July 02, 2025 a 09:03 am

DASH: Trend and Support & Resistance Analysis - DoorDash, Inc.

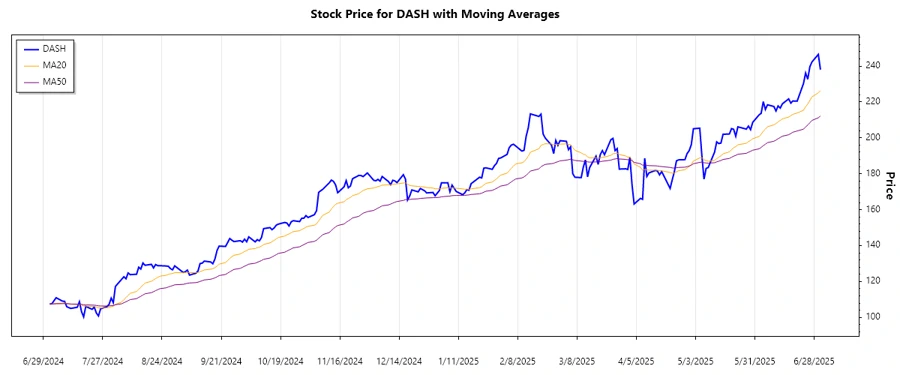

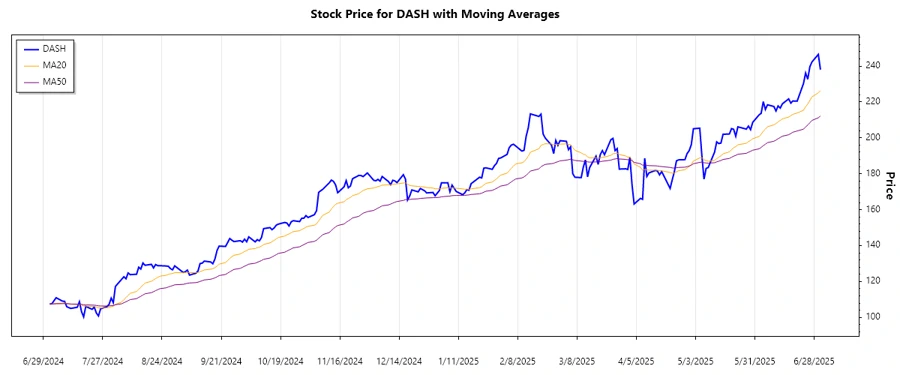

DoorDash, Inc., with its innovative logistics platform, has shown varied trends over recent months. With its ability to connect merchants, consumers, and dashers, DoorDash continues to expand beyond traditional delivery services. Evaluating recent stock price movements and trends can provide insights into the company's current market standing and potential future performance.

Trend Analysis

Reviewing the historical stock data, the calculated EMA values reveal a significant pattern. Over the past few months, the EMA20 has consistently remained above the EMA50, indicating a strong upward trend. The table below displays price movements for the last seven trading days, showing a continuing bullish outlook for the stock.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-07-01 | $238.01 | ▲ |

| 2025-06-30 | $246.51 | ▲ |

| 2025-06-27 | $242.32 | ▲ |

| 2025-06-26 | $239.64 | ▲ |

| 2025-06-25 | $232.68 | ▲ |

| 2025-06-24 | $236.17 | ⚖️ |

| 2025-06-23 | $230.32 | ⚖️ |

Overall, the market shows bullish energy, signaling potential for further growth as technical metrics favor upward movement.

Support and Resistance

Based on recent price action, important support and resistance zones have been identified. These levels provide insights into potential price gauges where the stock may encounter difficulty moving past, either due to increased buying in support zones or selling in resistance zones.

| Zone Type | From Price | To Price |

|---|---|---|

| Support Zone 1 | $200.00 | $205.00 |

| Support Zone 2 | $210.00 | $215.00 |

| Resistance Zone 1 | $240.00 | $245.00 |

| Resistance Zone 2 | $250.00 | $255.00 |

Currently, the stock is trading close to the resistance zone, suggesting that overcoming this barrier could signal continued strength and higher price targets ahead.

Conclusion

DoorDash, Inc. presents an ongoing bullish narrative according to technical analyses, with strong upward trends and strategic positions in support and resistance zones. The company's business model and growth trajectory will be decisive for overcoming market barriers. Analysts will watch how DoorDash's ability to leverage its logistics platform impacts its stock trajectory. However, investors should remain vigilant with market conditions and stock volatility. In conclusion, careful monitoring and analysis of key technical indicators would be beneficial for evaluating transaction opportunities within this dynamic market environment.