February 03, 2026 a 04:38 pm

DIS: Analysts Ratings - The Walt Disney Company

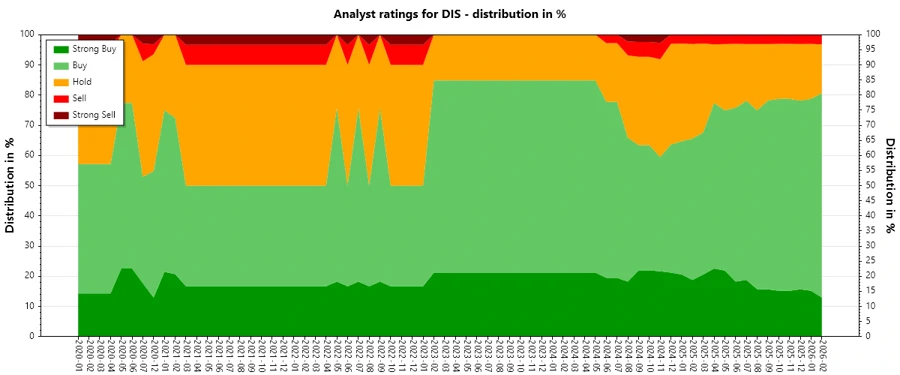

The Walt Disney Company, known for its diverse entertainment ventures, remains a focal point of analyst discussions. Given its critical roles in media distribution, theme parks, and direct-to-consumer streaming services, analysts continually adjust their ratings to reflect market dynamics and company performance. Recent trends indicate slight movements in analyst sentiment, showcasing the ongoing re-evaluation of Disney's strategic offerings and market conditions.

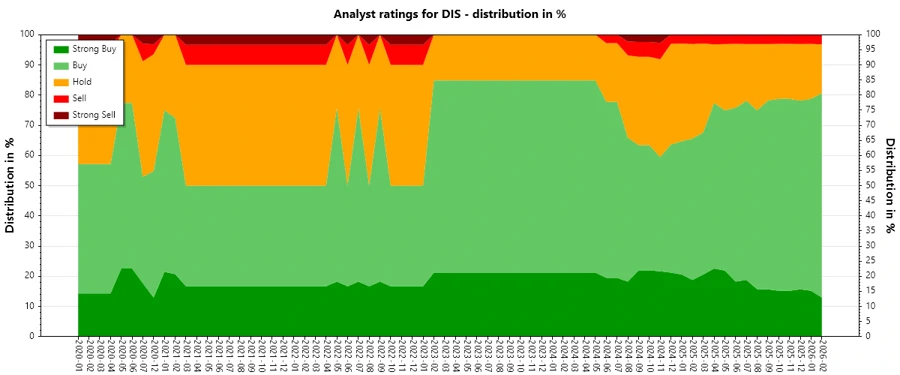

Historical Stock Grades

Over the past months, The Walt Disney Company has seen subtle yet noteworthy shifts in analyst recommendations. As of February 2026, the majority of analysts tend to favor a "Buy" stance, with a small proportion advocating "Hold" and very few opting for "Sell" or "Strong Sell" recommendations. This balance suggests cautious optimism towards Disney's potential in the near future.

| Rating | Number of Analysts | Score |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 21 | |

| Hold | 5 | |

| Sell | 1 | |

| Strong Sell | 0 |

Sentiment Development

Over the reviewed months, DIS analyst sentiment demonstrates a clear inclination towards "Buy" recommendations. The consistency in "Hold" numbers and the rare occurrence of "Sell" or "Strong Sell" ratings highlight ongoing investor confidence. Notably:

- Gradual reduction in "Strong Buy" ratings, indicating tempered enthusiasm.

- The stable number of "Buy" ratings suggests continued confidence in Disney's long-term growth potential.

- "Hold" ratings maintain a moderate presence, while "Sell" and "Strong Sell" remain minimal, showing limited bearish sentiment.

Percentage Trends

A detailed monthly review reveals percentage changes reflecting sentiment shifts. Analyst confidence in Disney's stability is robust among "Buy" adherents, while:

- A slight decrease in "Strong Buy" percentages aligns with a trend of cautious optimism.

