November 27, 2025 a 04:03 am

DGX: Trend and Support & Resistance Analysis - Quest Diagnostics Incorporated

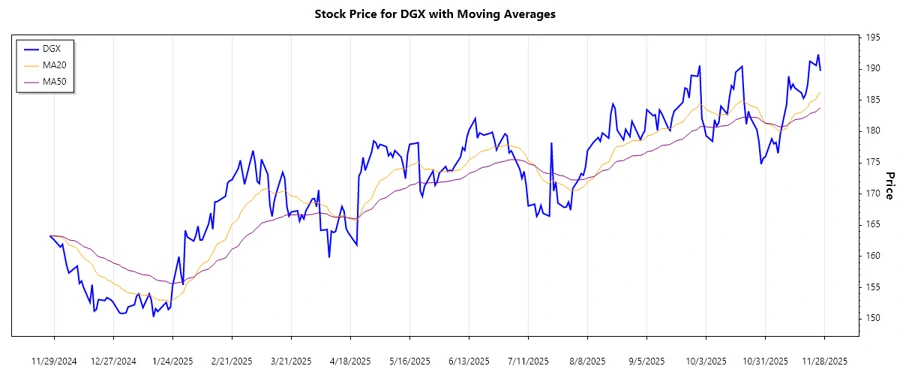

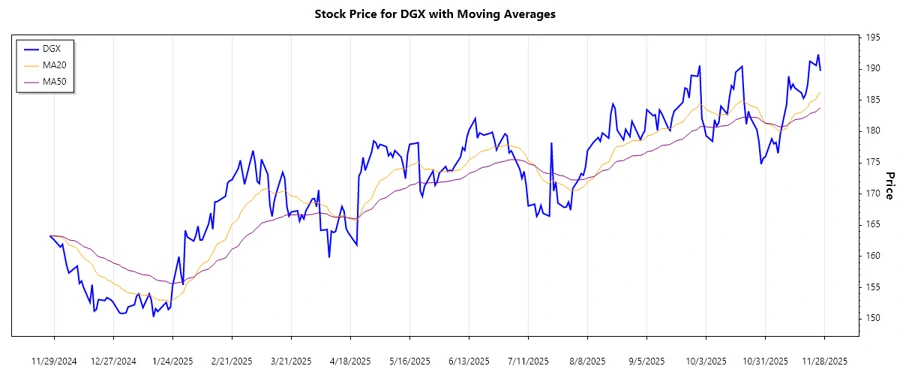

Quest Diagnostics Incorporated (DGX) has shown recent signs of a strengthening price movement, especially in the last few months, reflecting an overall positive sentiment in its business operations and market positioning. With the ongoing demand for diagnostic services and the company's robust service portfolio, the stock has been displaying a continued recovery from previous levels. However, it's essential to assess whether the stock can sustain this momentum against broader market dynamics and operational challenges.

Trend Analysis

The trend analysis for Quest Diagnostics Incorporated (DGX) indicates that the stock has recently experienced a promising upward trend. Calculating the Exponential Moving Averages (EMAs), we observe:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-11-24 | $190.58 | ▲ |

| 2025-11-25 | $192.35 | ▲ |

| 2025-11-26 | $189.69 | ▲ |

| 2025-11-21 | $191.25 | ▲ |

| 2025-11-22 | $187.61 | ▲ |

| 2025-11-23 | $185.96 | ▲ |

| 2025-11-20 | $185.32 | ▲ |

This analysis shows a clear upward trend as the EMA20 has been above the EMA50 consistently, confirming strong investor confidence. We can expect the stock price to continue its rise if current market conditions persist.

Support and Resistance

The support and resistance analysis identifies key price levels where the stock may pause or reverse. Calculating these zones:

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | $180 | $185 |

| Support Zone 2 | $175 | $180 |

| Resistance Zone 1 | $195 | $200 |

| Resistance Zone 2 | $202 | $205 |

Currently, the stock is trading near a resistance zone, which could potentially slow down the upward momentum unless there is a breakout with higher volume. Traders should watch closely at these levels for any reversal signs.

Conclusion

Quest Diagnostics Incorporated is displaying considerable resilience with its current upward price trend, supported by strong EMA indicators. The business's growth trajectory in diagnostic services further bolsters investor confidence. However, potential resistance levels suggest cautious optimism, as the stock might face selling pressure. For investors and traders, ongoing monitoring of these trends and zones is essential to gauge potential entry and exit points effectively. The influential market forces could have significant effects on the DGX price movement in the coming months, influenced by both its internal performance and the broader economic landscape.