August 30, 2025 a 05:00 pm

DGX: Analysts Ratings - Quest Diagnostics Incorporated

Quest Diagnostics Incorporated (DGX) stands as a prominent entity in the diagnostic services sector, showcasing a robust portfolio of services. The company has maintained a steady performance with a focus on routine and advanced clinical testing. Current analyst ratings suggest a conservative outlook, with a balanced footing between buys and holds, indicating market stability yet caution. As an established corporation in a critical industry, DGX sustains investor interest, albeit with a mindful eye on industry transformations and healthcare innovations.

Historical Stock Grades

| Recommendation | Number | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 8 | |

| Hold | 10 | |

| Sell | 0 | |

| Strong Sell | 0 |

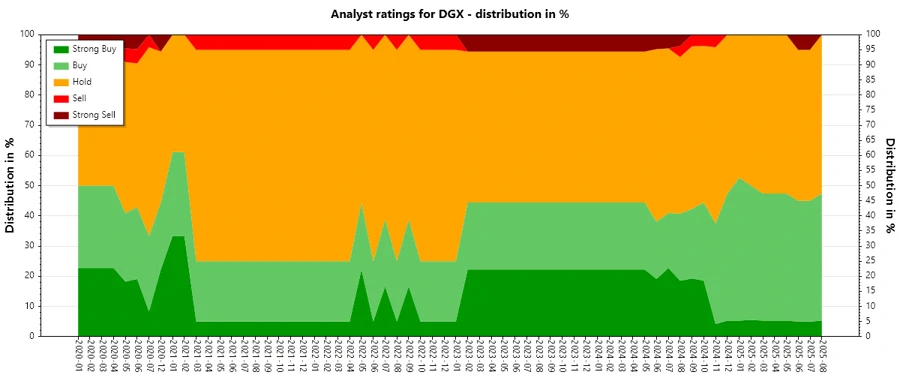

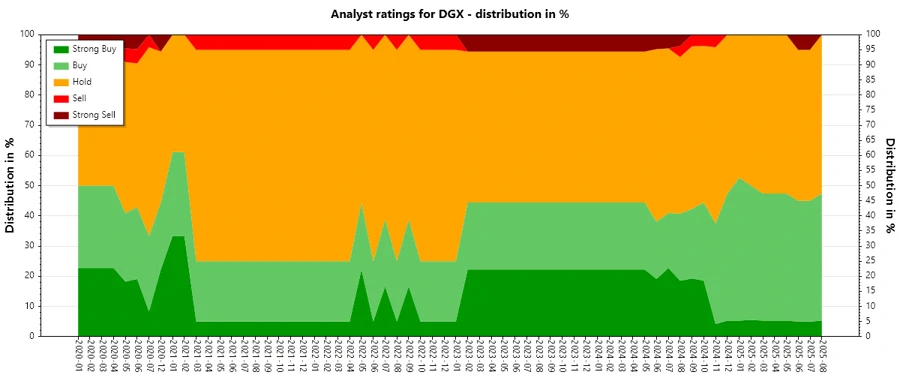

Sentiment Development

- Over recent months, the analyst ratings for DGX have shown slight consistency but with nuanced shifts.

- There's been a slight increase in Hold ratings, reflecting a more conservative stance among analysts.

- The number of Buy ratings has remained stable, displaying steady confidence in the company's fundamentals.

- Strong Buy ratings have reduced compared to historical data, pointing to a cautious optimism.

Percentage Trends

- The percentage of Hold ratings has seen an increase, suggesting a more cautious outlook among analysts.

- Buy recommendations hover around 40%, representing steady but cautious optimism regarding DGX's market position.

- A significant trend is the gradual decrease in Strong Buy ratings over the past year.

- The absence of Sell and Strong Sell ratings denotes minimal analyst negativity towards the stock.

Latest Analyst Recommendations

The table below outlines the latest analyst recommendations, showing varied opinions with a tendency towards neutral and hold positions:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-25 | Neutral | Outperform | Baird |

| 2025-07-23 | Hold | Hold | Deutsche Bank |

| 2025-07-23 | Neutral | Neutral | UBS |

| 2025-07-23 | Hold | Hold | Truist Securities |

| 2025-07-18 | Neutral | Neutral | UBS |

Analyst Recommendations with Change of Opinion

A deeper look reveals certain downgrades and upgrades, indicating analysts' evolving perceptions of DGX:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-25 | Neutral | Outperform | Baird |

| 2025-03-04 | Neutral | Buy | Citigroup |

| 2025-01-06 | Outperform | Market Perform | Leerink Partners |

| 2024-12-17 | Overweight | Equal Weight | Morgan Stanley |

| 2024-10-23 | Outperform | Neutral | Baird |

Interpretation

The market sentiment for DGX appears relatively stable, with a prevailing neutral stance among analysts. While downgrades hint at cautious market trends, the lack of strong sell signals and consistent buy ratings suggest solid underlying fundamentals. There appears to be a cautious approach reflecting potential uncertainty or market unpredictability. Changes in opinion, especially from outperform to neutral, indicate a shift towards moderation in expectations. Overall, the sentiment leans toward steadiness, albeit with a conservative edge.

Conclusion

Quest Diagnostics Incorporated maintains a pivotal role in the diagnostic sector, attracting a balance of Hold and Buy recommendations. Recent trends highlight an inclination towards neutrality among analysts, driven by market cautions and sector dynamics. As the diagnostic industry evolves, DGX remains a stable, albeit cautiously optimistic, investment opportunity. Market participants should continue to watch for industry shifts and policy impacts that could either challenge or bolster DGX's standing. A stabilizing but prudent investment outlook is advised for this stock.