September 28, 2025 a 08:00 am

DE: Fundamental Ratio Analysis - Deere & Company

Deere & Company is a leading player in the agricultural machinery industry, known for its innovation and productivity solutions. The stock performance reflects the dynamic demand in agriculture and construction sectors. Investors should consider the cyclical nature of its markets when making decisions.

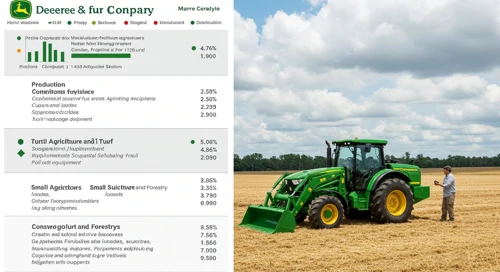

Fundamental Rating

The fundamental analysis shows balanced performance in various financial aspects. Deere & Company's business is well-supported by strong operational efficiency.

| Category | Score | Visual |

|---|---|---|

| Discounted Cash Flow | 3 | |

| Return On Equity | 5 | |

| Return On Assets | 4 | |

| Debt To Equity | 1 | |

| Price To Earnings | 2 | |

| Price To Book | 1 |

Historical Rating

Inspection of historical data shows consistent achievement in the fundamentals over time, providing insights into potential future performance stability.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-09-26 | 3 | 3 | 5 | 4 | 1 | 2 | 1 |

| Previous | 0 | 3 | 5 | 4 | 1 | 2 | 1 |

Analyst Price Targets

Analyst consensus predicts a moderate share price growth, with targets reflecting a balanced view of the stock's potential.

| High | Low | Median | Consensus |

|---|---|---|---|

| 619 | 491 | 560 | 557.5 |

Analyst Sentiment

Current analyst sentiment suggests a balanced viewpoint with recommendations leaning towards holding the stock.

| Recommendation | Count | Visual |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 18 | |

| Hold | 21 | |

| Sell | 6 | |

| Strong Sell | 0 |

Conclusion

Deere & Company remains a significant entity in the agricultural machinery sector with solid long-term fundamentals. The firm's operations are tightly linked to the agricultural cycle, offering both growth opportunities and inherent risks. Current analyst sentiment advocates holding the stock, reflecting cautious optimism about its market exposure and valuation. The historical ratings show stability and an ongoing capability to navigate industry challenges. Investors may find value in its stable revenue streams, but should stay alert to economic shifts impacting its core markets.