August 20, 2025 a 01:01 pm

EA: Analysts Ratings - Electronic Arts Inc.

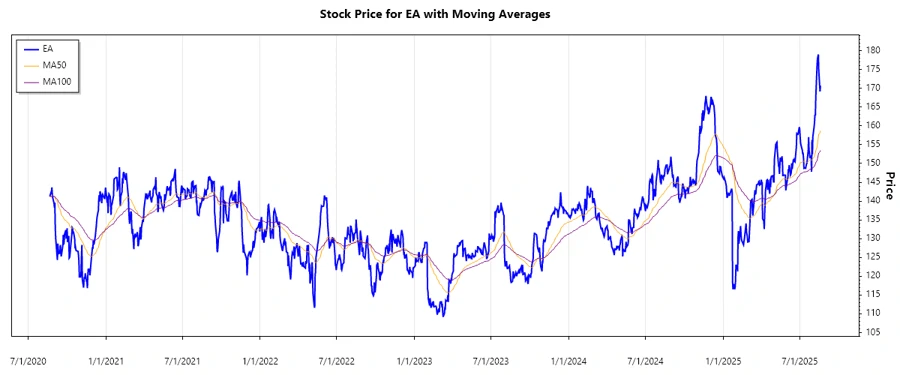

Electronic Arts Inc., a leader in the global gaming industry, faces evolving market conditions influenced by shifts in consumer preferences and technological advancements. The current analyst ratings reflect a predominant 'Hold' sentiment, suggesting cautious optimism amid industry competition and internal strategic adjustments. Monitoring the company's adaptation to digital trends and franchise developments will be pivotal for future performance.

Historical Stock Grades

The recent analyst ratings for Electronic Arts Inc. indicate a notable inclination towards 'Hold' recommendations, with some 'Buy' recommendations persisting. The data from August 2025 highlights a singular 'Strong Sell' opinion amidst a broader conservative market outlook.

| Rating | Number | Score |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 13 | |

| Hold | 17 | |

| Sell | 0 | |

| Strong Sell | 1 |

Sentiment Development

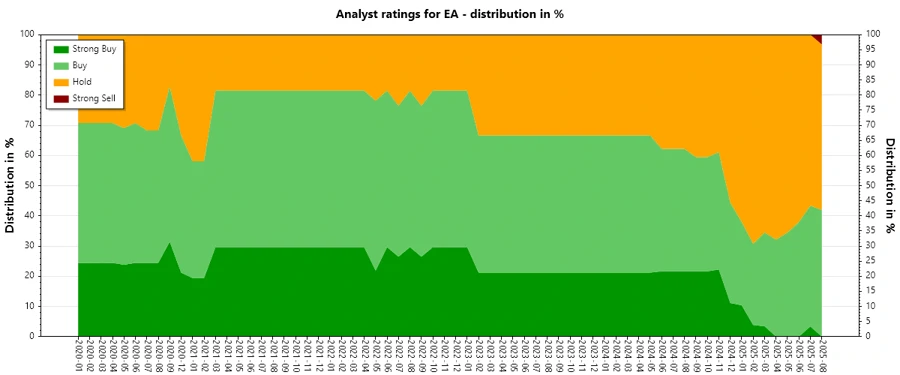

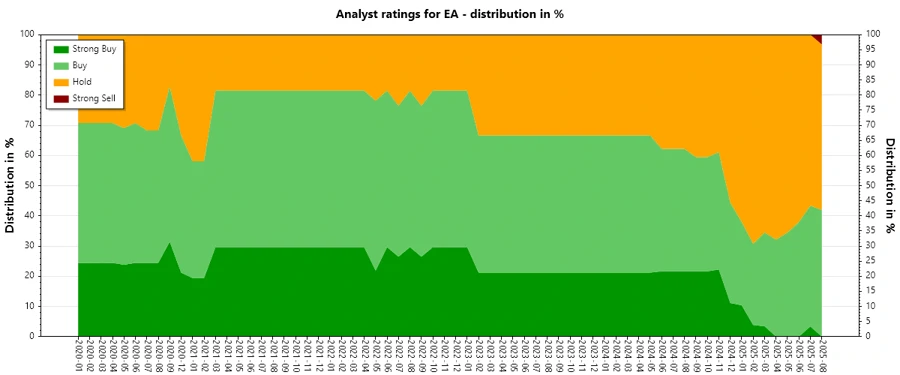

Over recent months, analyst sentiment for EA has shifted notably towards a 'Hold' stance. From a previous balance of 'Strong Buy' and 'Buy', there has been an evident rise in 'Hold' ratings. The tendency towards conservatism indicates a market wait-and-see approach, reflective of underlying uncertainties.

- Decrease in 'Strong Buy' ratings over time.

- Significant rise in 'Hold' recommendations from previous months.

- The overall number of ratings has shown a slight increase, emphasizing increased analysis and scrutiny.

Percentage Trends

The percentage distribution of analyst ratings has displayed marked shifts, especially apparent in the reduction of 'Strong Buy' percentages and concurrent increase in 'Hold' ratings. This trend suggests a cautious market stance, aligning with external industry pressures and speculative insights.

- 'Strong Buy' ratings have decreased from 25% to nearly 0%.

- 'Buy' ratings remain stable, though slightly reduced as focus shifts to 'Hold'.

- 'Hold' ratings now dominate, previously constituting 30% and currently making up 65% of opinions.

Overall, recent months signal an analyst trend toward caution, with notable reservations about robust buying strategies.

Latest Analyst Recommendations

Recent analyst activity surrounding EA reflects continuity and stability, as evidenced by consistent ratings. Changes have been minimal, indicating sustained views amidst minor strategic adjustments.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-11 | Neutral | Neutral | DA Davidson |

| 2025-07-30 | Outperform | Outperform | Baird |

| 2025-07-30 | Neutral | Neutral | B of A Securities |

| 2025-07-22 | Outperform | Outperform | Wedbush |

| 2025-06-24 | Buy | Neutral | Roth Capital |

Analyst Recommendations with Change of Opinion

Shifts in analyst opinions hint at marginal market sentiment changes. The upgrades and downgrades, though limited, reflect nuanced perceptions of EA's strategic positioning and market adaptability.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-06-24 | Buy | Neutral | Roth Capital |

| 2025-01-23 | Neutral | Buy | B of A Securities |

| 2025-01-23 | Market Perform | Outperform | Raymond James |

| 2025-01-23 | Market Perform | Outperform | BMO Capital |

| 2024-12-18 | Hold | Buy | Stifel |

Interpretation

The data suggests a prevailing cautionary approach adopted by analysts towards EA, reflective of external market pressures and intrinsic company challenges. The analyst sentiment mirrors a wait-and-see posture, indicative of potential uncertainties yet to be resolved. There is no overwhelming evidence of drastic change in opinion, highlighting a potential ongoing adaptation to market dynamics.

Conclusion

In summary, Electronic Arts Inc. remains a closely scrutinized entity within the gaming industry. Analysts' ratings and market sentiment underscore a cautious optimism, tempered by competitive pressures and evolving market dynamics. While recent months have showcased a shift towards 'Hold', indicating measured patience, the landscape offers both challenges and opportunities for future growth. Maintaining awareness of industry trends and company strategy will be critical in anticipating EA's performance trajectory.