October 29, 2025 a 03:31 pm

Consumer Cyclical Stocks - Performance Analysis

The consumer cyclical sector has demonstrated diverse performance across various time frames. While market leaders like Tesla and Amazon show resilience and growth, others face challenges, especially over the longer three-month period. This analysis provides insights into both short-term spikes and persistent trends in stock performance.

Consumer Cyclical Stocks Performance One Week

📊 The analysis for one week highlights Tesla and Amazon as the top performers, signaling investor optimism in tech-centric consumer cyclical stocks. In contrast, O'Reilly Automotive and Nike showed significant downturns, which might be attributed to sector-specific challenges or broader market sentiments.

| Stock | Performance (%) | Performance |

|---|---|---|

| AMZN | 5.08 | |

| TSLA | 4.99 | |

| TJX | 0.69 | |

| LOW | 0.22 | |

| SBUX | -0.05 | |

| HD | -0.82 | |

| MCD | -1.17 | |

| BKNG | -2.04 | |

| NKE | -2.39 | |

| ORLY | -4.91 |

Consumer Cyclical Stocks Performance One Month

📈 Over the one month period, Tesla again tops the chart, while O'Reilly Automotive experiences significant declines. This variance indicates a potential shift in consumer spending priorities or external economic pressures impacting specific businesses more heavily.

| Stock | Performance (%) | Performance |

|---|---|---|

| TSLA | 4.83 | |

| AMZN | 3.42 | |

| MCD | 1.22 | |

| TJX | 0.47 | |

| SBUX | 0.09 | |

| NKE | -2.56 | |

| LOW | -3.62 | |

| HD | -5.22 | |

| BKNG | -5.93 | |

| ORLY | -10.87 |

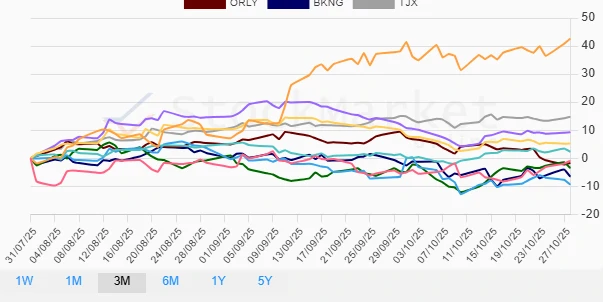

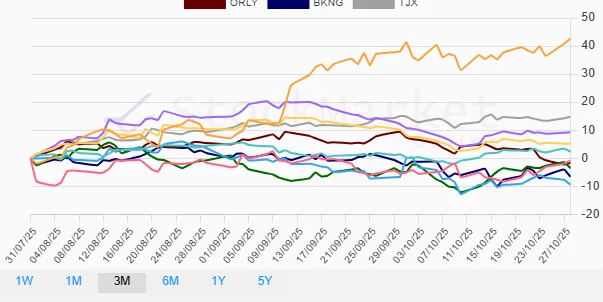

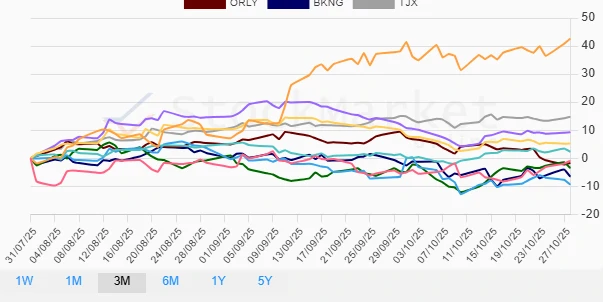

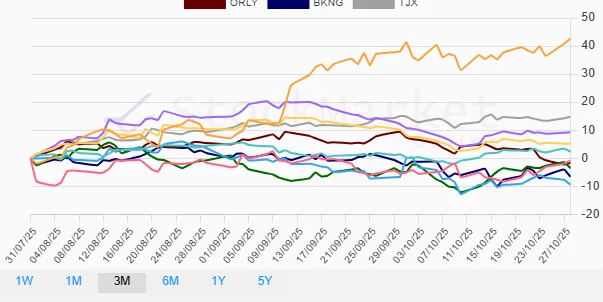

Consumer Cyclical Stocks Performance Three Months

📉 Over a three-month horizon, Tesla's exceptional growth at over 42% contrasts starkly with Nike's nearly 10% decline. This indicates significant volatility and potential sector rotation, where investors may be selectively investing in growth opportunities while retreating from more traditional retail stocks.

| Stock | Performance (%) | Performance |

|---|---|---|

| TSLA | 42.63 | |

| TJX | 14.83 | |

| LOW | 9.30 | |

| HD | 5.30 | |

| MCD | 2.33 | |

| SBUX | -3.43 | |

| ORLY | -1.68 | |

| BKNG | -6.54 | |

| NKE | -9.34 | |

| AMZN | -0.90 |

Summary

🔍 Overall, the consumer cyclical sector is marked by volatility and opportunities for dynamic growth. Tesla's consistent outperformance across all periods underscores its role as a leading force in the sector's transformation. Investors should monitor these trends closely, considering the megatrends driving consumer behavior alongside macroeconomic pressures. Strategic allocation towards resilient stocks like Tesla and Amazon could offer a hedge against sector-specific headwinds while capitalizing on growth potentials.