August 23, 2025 a 03:31 pm

📊 Consumer Staple Stocks - Performance Analysis

The analysis delves into the recent performance trends of major stocks within the consumer staples sector. Over varying periods, fluctuations in global demand, supply chain robustness, and consumer behavior have impacted stock trends differently. This evaluation aims to highlight both impressive performers and those facing challenges, providing insights for strategic investment decisions.

📈 Consumer Staple Stocks Performance One Week

In the past week, PM emerged as the top performer, bolstered by robust earnings and market expansion, while TGT faced headwinds with the largest decline. Overall, mixed performance is visible, reflecting sector-specific challenges and company strategies in navigating market conditions.

| Stock | Performance (%) | Performance |

|---|---|---|

| PM | 3.35% | |

| MO | 2.79% | |

| PG | 2.77% | |

| MDLZ | 2.14% | |

| CL | 1.05% | |

| KO | 0.32% | |

| COST | -1.35% | |

| PEP | -0.48% | |

| WMT | -3.09% | |

| TGT | -3.47% |

📈 Consumer Staple Stocks Performance One Month

Looking over the month, MO has been the forerunner, enjoying a significant uptick due to strategic positioning and market sentiment improvements. Conversely, MDLZ reported the steepest decline, possibly attributed to transitional business phases or adverse market conditions.

| Stock | Performance (%) | Performance |

|---|---|---|

| MO | 12.87% | |

| PM | 6.62% | |

| PEP | 3.69% | |

| COST | 2.74% | |

| KO | 1.57% | |

| WMT | 0.51% | |

| PG | -0.01% | |

| CL | -2.74% | |

| TGT | -5.96% | |

| MDLZ | -9.83% |

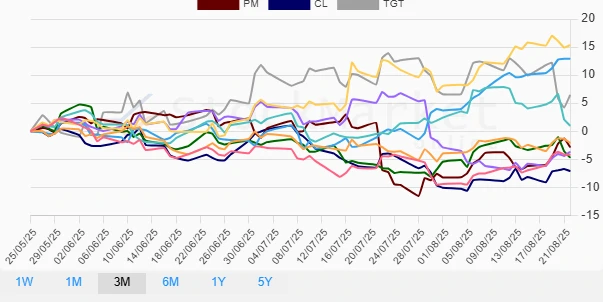

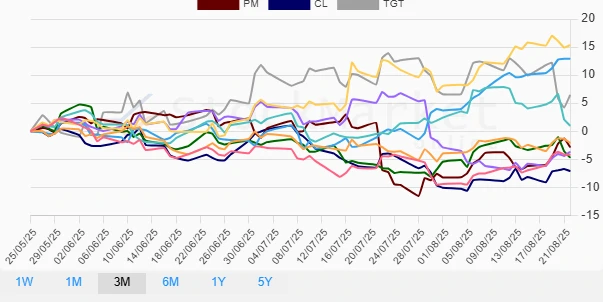

📈 Consumer Staple Stocks Performance Three Months

Over three months, PEP leads with substantial gains, driven by strategic initiatives. In contrast, CL and COST experienced declines, possibly due to market dynamics or strategic realignments. The quarter has presented varied results across stocks, reflecting unique company narratives.

| Stock | Performance (%) | Performance |

|---|---|---|

| PEP | 15.35% | |

| MO | 12.90% | |

| TGT | 6.46% | |

| WMT | 0.98% | |

| KO | -2.09% | |

| PM | -2.85% | |

| MDLZ | -3.65% | |

| PG | -4.18% | |

| COST | -4.70% | |

| CL | -7.10% |

📊 Summary

Through careful observation of the consumer staples sector within varying time frames, it's clear that while some companies have strategically leveraged market opportunities, others are facing challenges, perhaps indicative of internal realignments or sector-specific externalities. Stock accumulators should watch for trends in PM, MO, and PEP as they appear poised for growth. In contrast, watch the developments of MDLZ and CL which may be struggling but present potential recovery opportunities if managed correctly.