September 15, 2025 a 02:03 pm

CHTR: Trend and Support & Resistance Analysis - Charter Communications, Inc.

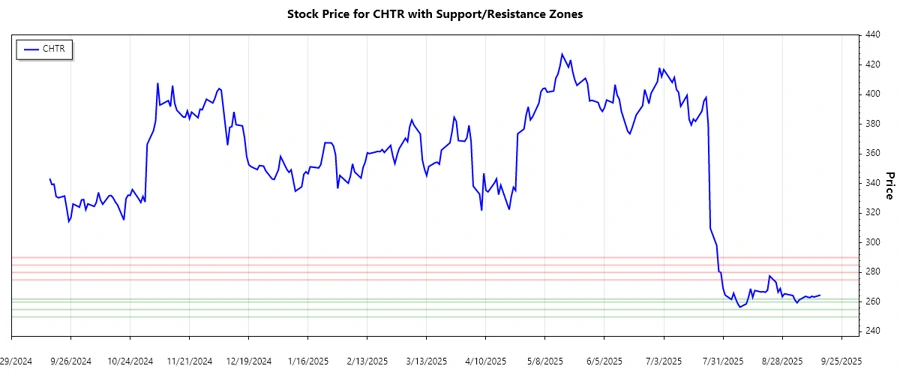

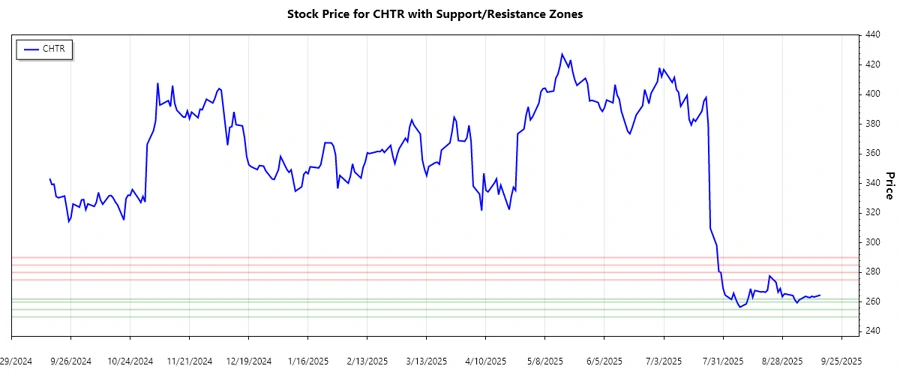

Charter Communications, Inc. has seen significant price fluctuation over the past few months with a sharp decline followed by a gradual recovery. The stock has shown resilience in bouncing back from its lows, presenting potential investment opportunities. However, risks remain given the competitive broadband market and evolving consumer demands. Monitoring key technical levels could provide insight into the stock's future direction.

Trend Analysis

The analysis of CHTR's recent price action indicates an interesting trend development. Calculating the Exponential Moving Averages (EMAs) for a period of 20 and 50 days helps identify current trends. Based on the computed data, we can observe:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-09-15 | 264.75 | ⚖️ |

| 2025-09-12 | 263.40 | ⚖️ |

| 2025-09-11 | 263.92 | ⚖️ |

| 2025-09-10 | 263.00 | ▼ |

| 2025-09-09 | 263.35 | ▼ |

| 2025-09-08 | 263.88 | ▼ |

| 2025-09-05 | 261.50 | ▼ |

Overall, the stock is exhibiting a downward trend with EMA20 falling below EMA50. This suggests potential bearish movement unless key resistance levels are breached.

Support- and Resistance

The analysis for support and resistance levels enables better trading decisions. Based on the historical data provided, we have identified the following key zones:

| Zone Type | From | To |

|---|---|---|

| Support 1 | ➔ 260 | ➔ 262 |

| Support 2 | ➔ 250 | ➔ 255 |

| Resistance 1 | ➔ 275 | ➔ 280 |

| Resistance 2 | ➔ 285 | ➔ 290 |

The current price level of 264.75 resides between the support and resistance zones, leaning towards the support, indicating it might find buying interest around these levels.

Given the proximity to support zones, traders might anticipate a potential rebound, though caution is advised as continued pressure may result in further dips.

Conclusion

The stock of Charter Communications, Inc. is currently in a precarious position, with a downward trend underlined by technical indicators. While it rests near support levels implying possible resilience, the overall bearish sentiment casts uncertainty. Opportunities lie in a potential bounce from these levels or a breakthrough past resistance, but the risks associated include further descent if supports do not hold. Hence, careful monitoring of the market conditions and macroeconomic factors affecting the broadband sector is essential for making informed decisions.