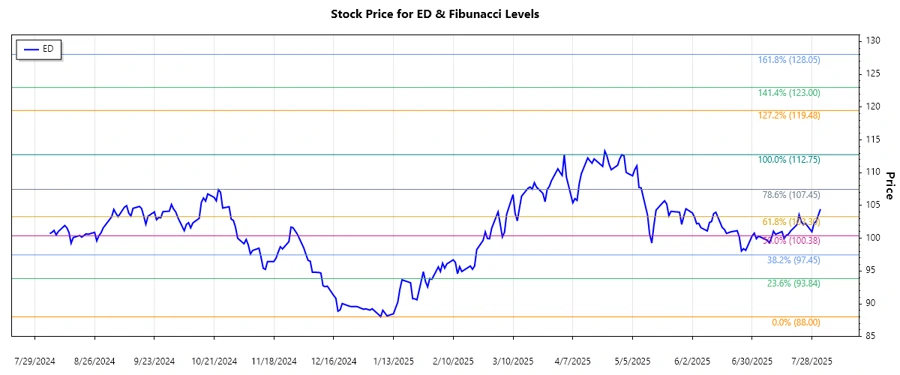

ED: Fibonacci Analysis - Consolidated Edison, Inc.

The recent analysis of Consolidated Edison, Inc. (Ticker: ED) indicates a consistent upward trend in stock prices over the past months. As a significant player in the regulated utilities sector, the company's reliability in electric, gas, and steam delivery services supports its stable stock performance. The potential for growth in energy infrastructure projects further enhances its investment appeal. Investors should consider the stock's defensive nature amid volatile market conditions.

Fibonacci Analysis

| Metric | Details |

|---|---|

| Trend Start Date | 2024-12-02 |

| Trend End Date | 2025-08-01 |

| High Price | $112.75 on 2025-04-30 |

| Low Price | $88.00 on 2024-01-07 |

| Fibonacci Level 0.236 | $96.97 |

| Fibonacci Level 0.382 | $101.22 |

| Fibonacci Level 0.5 | $105.37 |

| Fibonacci Level 0.618 | $109.52 |

| Fibonacci Level 0.786 | $114.19 |

| Current Price and Retracement Zone | $104.44 at 0.5 Fibonacci Level |

| Technical Interpretation | The price currently hovers around the 50% retracement level, suggesting a potential support area. If the stock maintains stability above this zone, further upward movement is plausible. |

Conclusion

Consolidated Edison, Inc. has shown a steady upward trajectory, reflecting its robust position in utility services. The stock's movement to the 50% Fibonacci retracement level hints at a temporary pause in the trend, offering an opportunity for consolidation or potential reversal. Analysts should monitor if the support holds, which could indicate further gains. The company's diversification into renewable energy projects and infrastructure investments adds a layer of growth potential, presenting favorable scenarios for long-term investors. However, fluctuations in energy prices and regulatory changes remain underlying risks.