October 04, 2025 a 09:01 am

CI: Analysts Ratings - The Cigna Group

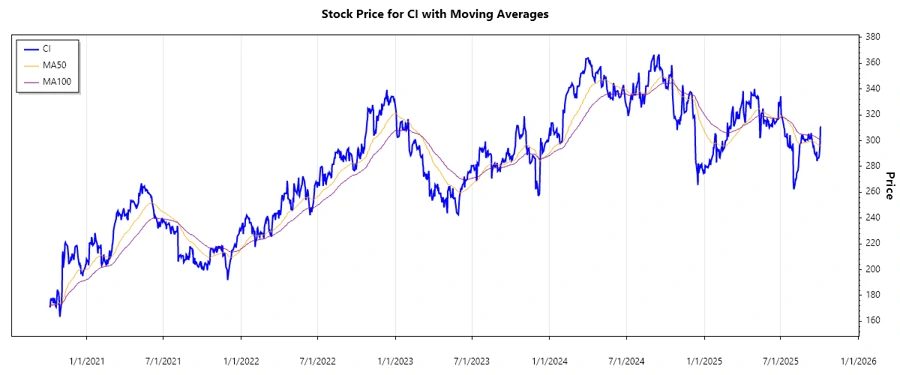

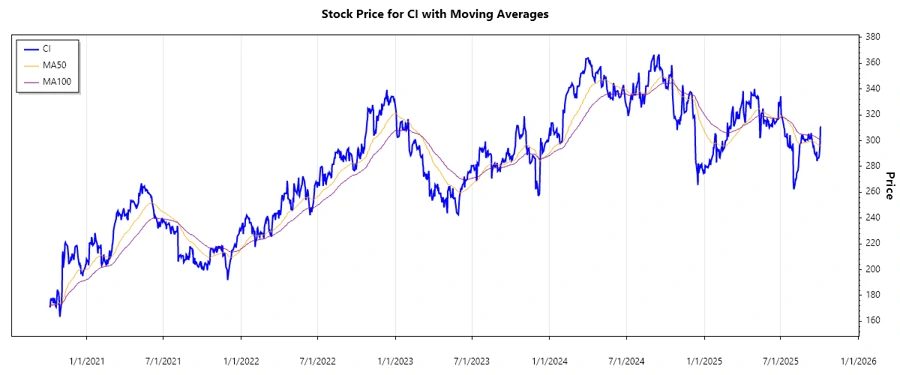

The Cigna Group (CI) continues to position itself as a formidable player within the insurance and health services sector. Analysts have shown consistent support with a predominant "Buy" sentiment, illustrating confidence in the company’s strategic direction and operational stability. While some caution is exhibited through increasing "Hold" ratings, market sentiment largely remains positive, reflecting strong backing from investors and analysts alike.

Historical Stock Grades

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 6 | |

| Buy | 13 | |

| Hold | 5 | |

| Sell | 0 | |

| Strong Sell | 0 |

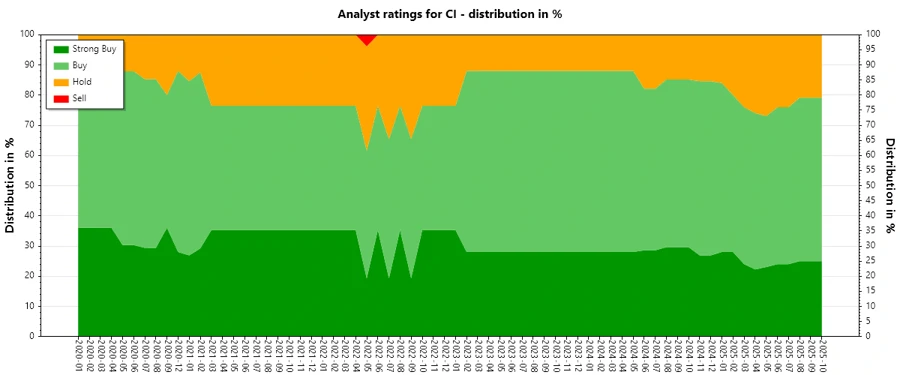

Sentiment Development

The analyst sentiment towards The Cigna Group has exhibited considerable stability over the past months, with a persistent majority in the "Buy" category. The transition from "Strong Buy" to "Hold" ratings suggests a cautious but optimistic outlook. While overall ratings numbers have slightly decreased, the balance between "Buy" and "Hold" indicates confidence in the company’s sustained growth potential.

