August 28, 2025 a 04:28 am

CHFJPY: Trend and Support & Resistance Analysis

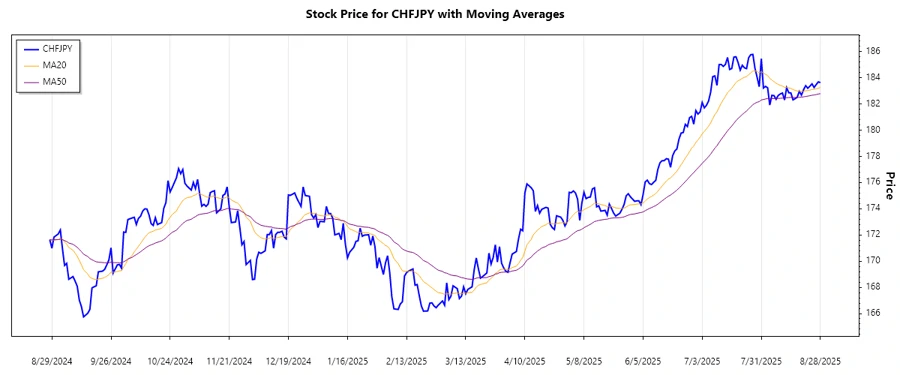

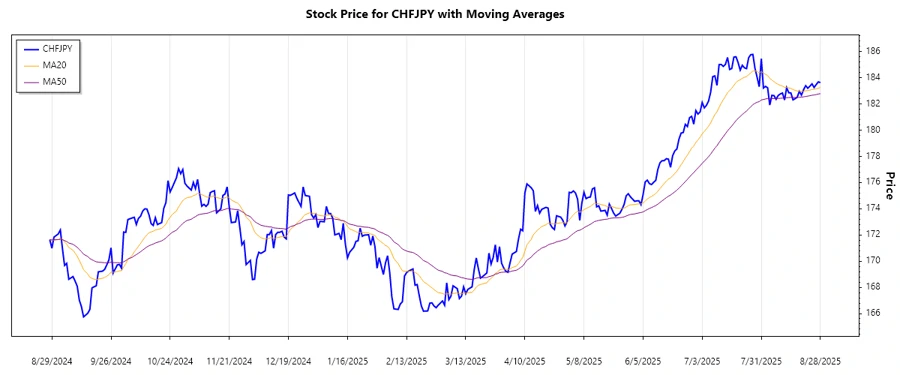

The CHFJPY currency pair has exhibited a notable level of volatility over the past months. Recent data suggests a consolidation phase with potential opportunities for both upward and downward movements depending on market conditions. Analysts should be attentive to the changing trend dynamics and key levels that may influence future price actions in this forex pair.

Trend Analysis

The recent analysis of the CHFJPY pair shows a trend transitioning into a possible consolidation or slight downtrend as noted from the crossover of EMAs. The 20-day EMA remains close to the 50-day EMA, suggesting a potential sideways movement.

| Date | Closing Price | Trend Indicator |

|---|---|---|

| 2025-08-28 | 183.635 | ⚖️ Sideways |

| 2025-08-27 | 183.691 | ⚖️ Sideways |

| 2025-08-26 | 183.488 | ⚖️ Sideways |

| 2025-08-25 | 183.262 | ⚖️ Sideways |

| 2025-08-24 | 183.541 | ⚖️ Sideways |

| 2025-08-23 | 183.361 | ⚖️ Sideways |

| 2025-08-22 | 183.200 | ⚖️ Sideways |

The EMA20 and EMA50 crossover during recent days supports the observation of a sideways trend, indicating limited directional strength in either direction currently.

Support and Resistance

Based on the recent historical data, CHFJPY currently hovers close to significant support and resistance levels.

| Zone Type | From | To |

|---|---|---|

| Support ▲ | 182.300 | 182.600 |

| Support ▲ | 183.000 | 183.200 |

| Resistance ▼ | 183.800 | 184.000 |

| Resistance ▼ | 184.300 | 184.500 |

The current price sits within the lower support range between 183.000 - 183.200. Traders should watch for either decisive rebounds or breakdowns below these levels.

Conclusion

The CHFJPY currency pair indicates a trending environment that is cautiously optimistic, although with marked zones of volatility. Current market conditions suggest a market poised at a pivotal juncture, with both upward potential and the risk of further consolidation or minor downturn. Analysts must account for potential impacts from geopolitical shifts, interest rate decisions, and currency interventions which might sway price action in upcoming sessions.