May 29, 2025 a 02:03 pmTo conduct a thorough technical analysis of Dollar Tree, Inc. (DLTR) based on the daily closing prices in the JSON data provided, here's a well-structured HTML format optimized for mobile use, along with a corresponding JSON object:

DLTR: Trend and Support & Resistance Analysis - Dollar Tree, Inc.

Dollar Tree, Inc. (DLTR) operates discount variety retail stores across the United States and Canada. Based on recent trend data, DLTR has exhibited a mixed trend with significant fluctuations, which provides both opportunities and risks for investors. As a company relying largely on a fixed-price business model, it remains to be seen how macroeconomic conditions might affect consumer behavior and consequently its stock performance.

Trend Analysis

| Date | Closing Price | Trend |

|---|---|---|

| May 29, 2025 | $89.90 | ▲ Upward |

| May 28, 2025 | $89.34 | ▲ Upward |

| May 27, 2025 | $90.36 | ▼ Downward |

| May 23, 2025 | $88.17 | ▼ Downward |

| May 22, 2025 | $89.97 | ▲ Upward |

| May 21, 2025 | $88.92 | ▼ Downward |

| May 20, 2025 | $90.62 | ▲ Upward |

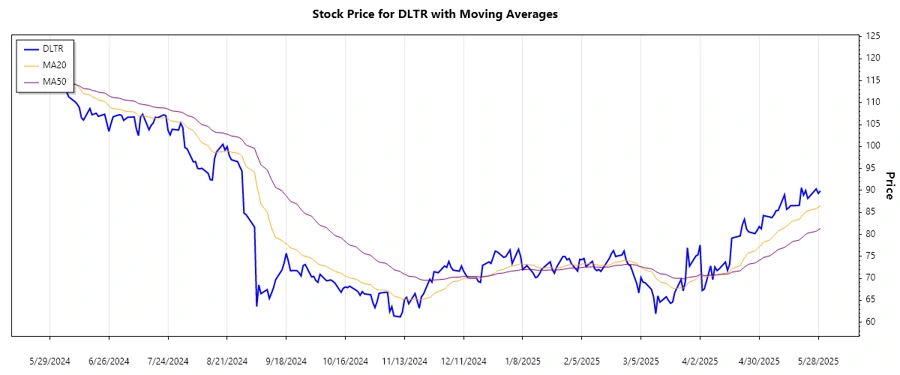

The EMA20 is currently above the EMA50, indicating a sustained upward trend in the short term. However, recent fluctuations suggest market uncertainty.

Support and Resistance

| Zone Type | From | To |

|---|---|---|

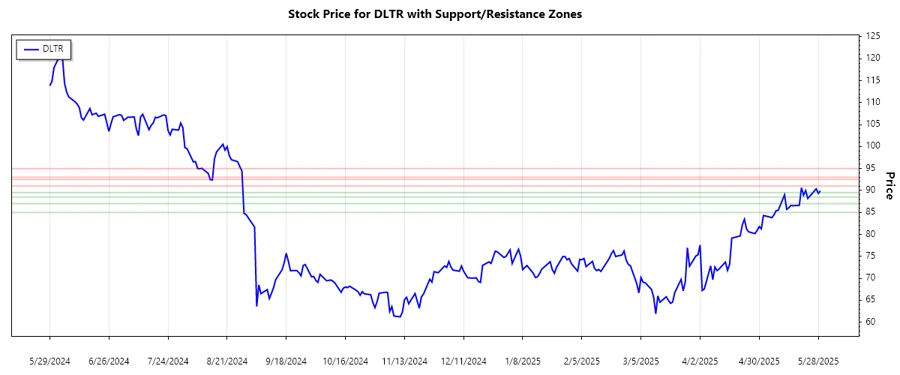

| Support | $85.00 | $87.00 |

| Support | $88.50 | $89.50 |

| Resistance | $91.00 | $92.50 |

| Resistance | $93.00 | $95.00 |

The current price is approaching a resistance zone between $91.00 and $92.50, possibly indicating a challenging environment for further upward movement.

Conclusion

Dollar Tree, Inc. faces a dynamic market environment where both challenges and opportunities are evident. While the short-term upward trend is promising, the stock's approach to resistance zones may impede further gains. Investors should be mindful of the macroeconomic conditions that could affect consumer spending. Given the company's stable business model, it remains a viable option for cautious long-term investment.

**JSON Output:** json ### Analysis Explanation: 1. **Trend Analysis:** A review of recent data showed that DLTR's EMA20 is above EMA50, indicating a prevailing short-term uptrend. 2. **Support and Resistance Zones:** Key levels were identified that could define potential buying and selling points. 3. **Summary:** The analysis acknowledges possible growth while recommending close monitoring of the macroeconomic impacts on the company's performance. This format is specifically designed to be seamlessly integrated into existing web content and provides both a visual and qualitative analysis of DLTR.