- Decreased from 28 total ratings in early 2024 to 24 in October 2025.

- A stable "Buy" sentiment, yet a slight reduction in "Strong Buy" ratings since early 2024.

- "Hold" ratings increased slightly, indicating a level of market caution.

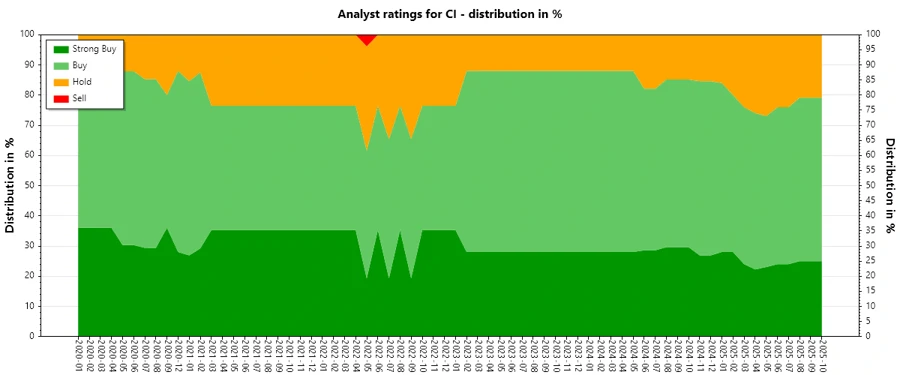

Percentage Trends

Observing the percentage trends over recent months reveals a gradual shift in analyst sentiment. Though there is a notable decrease in "Strong Buy" recommendations, the consistency in "Buy" ratings underpins a belief in Cigna’s resilient business model. The percentage of "Hold" ratings has modestly increased, reflecting prevailing cautious optimism.

- In October 2025, "Strong Buy" represents 25% of total recommendations.

- "Buy" continues to dominate with over 54% share among ratings.

- "Hold" has augmented its presence, demonstrating potential market apprehension.

- Overall, from 2024 to 2025, "Hold" ratings shifted positively, reflecting tempered market enthusiasm.

Latest Analyst Recommendations

The latest analyst recommendations mirror the ongoing confidence in The Cigna Group’s market position. Consistent grading with no downgrades in recent months suggests that analysts maintain anticipation for operational sustainability and growth.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-04 | Overweight | Overweight | Barclays |

| 2025-08-26 | Overweight | Overweight | Cantor Fitzgerald |

| 2025-08-14 | Equal Weight | Equal Weight | Wells Fargo |

| 2025-08-14 | Outperform | Outperform | Baird |

| 2025-08-04 | Buy | Buy | Guggenheim |

Analyst Recommendations with Change of Opinion

During 2024, several upgrades in recommendations highlight a shift towards a more favorable outlook for Cigna. These upgrades point towards improved confidence and perceived potential for superior performance in the industry landscape.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-02-05 | Overweight | Neutral | Cantor Fitzgerald |

| 2024-02-05 | Outperform | Sector Perform | RBC Capital |

| 2024-02-01 | Buy | Hold | Deutsche Bank |

| 2024-01-04 | Outperform | Market Perform | Bernstein |

| 2023-12-11 | Buy | Hold | Jefferies |

Interpretation

Analyst sentiment towards The Cigna Group reveals stable but cautiously optimistic market perceptions. With a dominant "Buy" sentiment, there is clear confidence in the company’s strategic path, albeit with some increase in "Hold" ratings, suggesting measured anticipation. The upgrades during 2024 underline a significant strengthening of market confidence, potentially driven by favorable financial metrics or strategic adjustments. Overall, expert opinions largely sustain a belief in the firm’s steady performance and robust market positioning.

Conclusion

The Cigna Group remains a compelling investment for stakeholders, backed by consistent "Buy" ratings despite a modest increase in "Hold" sentiment. Analysts' confidence, underscored by recent upgrades and maintained ratings, reflects belief in the company's capacity to navigate industry challenges. The ongoing strength suggests sustained growth opportunities; however, investors should remain vigilant of any emerging market risks. Despite minor fluctuations in ratings, the prevailing outlook anticipates continuing stability and long-term growth potential for The Cigna Group.