February 16, 2026 a 01:00 pm

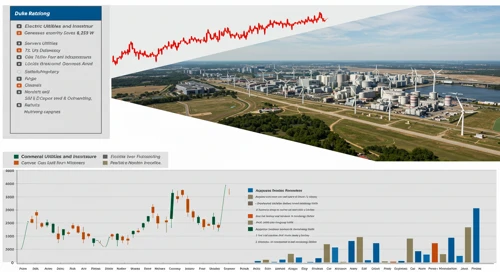

DUK: Fundamental Ratio Analysis - Duke Energy Corporation

Duke Energy Corporation, a leader in the utility sector, shows a stable performance in a highly regulated industry. It has a balanced operating model through its electric, gas, and renewable segments. The stock potentially offers stable returns, but its growth may be limited by regulatory constraints and capital expenditure demands.

Fundamental Rating

Duke Energy has a mixed set of fundamental ratings, reflecting moderate strengths and weaknesses. The stock's performance is average across most fundamental metrics.

| Category | Score | Visualization |

|---|---|---|

| Overall | 2 | |

| Discounted Cash Flow | 1 | |

| Return on Equity | 3 | |

| Return on Assets | 3 | |

| Debt to Equity | 2 | |

| Price to Earnings | 2 | |

| Price to Book | 2 |

Historical Rating

The historical perspective shows a consistent score, with minor fluctuations in recent evaluations.

| Date | Overall Score | DCF | ROE | ROA | Debt to Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2026-02-13 | 2 | 1 | 3 | 3 | 2 | 2 | 2 |

| Unknown | 0 | 1 | 3 | 3 | 2 | 2 | 2 |

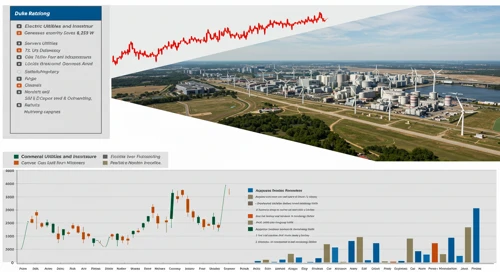

Analyst Targets

The current analyst price targets suggest a moderate upside potential. The consensus hovers closely around the median target.

| High | Low | Median | Consensus |

|---|---|---|---|

| $143 | $115 | $134 | $132.64 |

Analyst Sentiment

Analyst sentiment shows a predominant inclination towards holding the stock, with a fair number recommending a buy.

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 13 | |

| Hold | 18 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

The Duke Energy Corporation presents itself as a stable player in the utilities market, primarily through its diversified segments. While the stock offers consistent returns, its growth potential may be restrained by regulatory environments and significant capital investments. The fundamental analysis scores suggest areas of improvement, yet the overall sentiment remains positive among analysts. Investors should consider both the stability and the regulatory risks involved. Thus, it's potentially a suitable option for those favoring steady income over growth.