September 24, 2025 a 09:03 am

CTSH: Trend and Support & Resistance Analysis - Cognizant Technology Solutions Corporation

Cognizant Technology Solutions Corporation has shown notable shifts in its stock prices over recent months. By offering a wide range of consulting and technology services, Cognizant remains a key player in the global market. The current trend reflects recent fluctuations, with potential implications for investors and analysts. Understanding support and resistance levels is crucial for assessing future price movements.

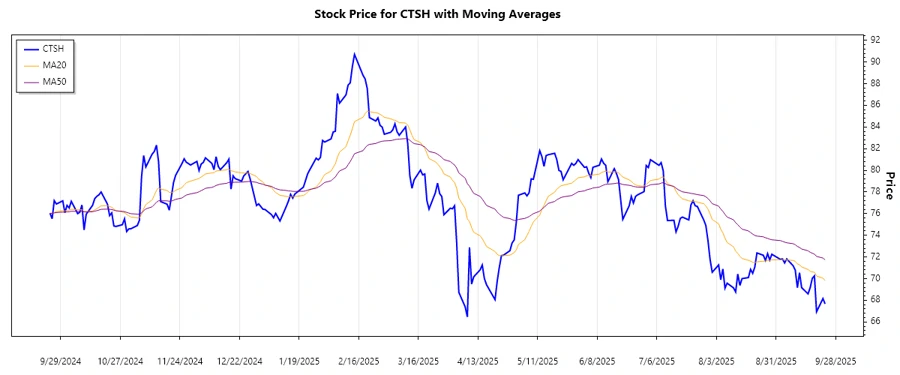

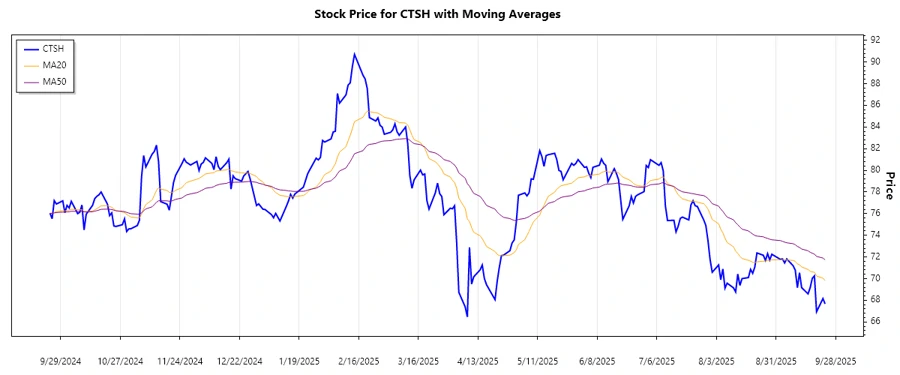

Trend Analysis

The price data over the past months indicate a significant downward trend, particularly noticeable since mid-July 2025. Using the Exponential Moving Averages (EMAs), we observe the EMA20 recently crossing below the EMA50, confirming the downward trajectory. This suggests that the stock is experiencing bearish movements.

| Date | Close Price | Trend |

|---|---|---|

| 2025-09-23 | $67.67 | ▼ |

| 2025-09-22 | $68.16 | ▼ |

| 2025-09-19 | $66.94 | ▼ |

| 2025-09-18 | $70.26 | ▲ |

| 2025-09-17 | $70.03 | ▲ |

| 2025-09-16 | $69.17 | ▲ |

| 2025-09-15 | $68.59 | ▼ |

Conclusively, the downward trend is continuing with potential minor upticks, indicating bearish sentiment. This is a crucial observation for short-term trading strategies.

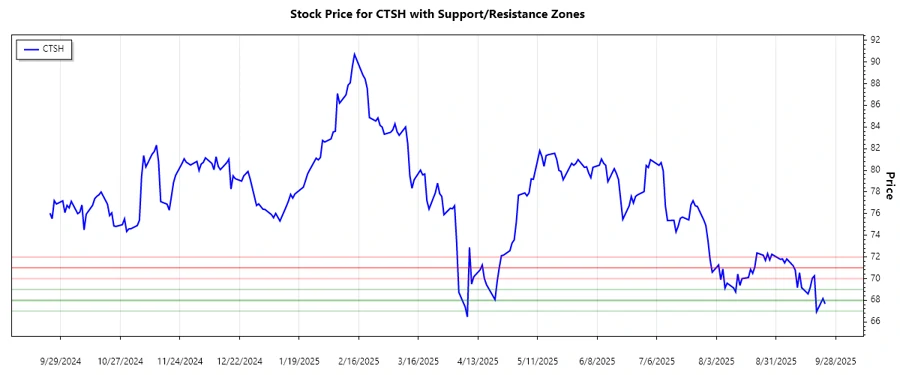

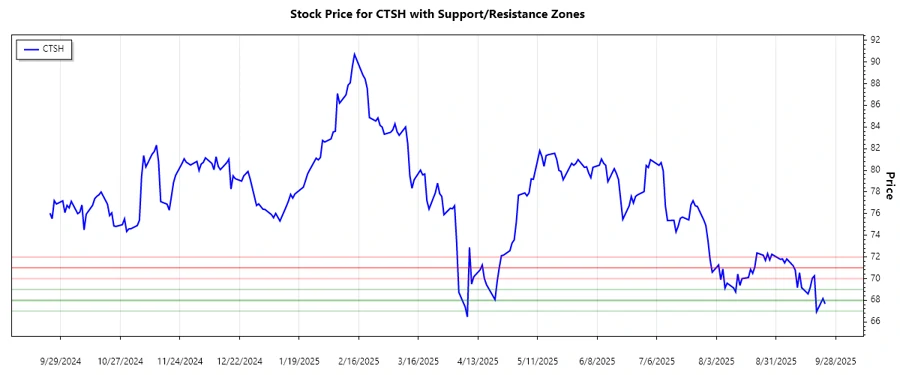

Support and Resistance

Current analysis identifies two primary support zones around $68.16 and $67.67. Resistance zones are seen at approximately $70.78 and $71.82.

| Zone | From | To |

|---|---|---|

| Support 1 | $67 | $68 |

| Support 2 | $68 | $69 |

| Resistance 1 | $70 | $71 |

| Resistance 2 | $71 | $72 |

Currently, the stock close price at $67.67 places it within the first support zone. This suggests possible buying interest or a potential rebound from this level.

Conclusion

The technical analysis of Cognizant Technology Solutions Corporation reveals a predominantly bearish trend. While the stock currently resides within a support zone, offering a potential entry point for bullish strategies, the dominant downward momentum presents risks for long positions. The identified resistance levels will be key areas to monitor for future breakout attempts. Overall, while short-term trading opportunities may arise, cautious consideration is advisable given the prevailing downtrend.