June 21, 2025 a 04:44 pm

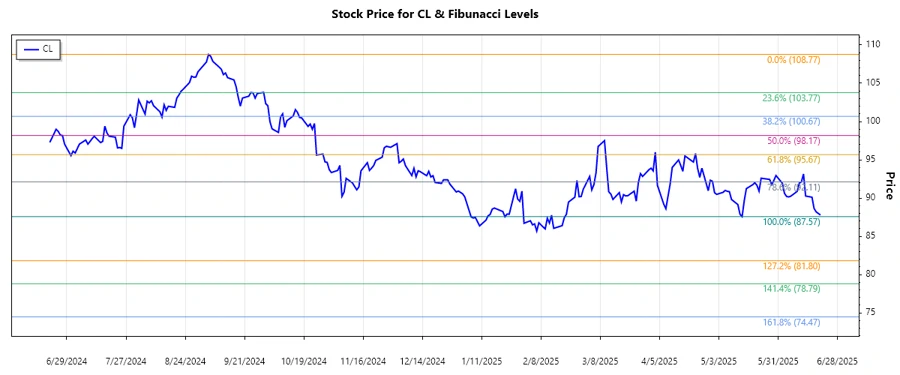

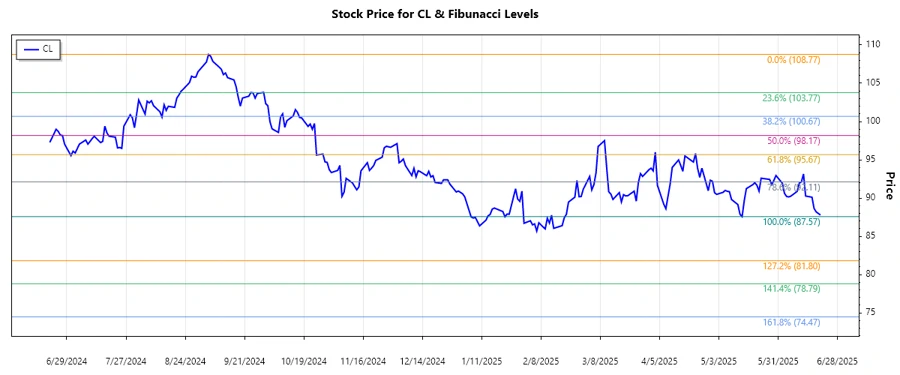

CL: Fibonacci Analysis - Colgate-Palmolive Company

Colgate-Palmolive Company's stock demonstrates a steady performance amidst a competitive market landscape, bolstered by its strong brand portfolio in consumer goods and pet nutrition. Recent trends show stabilization in its price, suggesting potential for moderate growth backed by consistent demand for essential products. Investors might consider observing further market movements given the recent trend shifts.

Fibonacci Analysis

| Details | Data |

|---|---|

| Trend Type | Downtrend |

| Start Date | 2024-09-06 |

| End Date | 2025-06-20 |

| High Price and Date | $108.77 on 2024-09-04 |

| Low Price and Date | $87.57 on 2025-05-14 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | $92.92 |

| 0.382 | $95.24 |

| 0.5 | $97.17 |

| 0.618 | $99.10 |

| 0.786 | $101.72 |

Current price analysis suggests the stock is within the 0.5 retracement zone.

This potentially indicates a mid-level support, suggesting that prices may consolidate before any further decisive movement.

Conclusion

The recent downtrend in Colgate-Palmolive's stock highlights caution with potential stabilization within the $97.17 price level, offering moderate support. Analysts observe this consolidation as an opportunity to monitor market sentiment and internal company developments closely. Risks remain, especially if the price breaks below the Fibonacci support levels, indicating further downside potential. However, the consistent demand for its strong consumer goods portfolio provides an underpinning cushion for price resilience.