August 18, 2025 a 07:43 am

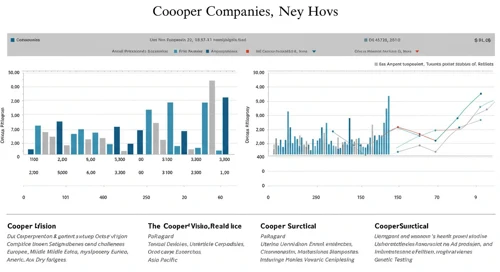

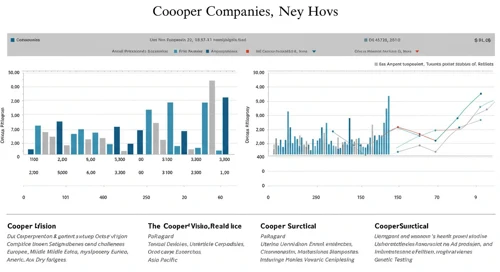

COO: Fundamental Ratio Analysis - The Cooper Companies, Inc.

The Cooper Companies, Inc. has a strong market presence in the healthcare and contact lens industry. Their focus on vision correction and women's health has positioned them well with a diverse product line. The company has shown resilience with consistent performance across its segments.

Fundamental Rating

The fundamentals of The Cooper Companies show a solid balance across multiple metrics, with strengths in discounted cash flow and return on assets.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return on Equity | 3 | |

| Return on Assets | 4 | |

| Debt to Equity | 2 | |

| Price to Earnings | 1 | |

| Price to Book | 3 |

Historical Rating

The historical data of The Cooper Companies display consistent scores with a stable outlook, reflecting robust operational performance over time.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-08-15 | 3 | 4 | 3 | 4 | 2 | 1 | 3 |

| (Previous) | 0 | 4 | 3 | 4 | 2 | 1 | 3 |

Analyst Price Targets

Analyst estimates suggest a range of price targets, with consensus leaning towards a 'Buy', highlighting investor confidence in future growth.

| High | Low | Median | Consensus |

|---|---|---|---|

| $107 | $94 | $102.5 | $101.5 |

Analyst Sentiment

The current analyst sentiment reflects strong confidence, with most recommendations favoring 'Buy' over 'Hold' or 'Sell.'

| Recommendation | Count | Distribution |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 17 | |

| Hold | 5 | |

| Sell | 1 | |

| Strong Sell | 0 |

Conclusion

The Cooper Companies, Inc. presents a well-rounded investment opportunity with steady fundamentals and favorable analyst ratings. The company benefits from its diverse segments in vision correction and women's health, providing a cushion against market volatility. However, challenges may arise from fluctuating market demands or changes in the healthcare landscape. Overall, the stock is positively viewed in the current market scenario, suggesting an optimistic outlook for investors.