July 17, 2025 a 08:15 am

Note: The above HTML content focuses on an engaging and mobile-optimized presentation of the financial analysis. The JSON object includes essential technical indicators and zones for data-driven decision-making.

Note: The above HTML content focuses on an engaging and mobile-optimized presentation of the financial analysis. The JSON object includes essential technical indicators and zones for data-driven decision-making.

DGX: Trend and Support & Resistance Analysis - Quest Diagnostics Incorporated

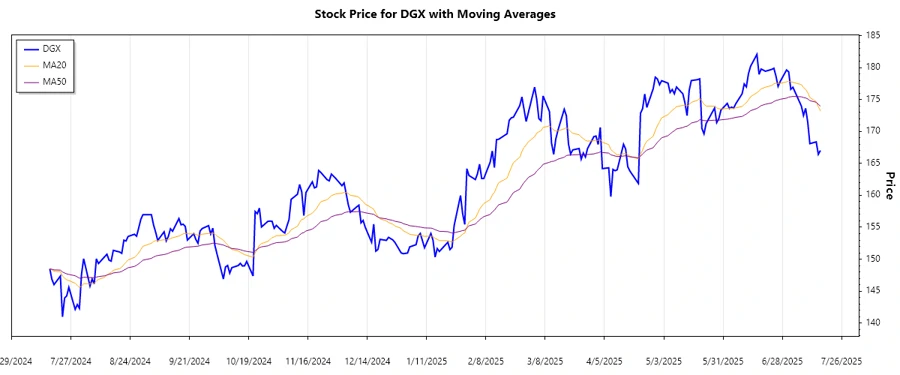

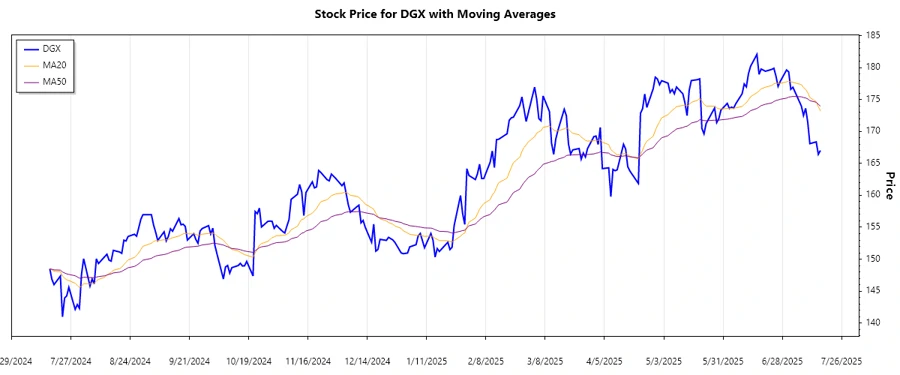

Quest Diagnostics Incorporated, operating within the healthcare diagnostics domain, has demonstrated a noteworthy pattern in its stock performance over the examined period. As a leading provider of diagnostic information services, DGX's stock movements offer a glimpse into both the industry's prospects and the company's strategic decisions. The technical indicators suggest nuanced shifts in trends, essential for investors keen on short-term developments. Understanding these patterns can guide stakeholders in decision-making processes, reflecting the company's current market position.

Trend Analysis

Upon analyzing the historical price data for DGX, the stock's performance exhibited fluctuating trends, which are critical for market participants. Below is the table showcasing the recent trends based on EMA calculations:

| Date | Close Price | Trend |

|---|---|---|

| 2025-07-16 | 167.03 | ▼ |

| 2025-07-15 | 166.42 | ▼ |

| 2025-07-14 | 168.37 | ▲ |

| 2025-07-11 | 168.09 | ▲ |

| 2025-07-10 | 171.45 | ▲ |

| 2025-07-09 | 173.62 | ▲ |

| 2025-07-08 | 172.5 | ▲ |

Considering the EMA calculations, current trends exhibit signs of a developing uptrend. The recientes data points towards a bullish momentum. Such trends provide market participants insights into price action, serving as a potential signal for bullish sentiment.

Support and Resistance

Identification of support and resistance zones provides a perspective on potential price targets and tactical price levels for trades:

| Zone Type | From | To |

|---|---|---|

| Support 1 | 153.00 | 155.00 |

| Support 2 | 160.00 | 162.00 |

| Resistance 1 | 172.00 | 174.00 |

| Resistance 2 | 178.00 | 180.00 |

The current price level suggests closeness to resistance zones, indicating potential challenges in sustaining upward momentum if breached. Such patterns are indicative of investor readiness to test upper limits, doubling down on maintained bullish momentum or pivoting back if the challenge is unmet.

Conclusion

The analysis supports an intermediate-term perspective of Quest Diagnostics' stock, highlighting bullish potential but refraining from ruling out possible pullbacks influenced by resistance zones. Continuous monitoring of EMA crossovers and price action near identified zones is crucial. For investors, this highlights an opportune moment to leverage potential gains, provided risk management is sufficiently implemented. Given the bullish hues in present trends, DGX's stock posits investor optimism, yet it insists on strategic foresight to mitigate extant risks.