- "Buy" recommendations remain dominant, but the slight incline in "Hold" ratings introduces a note of caution.

- No significant rise in "Sell" or "Strong Sell," suggesting limited negative sentiment.

The last 6-12 months show a noteworthy consolidation of "Buy" recommendations even as "Strong Buy" sentiments modestly wane. Analysts appear confident yet vigilant, balancing growth expectations with emerging market conditions.

Latest Analyst Recommendations

Recent analyst recommendations reinforce the continuity of prior sentiments. The focus remains firmly on maintaining existing ratings, suggesting confidence in Disney's strategic direction. Below are the latest updates:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2026-02-03 | Overweight | Overweight | Wells Fargo |

| 2026-02-03 | Hold | Hold | TD Cowen |

| 2026-02-03 | Buy | Buy | Jefferies |

| 2026-02-02 | Buy | Buy | Needham |

| 2026-01-16 | Buy | Buy | Citigroup |

Analyst Recommendations with Change of Opinion

While shifts in analyst opinions are infrequent, recent upgrades imply renewed strategic vitality in Disney's portfolio. The transitions from "Hold" to "Buy" showcase strategic trust, whereas rare downgrades highlight careful scrutiny over time:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-06-30 | Buy | Hold | Jefferies |

| 2025-04-21 | Outperform | Peer Perform | Wolfe Research |

| 2025-01-07 | Buy | Neutral | Redburn Atlantic |

| 2024-10-01 | Market Perform | Outperform | Raymond James |

| 2024-09-30 | Buy | Neutral | Seaport Global |

Interpretation

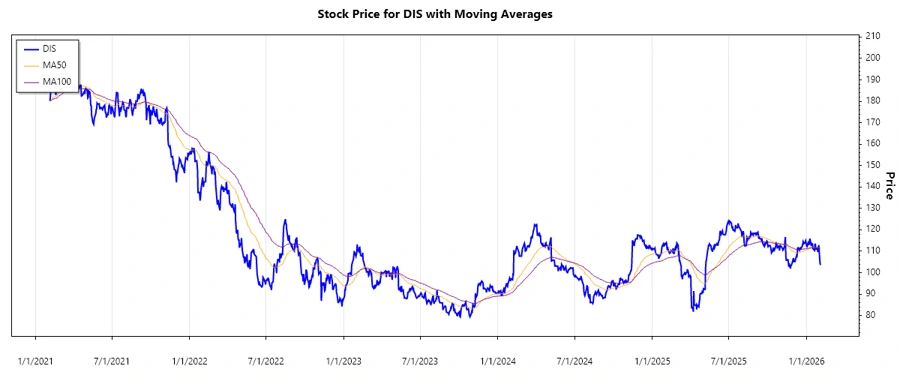

The Walt Disney Company remains an attractive prospect for many analysts, with predominant "Buy" ratings reflecting a durable belief in the company’s strategic vision and offerings. Although there’s a slight drift towards more conservative ratings, the continuous robust endorsements suggest a stable outlook. The relative stability of these ratings indicates sustained confidence, although vigilance towards market flux is evident. Analysts are cautiously optimistic, reflecting on Disney’s potential for adaptation and growth amidst evolving market dynamics.

Conclusion

The stability of analyst ratings underscores the perception of The Walt Disney Company as a stable investment with promising prospects. Despite a decrease in "Strong Buy" ratings, the abiding "Buy" sentiment signifies ongoing trust in Disney’s adaptive strategies and diverse portfolio. While market uncertainties exist, Disney's entrenched position across various entertainment sectors provides both resilience and opportunity. The fluctuating analyst opinions with occasional upgrades and the rare downgrade reflect a nuanced view, considering both risks and growth possibilities. Overall, Disney's continued focus on innovative content delivery and experience-driven growth fortifies its standing in the marketplace, making it a stock to watch amidst evolving global dynamics.

This HTML structure comprehensively presents the analysis based on the given guidelines and data, carefully noting any changes or constants in Disney's analyst ratings and sentiments. The thematic flow aims to provide clarity and direct insights to stakeholders or viewers analyzing the Disney stock trends.