August 06, 2025 a 12:38 pm

EBAY: Analysts Ratings - eBay Inc.

eBay Inc., a major player in the online marketplace industry, currently demonstrates a mixed outlook from analysts. Despite stable operations and a strong presence in its sector, recent trends in analyst recommendations suggest a cautious sentiment, with an increase in hold ratings, reflecting some market uncertainties. This warrants careful attention to future market developments and earnings performance.

Historical Stock Grades

Over the course of the last few months, eBay Inc. has experienced a steady approach from analysts. As of August 2025, there are 4 Strong Buy, 6 Buy, 18 Hold, 4 Sell, and 1 Strong Sell ratings. This distribution indicates a moderate level of confidence in the stock's short-term prospects.

| Recommendation | Count | Score Distribution |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 6 | |

| Hold | 18 | |

| Sell | 4 | |

| Strong Sell | 1 |

Sentiment Development

The sentiment around eBay's stock has experienced a palpable shift recently. Over the past year, a noticeable increase in Hold ratings has emerged, indicating a more conservative outlook from analysts.

- July 2025: Hold ratings increased to 20, hinting at market stabilization.

- Strong Buy recommendations have remained constant, limiting aggressive forecasts.

- Recent months show a reduction in Strong Sell opinions, suggesting reduced pessimism.

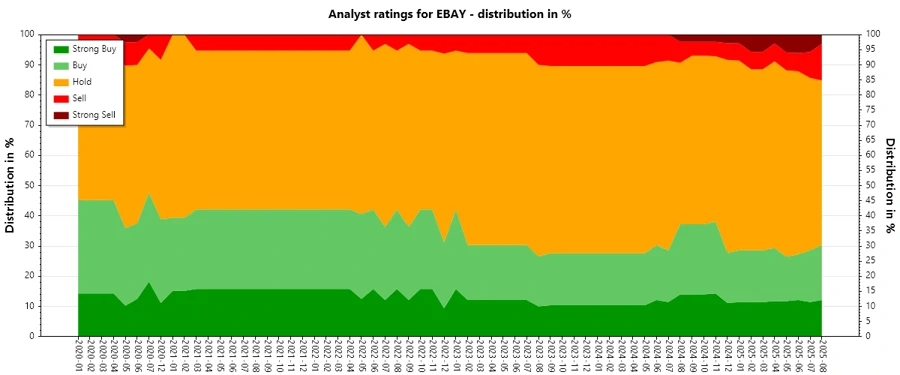

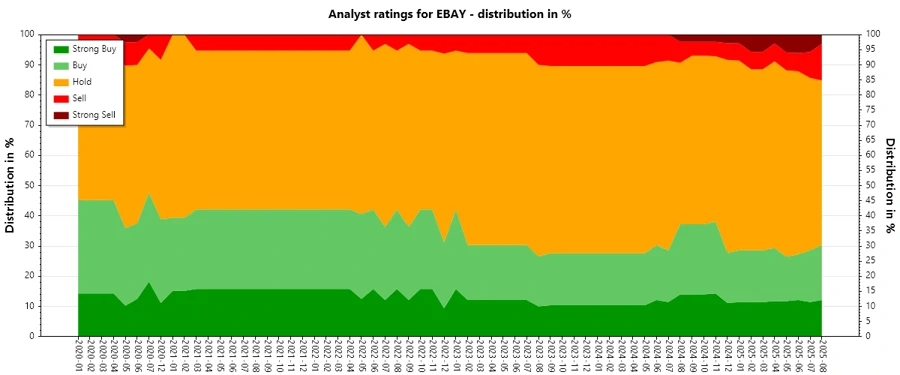

Percentage Trends

Percentage analysis reveals a gradual inclination towards conservative positions over the past year. Notably, as Hold ratings increase, the proportion of Strong Buy and Buy recommendations collectively decreased, signaling a shift towards neutrality.

- Strong Buy ratings slid from 17% in early 2025 to around 11% by August 2025.

- Hold's influence soared to a significant 56%, indicating prevailing market caution.

- The ratio of Buy recommendations maintained mid-20% stability, echoing consistent but cautious positivity.

Latest Analyst Recommendations

Recent months have seen minor shifts in the analyst ratings for eBay. Most recommendations maintain previous stances with occasional slight upgrades, reflecting modest confidence.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-01 | Neutral | Neutral | Susquehanna |

| 2025-07-31 | Buy | Buy | Benchmark |

| 2025-07-31 | Neutral | Neutral | Cantor Fitzgerald |

| 2025-07-31 | Outperform | Market Perform | BMO Capital |

| 2025-07-31 | Buy | Buy | Needham |

Analyst Recommendations with Change of Opinion

Analysis of changes in recommendations reveals slight realignments, with BMO Capital being the most notable upgrade from Market Perform to Outperform. However, overall opinion changes have been limited amidst stable market indicators.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-31 | Outperform | Market Perform | BMO Capital |

| 2025-04-22 | Market Perform | Outperform | Bernstein |

| 2024-12-10 | Underperform | Hold | Jefferies |

| 2024-11-05 | Outperform | Market Perform | Bernstein |

| 2024-04-18 | Overweight | Underweight | Morgan Stanley |

Interpretation

The current analyst sentiment towards eBay Inc. signals cautious optimism. Despite varying opinions, there appears to be a guarded level of confidence, as shown by the prevailing Hold and Buy recommendations. The existence of occasional upgrades indicates selective confidence boosts, largely in response to eBay's stable but uninspiring market performance. Analyzing these recommendations provides insight into broader market perspectives and suggests a high degree of market volatility, although significant shifts are yet to emerge in the overall analyst sentiment.

Conclusion

In recent months, eBay Inc.'s analyst ratings have stabilized, reflecting a cautious yet consistent sentiment among analysts. The balance between Hold and Buy recommendations implies a belief in eBay's robust market position but hedged with potential uncertainties about future growth. While there have been some upgrades, substantial changes in sentiment are yet to be realized. Traders should remain watchful of any emerging trends or earnings reports that could significantly impact market dynamics. Overall, eBay retains a solid place in the market, with opportunities contingent upon future strategic moves and external economic conditions.