August 09, 2025 a 03:31 pm

Consumer Staple Stocks - Performance Analysis

Consumer staple stocks have exhibited varied performance across different timeframes, reflecting the sector's diverse dynamics. Observing the data, certain stocks have demonstrated resilience, while others have faced challenges due to macroeconomic influences. This analysis aims to dissect these performance trends over different periods, providing insights into the consumer staples landscape.

📊 Consumer Staple Stocks Performance One Week

Over the past week, the consumer staple sector experienced mixed results. TGT led with a 5.57% increase, reflecting robust market sentiment, followed closely by WMT with a 5.28% gain. Conversely, MDLZ faced a notable decline, dropping by 3.32%. This indicates variability in investor confidence across key stocks.

| Stock | Performance (%) | Performance |

|---|---|---|

| TGT | 5.57 | |

| WMT | 5.28 | |

| PM | 4.38 | |

| PEP | 4.21 | |

| MO | 3.85 | |

| COST | 2.99 | |

| KO | 2.14 | |

| PG | 1.88 | |

| CL | 1.43 | |

| MDLZ | -3.32 |

📊 Consumer Staple Stocks Performance One Month

The last month observed substantial divergences within the sector. MO topped the list with a remarkable 9.36% gain, while MDLZ saw a substantial decrease of 7.90%. The sector as a whole saw some stocks outperforming expectations, notably PEP, and others under acute pressure.

| Stock | Performance (%) | Performance |

|---|---|---|

| MO | 9.36 | |

| WMT | 9.07 | |

| PEP | 6.97 | |

| TGT | 0.98 | |

| KO | 0.89 | |

| COST | 1.20 | |

| PG | -3.09 | |

| CL | -6.65 | |

| PM | -5.60 | |

| MDLZ | -7.90 |

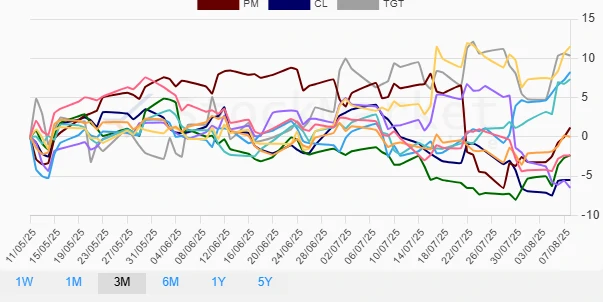

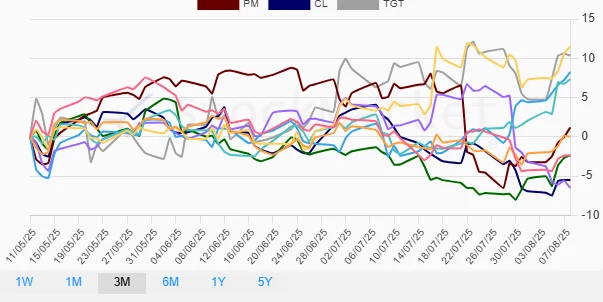

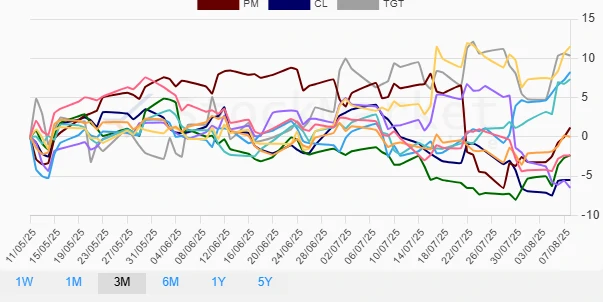

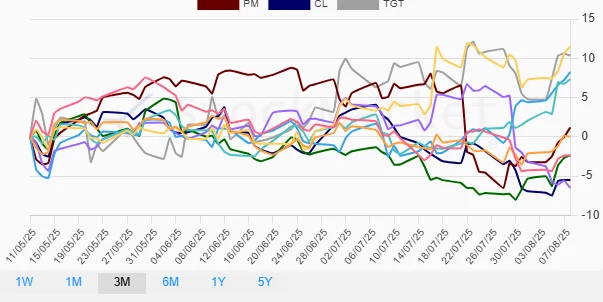

📊 Consumer Staple Stocks Performance Three Months

In the past three months, PEP significantly outperformed with an 11.50% increase, indicating strong investor confidence. TGT also posted a solid performance, while MDLZ continued to face challenges with a 6.48% decline. These varied performances highlight underlying sectoral strengths and weaknesses.

| Stock | Performance (%) | Performance |

|---|---|---|

| PEP | 11.50 | |

| TGT | 10.35 | |

| MO | 8.24 | |

| WMT | 7.34 | |

| PM | 1.17 | |

| KO | 0.02 | |

| COST | -2.34 | |

| PG | -2.37 | |

| CL | -5.50 | |

| MDLZ | -6.48 |

Summary

✅ The consumer staple sector has shown mixed performance over different time periods. PEP consistently emerges as a strong performer across various timeframes, indicating robust investor confidence. Conversely, stocks like MDLZ have struggled, particularly in the one-month and three-month analyses. These movements suggest varying degrees of resilience and vulnerability within the sector, influenced by both internal dynamics and macroeconomic factors. Future trends will be critical to monitor, especially for underperforming stocks, to gauge the sector's overall health and investor sentiment.