October 03, 2025 a 04:28 amHere is the technical analysis formatted for mobile display and easily integrable into a web page:

CHFJPY: Trend and Support & Resistance Analysis

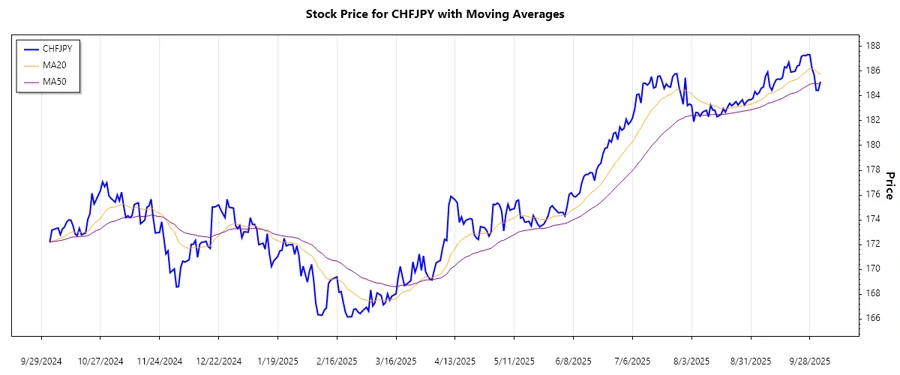

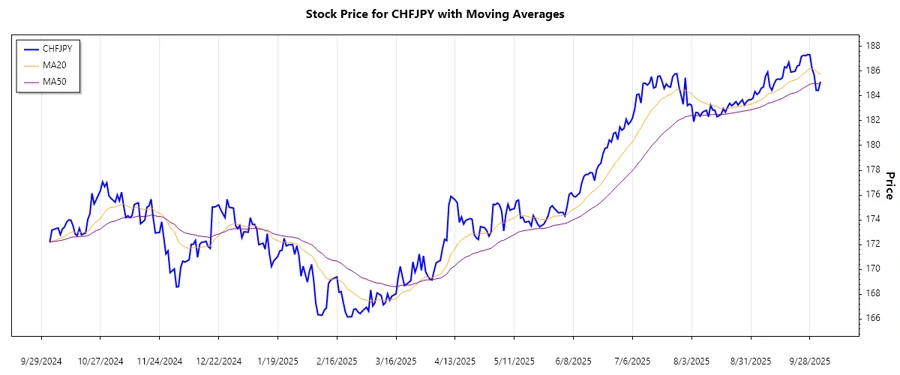

The CHFJPY pair has exhibited a notable trend over the past months. With the recent changes in global markets, this currency pair has shown both resilience and volatility, making it an interesting subject for technical analysis. In the following sections, a detailed analysis based on the EMA indicators and support/resistance zones will be presented. These insights are crucial for traders looking to capitalize on the current market conditions.

Trend Analysis

Analyzing the CHFJPY exchange rates over the recent months, we calculated the EMA20 and EMA50 based on the closing prices to identify the prevailing trend. Here is the detailed view of the latest trend:

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-03 | 185.147 | ▲ Uptrend |

| 2025-10-02 | 184.439 | ▲ Uptrend |

| 2025-10-01 | 184.443 | ▲ Uptrend |

| 2025-09-30 | 185.705 | ▲ Uptrend |

| 2025-09-29 | 186.214 | ▲ Uptrend |

| 2025-09-28 | 187.31 | ▲ Uptrend |

| 2025-09-27 | 187.346 | ▲ Uptrend |

The EMA20 has consistently remained above the EMA50, indicating a sustained uptrend. This suggests bullish momentum and a potential continuation unless key support levels are breached.

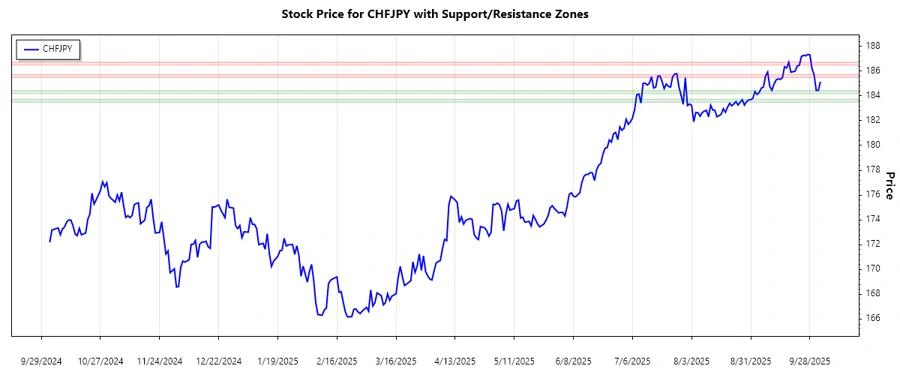

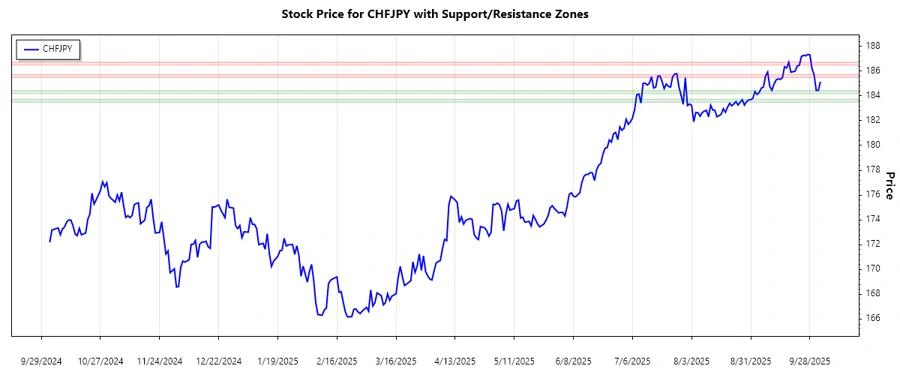

Support and Resistance Analysis

Upon examining the closing prices, we identified key support and resistance levels that may act as barriers to price movements.

| Zone Type | From | To |

|---|---|---|

| Support | 183.50 ↑ | 183.70 ↑ |

| Support | 184.20 ↑ | 184.40 ↑ |

| Resistance | 185.50 ↓ | 185.70 ↓ |

| Resistance | 186.50 ↓ | 186.70 ↓ |

As of the latest data, the current price is within the higher support zone. This may act as a cushion against downward moves, while the proximity to the resistance suggests caution for bullish positions.

Conclusion

The CHFJPY pair is currently experiencing an upward trend supported by bullish momentum as indicated by the EMA analysis. Traders should be mindful of the identified support and resistance zones, which may influence price action in the coming sessions. While the trend remains positive, understanding the implications of these zones is essential for managing trading risks effectively. As the currency navigates these levels, a robust strategy is advised, incorporating both potential opportunities and associated risks.

Output as a JSON object: