November 16, 2025 a 11:44 am

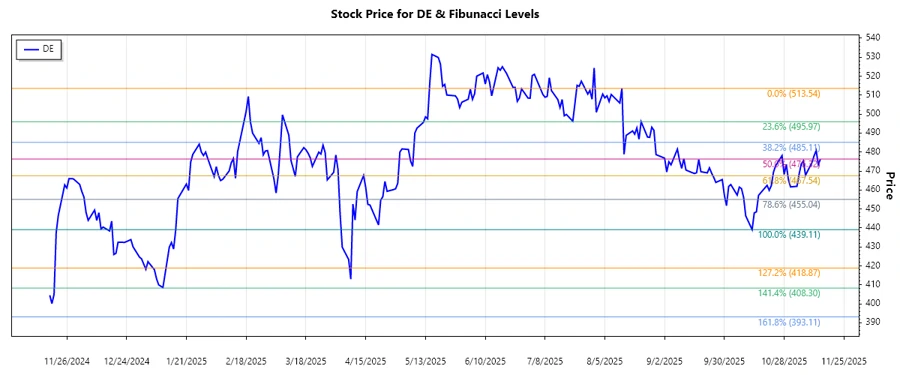

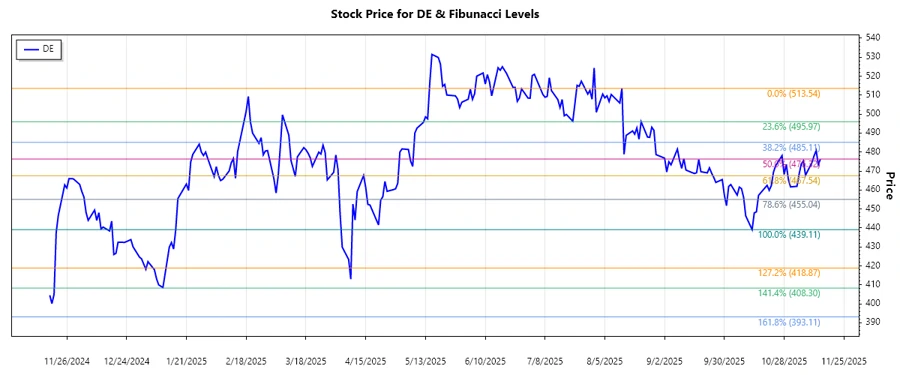

DE: Fibonacci Analysis - Deere & Company

Deere & Company has demonstrated strength in the agricultural and construction sectors, reflected in its recent price movements. The stock has shown resilience in adapting to market demands, indicating potential for long-term growth. However, it is essential to consider the volatility observed in recent months as part of a broader market trend. Investors should monitor the company's strategic direction and market position closely.

Fibonacci Analysis

| Details | Data |

|---|---|

| Start Date | 2025-08-12 |

| End Date | 2025-11-14 |

| High Point | $513.54 (2025-08-13) |

| Low Point | $439.11 (2025-10-13) |

| Fibonacci Level | Price |

|---|---|

| 0.236 | $457.11 |

| 0.382 | $475.64 |

| 0.5 | $493.33 |

| 0.618 | $510.49 |

| 0.786 | $535.27 |

The current price of $476.23 falls within the 0.382 Fibonacci retracement level, suggesting that the price may be stabilizing at a support level. This indicates a potential consolidation phase where the market might gather momentum for further upward movements.

Conclusion

The current technical setup in Deere & Company's stock suggests a potential for stabilization with opportunities for gains if the stock breaches higher resistance levels post-consolidation. However, the fluctuating nature of the market in recent months indicates possible volatility. As strategic decisions in the agriculture and construction equipment sector become pivotal, investors should stay informed on Deere's operational performance and broader market conditions. This setup could serve both as a launchpad for further gains and a warning of possible downturns should market sentiment shift.