June 27, 2025 a 05:01 pm

COP: Analysts Ratings - ConocoPhillips

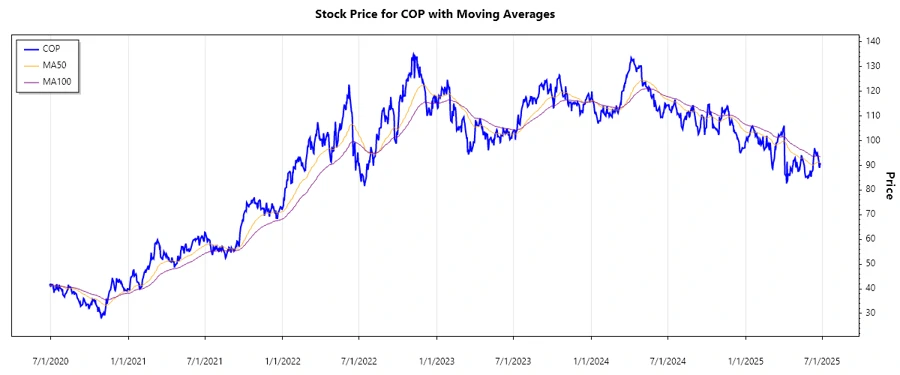

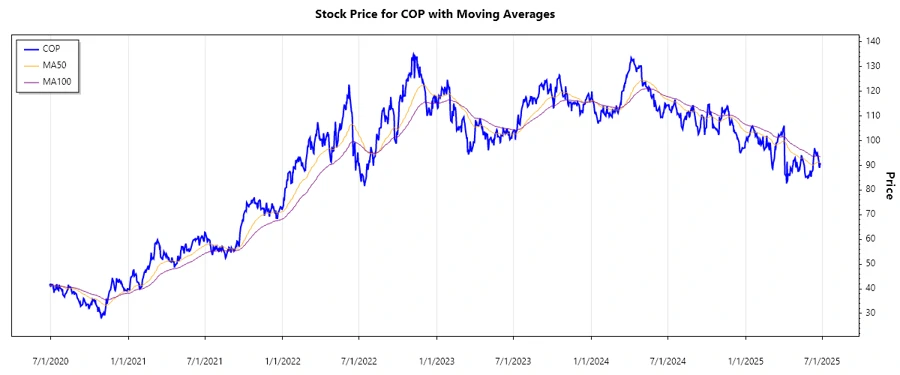

ConocoPhillips (COP) has shown resilience in its strategic operations, focusing on diverse geographical regions and energy sources. The company remains a solid player in the oil and gas sector, evident from the consistent analyst recommendations. Current market conditions and inherent industry challenges pose moderate risks, yet the stock exhibits a robust position in its field.

Historical Stock Grades

The latest analyst ratings for ConocoPhillips suggest a predominantly positive outlook. As of June 2025, the consensus is heavily inclined towards 'Strong Buy' and 'Buy' ratings, with no indications of 'Sell' or 'Strong Sell'. This reflects continued confidence in the stock's performance.

