July 02, 2025 a 03:15 pm

DLTR: Fibonacci Analysis - Dollar Tree, Inc.

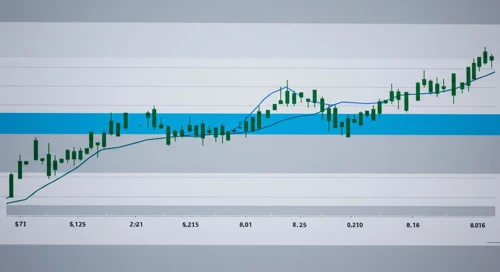

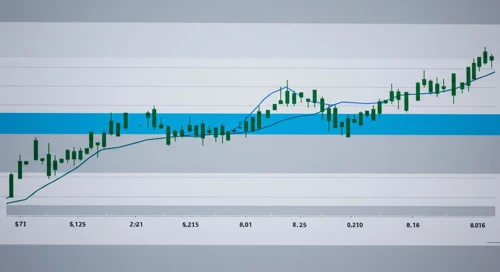

This analysis examines the recent trend of Dollar Tree, Inc., which shows a significant upward movement in its stock price over the analyzed period. The company's performance in the discount retail sector continues to secure a solid market position, with a rising stock trend suggesting investor confidence. The Fibonacci retracement levels derived from this uptrend serve as potential indicators for future price movements, offering essential insight for technical analysts watching for support and resistance levels.

Fibonacci Analysis

| Details | Information |

|---|---|

| Trend Period | April 2, 2025 - July 2, 2025 |

| High Point | $101.69 on July 2, 2025 |

| Low Point | $67.22 on April 3, 2025 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | $78.49 |

| 0.382 | $84.44 |

| 0.5 | $89.45 |

| 0.618 | $94.46 |

| 0.786 | $101.08 |

The current price is $101.69, which positions it just above the 0.786 retracement level. This suggests that the price is nearing a potential resistance point, where the trend could either consolidate or face a pullback.

The Fibonacci level analysis indicates the stock may find resistance at these retracement points, providing technical analysts with insight into potential future movements that could impact trading strategies.

Conclusion

The Dollar Tree, Inc. stock has experienced an impressive uptrend recently, reaching a high that suggests a potential plateau near current levels. The identification of Fibonacci retracement zones provides investors with specific price points to watch, signaling potential support and resistance levels that could influence future trading decisions. While the robust upward trajectory showcases investor confidence, analysts should remain cognizant of market conditions and potential corrections. Balancing opportunities against inherent market risks is pivotal for strategic investment and portfolio diversification decisions concerning Dollar Tree, Inc.