July 21, 2025 a 02:03 pm

EA: Trend and Support & Resistance Analysis - Electronic Arts Inc.

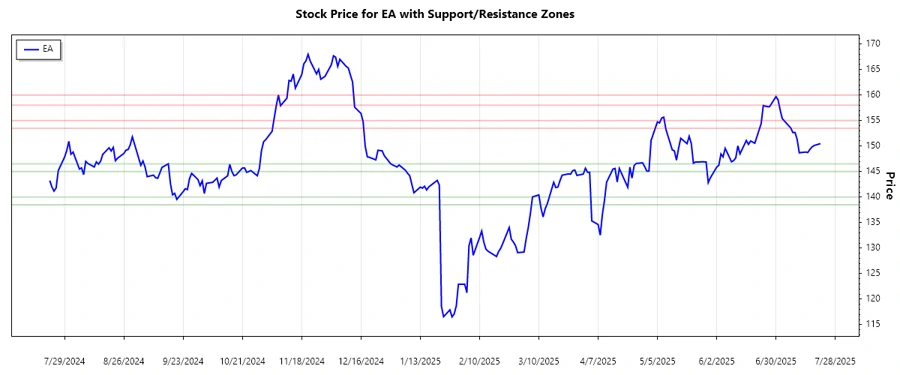

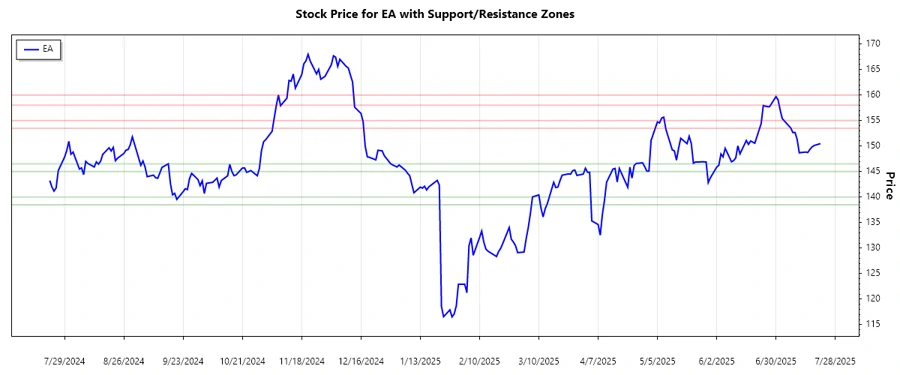

Electronic Arts Inc., a leading developer and publisher in the gaming industry, has shown a moderate upward trajectory over the past months. Despite some volatility, the overall stock performance aligns with broader market trends. Investors may find opportunities in its robust portfolio and strategic ventures, although market fluctuations are ever-present.

Trend Analysis

The analysis of the stock prices of Electronic Arts Inc. over the past months indicates a nuanced pattern. The EMA20, calculated from recent closing data, suggests a slight upward movement compared to the EMA50. This crossover reflects a moderate bullish sentiment.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-07-21 | 150.485 | ▲ Upward |

| 2025-07-18 | 150.11 | ▲ Upward |

| 2025-07-17 | 149.83 | ▲ Upward |

| 2025-07-16 | 149.35 | ▲ Upward |

| 2025-07-15 | 148.74 | ▲ Upward |

| 2025-07-14 | 148.83 | ▲ Upward |

| 2025-07-11 | 148.69 | ▲ Upward |

The trend indicates a consistent upward momentum, suggesting potential for future growth within the stock.

Support and Resistance

Upon examining the historical closing prices, several key support and resistance zones have emerged. These zones are crucial for investors to identify potential price reversals.

| Zone Type | From | To |

|---|---|---|

| Support | 146.50 | 145.00 |

| Support | 140.00 | 138.50 |

| Resistance | 153.50 | 155.00 |

| Resistance | 158.00 | 160.00 |

Currently, the stock price hovers above the primary support zone, suggesting a favorable buying zone for cautious investors. Nonetheless, resistance levels indicate potential challenges to growth.

Conclusion

The analysis reveals a positive outlook for Electronic Arts' stock, supported by an emerging upward trend. The company's strong market position and product diversification provide a stable foundation against market volatility. However, resistance levels must be monitored closely, as they may impede significant upward movements. Investors might view the current support zones as entry points, though awareness of potential risks is essential. This technical assessment suggests optimism for the company's stock trajectory, subject to market conditions and strategic execution.