July 13, 2025 a 03:43 pm

DECK: Fundamental Ratio Analysis - Deckers Outdoor Corporation

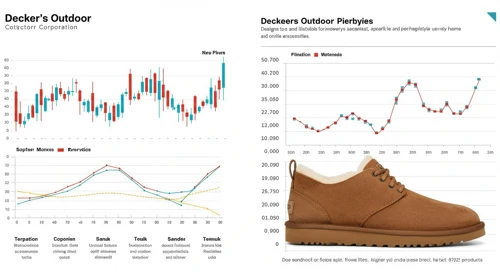

Deckers Outdoor Corporation, with its strong presence in the footwear and apparel market, presents an appealing investment prospect with varied brand offerings such as UGG and Hoka. The company’s solid global reach and direct-to-consumer strategy, alongside strong brand recognition, are key strengths. Despite these strengths, investors should be wary of potential risks like market volatility and economic downturns affecting retail demand.

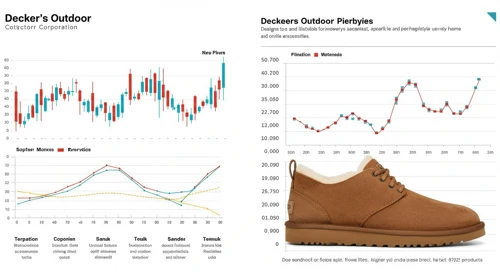

Fundamental Ratings

Deckers Outdoor Corporation holds a solid fundamental score, showcasing strengths across several key financial metrics:

| Category | Score | Visualization |

|---|---|---|

| Overall | 4 | |

| Discounted Cash Flow | 4 | |

| Return on Equity | 5 | |

| Return on Assets | 5 | |

| Debt to Equity | 4 | |

| Price to Earnings | 3 | |

| Price to Book | 1 |

Historical Rating

Analysis of historical scores provides insight into the company's financial health progression:

| Date | Overall | DCF | ROE | ROA | Debt/Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-07-11 | 4 | 4 | 5 | 5 | 4 | 3 | 1 |

| N/A | 0 | 4 | 5 | 5 | 4 | 3 | 1 |

Analyst Price Targets

Price target analysis indicates valuation expectations from market analysts:

| High | Low | Median | Consensus |

|---|---|---|---|

| 169 | 100 | 124 | 129.5 |

Analyst Sentiment

Investment analysts provide detailed recommendations that can guide potential investors:

| Recommendation | Number | Proportion |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 22 | |

| Hold | 25 | |

| Sell | 4 | |

| Strong Sell | 0 |

Conclusion

Deckers Outdoor Corporation remains a solid player in its sector with diversified brand offerings and international market reach. While its fundamental scores are generally strong, some valuation ratios like Price-to-Book warrant caution. Analyst targets suggest moderate growth potential, with a consensus on holding the stock. Before investing, one must weigh the company's resilience against market instability and global economic shifts.