September 06, 2025 a 10:15 am

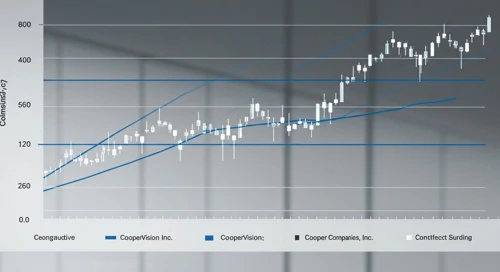

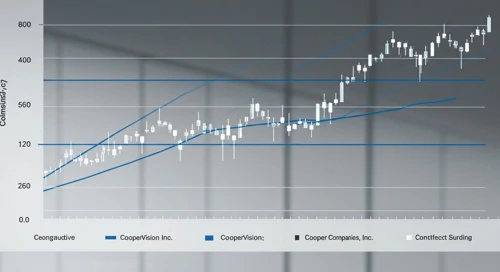

COO: Fibonacci Analysis - The Cooper Companies, Inc.

The Cooper Companies, Inc. has demonstrated dynamic price movements in recent months, suggesting significant market interest. As a leading player in the contact lens and surgical product sectors, the company's stock performance reflects both consumer demand and healthcare industry trends. Technical analysis of the recent price actions offers insight into potential future market behavior.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Trend Start Date | 2025-05-07 |

| Trend End Date | 2025-09-05 |

| High Price (Date) | $68.09 (2025-09-05) |

| Low Price (Date) | $84.44 (2025-05-12) |

| Fibonacci Level 0.236 | $75.89 |

| Fibonacci Level 0.382 | $73.67 |

| Fibonacci Level 0.5 | $71.27 |

| Fibonacci Level 0.618 | $68.86 |

| Fibonacci Level 0.786 | $65.61 |

| Current Price Position | The current price of $68.09 is in the 0.618 Fibonacci retracement zone. |

| Technical Interpretation | The current retracement level suggests potential support at this zone, with a possible reversal or consolidation trend before further movements. |

Conclusion

Analyzing The Cooper Companies, Inc. within its recent bearish trend reveals significant retracement opportunities aligned with Fibonacci levels. The current price positioning within the 0.618 zone suggests potential stabilization or support, crucial for traders to assess its continuation or reversal. With healthcare demands influencing the market, both risks and prospects are heightened amidst evolving consumer patterns. Technical indicators are pivotal for predicting price adjustments, informing investment strategies based on retracement behavior. Monitoring market reactions in the indicated support zone can guide further technical and fundamental analysis.