| Rating | Count | Score Bar |

|---|---|---|

| Strong Buy | 13 | |

| Buy | 14 | |

| Hold | 3 | |

| Sell | 0 | |

| Strong Sell | 0 |

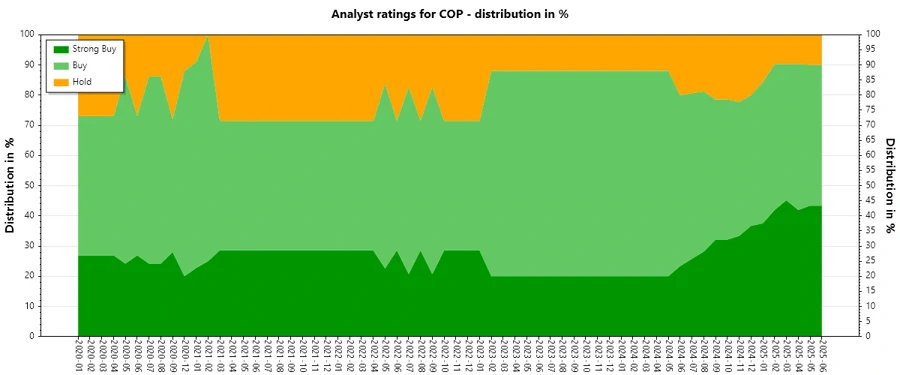

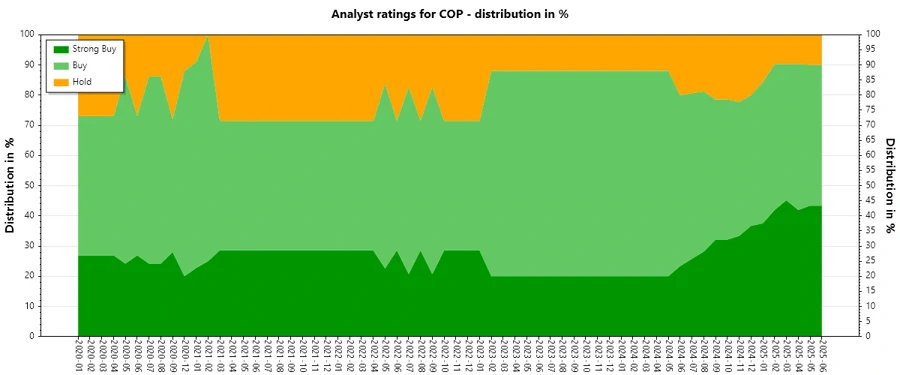

Sentiment Development

In examining the sentiment over recent months, the analyst ratings show consistency with a strong leaning towards 'Buy' and 'Strong Buy'. The volume of ratings has generally remained stable, indicating sustained interest and belief in the stock. Notably:

- There is a consistent preference for 'Buy' and 'Strong Buy', implying bullish sentiment.

- The 'Hold' category has decreased from previous peaks, suggesting a shift in confidence towards more positive ratings.

- No 'Sell' or 'Strong Sell' ratings suggest limited skepticism around ConocoPhillips' market position.

Percentage Trends

Over the past year, the distribution of ratings for ConocoPhillips indicates modest changes in analyst sentiment. A noticeable reduction in 'Hold' recommendations, combined with stable 'Buy' and 'Strong Buy' percentages, signals increasing confidence.

- Strong Buy ratings have risen from 5 to 13, marking a significant positive trend.

- Hold ratings have decreased from 6 to 3, reflecting increased positive sentiment among analysts.

- The balance is clearly towards a positive outlook, reinforced by the absence of negative ratings ('Sell' or 'Strong Sell').

Latest Analyst Recommendations

Recent months have seen a continuation of stable recommendations from major financial institutions, with a focus on maintaining current ratings. This stability hints at a consistent market confidence in ConocoPhillips.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-06-11 | Buy | Buy | Citigroup |

| 2025-05-30 | Outperform | Outperform | RBC Capital |

| 2025-05-23 | Neutral | Neutral | B of A Securities |

| 2025-05-20 | Outperform | Outperform | Raymond James |

| 2025-05-14 | Overweight | Overweight | Wells Fargo |

Analyst Recommendations with Change of Opinion

There have been some changes in analyst opinions in the recent past. These shifts, though few, indicate nuanced views on ConocoPhillips' strategic movements or market conditions.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-29 | Neutral | Buy | B of A Securities |

| 2025-02-10 | Outperform | Strong Buy | Raymond James |

| 2024-12-16 | Outperform | Neutral | Mizuho |

| 2024-12-04 | Overweight | Neutral | JP Morgan |

| 2023-09-08 | Buy | Hold | Erste Group |

Interpretation

The market sentiment regarding ConocoPhillips appears overall positive, with a solid foundation in analyst confidence. The trends illustrate a decline in neutral opinions and an increase in positive ratings, highlighting a growing optimism. The lack of negative ratings suggests stability in the stock's perception. Continuous recommendations without major downgrades indicate trust in the company's operations and strategic outlook, with no immediate signs of market uncertainty.

Conclusion

ConocoPhillips remains a strong performer in the energy sector with consistent positive analyst ratings. While market volatility and industry challenges persist, the recent trends indicate increasing optimism and support. The stability of analyst opinions suggests that the company is well-positioned to capitalize on opportunities while managing risks. Overall, ConocoPhillips offers a promising outlook for investors looking for exposure to the energy market, with the potential for growth and value creation.