September 08, 2025 a 03:07 pm

Currencies - Performance Analysis

📊 This detailed currency performance analysis reviews recent market movements across different currency pairs. The report evaluates performance over periods of one week, one month, and three months, identifying significant trends, outperformers, and underperformers.

Currencies Performance One Week

🔍 Over the past week, the USD/JPY pair led gains with a substantial increase of 0.86%, while GBP/USD struggled the most, reporting a decline of 0.40%. The performance variance indicates a preference for the USD against the JPY and the weakening sentiment towards the GBP.

| Currency | Performance (%) | Performance |

|---|---|---|

| USD/JPY | 0.86 | |

| USD/CAD | 0.66 | |

| AUD/USD | -0.01 | |

| EUR/USD | -0.03 | |

| USD/CHF | -0.14 | |

| NZD/USD | -0.16 | |

| GBP/USD | -0.40 |

Currencies Performance One Month

📈 The USD/CAD outperformed others over the past month with a gain of 0.64%. The NZD/USD, however, experienced the most notable decline of -1.09%. This shift suggests increased market volatility and changing economic conditions, potentially affecting long-term strategies for investors.

| Currency | Performance (%) | Performance |

|---|---|---|

| USD/CAD | 0.64 | |

| EUR/USD | 0.58 | |

| AUD/USD | 0.52 | |

| USD/JPY | 0.51 | |

| GBP/USD | 0.30 | |

| USD/CHF | -1.04 | |

| NZD/USD | -1.09 |

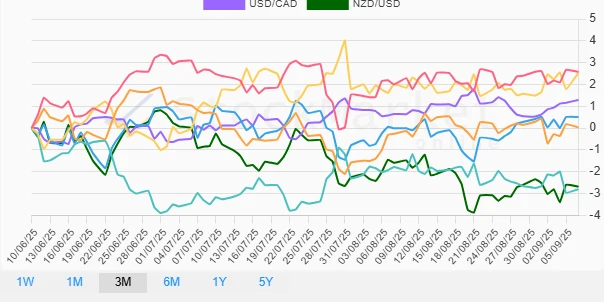

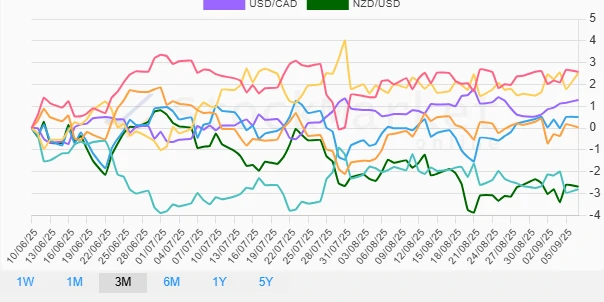

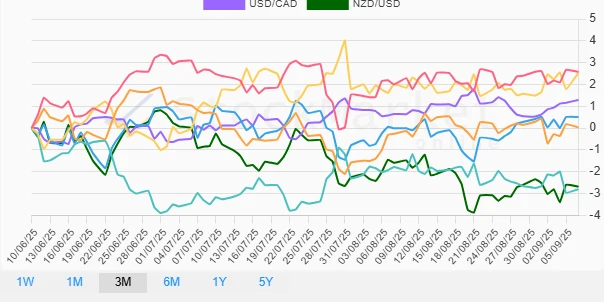

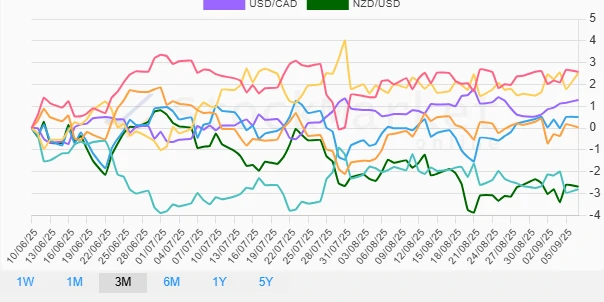

Currencies Performance Three Months

📉 Over three months, the EUR/USD demonstrated a solid gain of 2.58%. Conversely, the USD/CHF saw a significant decline of -2.80%. These movements may signal long-term shifts in economic fundamentals and central bank policies, influencing investor sentiment and currency valuations.

| Currency | Performance (%) | Performance |

|---|---|---|

| EUR/USD | 2.58 | |

| USD/JPY | 2.52 | |

| USD/CAD | 1.29 | |

| AUD/USD | 0.51 | |

| GBP/USD | 0.04 | |

| NZD/USD | -2.68 | |

| USD/CHF | -2.80 |

Summary

💡 In conclusion, currency markets exhibit varying performances, reflecting diverse economic conditions globally. The USD's fluctuations against other major currencies suggest an ongoing shift in investor preferences and economic environments. Strategic positioning based on these insights could help investors navigate through market unpredictability, optimizing returns while mitigating risks in a dynamic forex market.