November 15, 2025 a 11:44 am

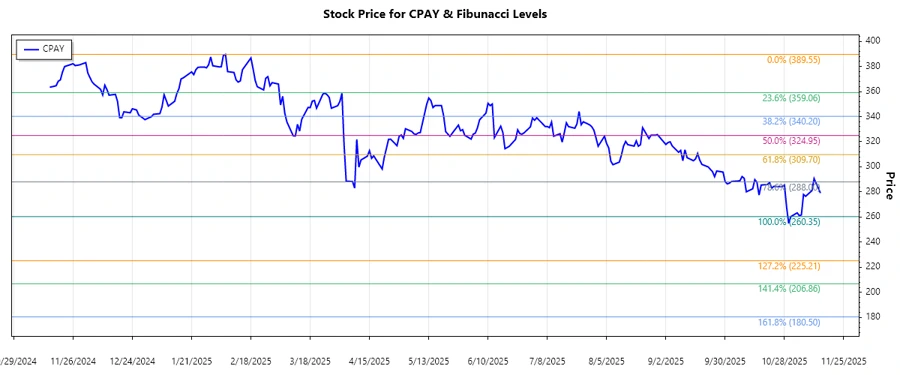

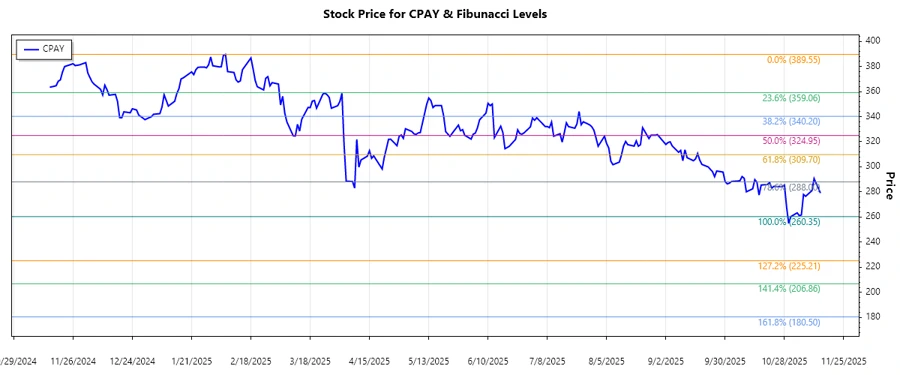

CPAY: Fibonacci Analysis - Corpay, Inc.

Corpay, Inc. shows a volatile trend with recent activities indicating a bearish movement. Although the company has seen a transformation in its branding and expansion, the stock seems to be in a corrective phase after a long-term bullish period. It will be crucial for investors to watch for key retracement levels where significant support might be found.

Fibonacci Analysis

| Parameters | Details |

|---|---|

| Trend Start Date | 2024-12-03 |

| Trend End Date | 2025-11-14 |

| High Point | $389.55 on 2025-02-06 |

| Low Point | $260.35 on 2025-10-31 |

Fibonacci Retracement Levels

| Level | Price |

|---|---|

| 0.236 | $293.92 |

| 0.382 | $314.12 |

| 0.500 | $324.95 |

| 0.618 | $355.78 |

| 0.786 | $365.83 |

The current price is moving within the 0.786 retracement level, indicating a potential resistance if the price tests this level again. This could serve as a barrier before a reversal or continuation might occur.

Conclusion

Given the stock's movement into the Fibonacci retracement zones, CPAY shows signs that it could encounter resistance levels that may impede further growth unless overcome with volume and momentum. There could be opportunities for strategic buys if the price were to hold above key support levels, especially around 0.618 to 0.786 levels. However, the downward trend suggests caution, as breaking below the 0.618 level could lead to further declines. Analysts should consider both geopolitical and market-specific risks that could influence short-term trends.